Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2: CAPITAL BUDGETING (38 marks) Joe & L Limited has a cash surplus which they would like to invest. They have an option between

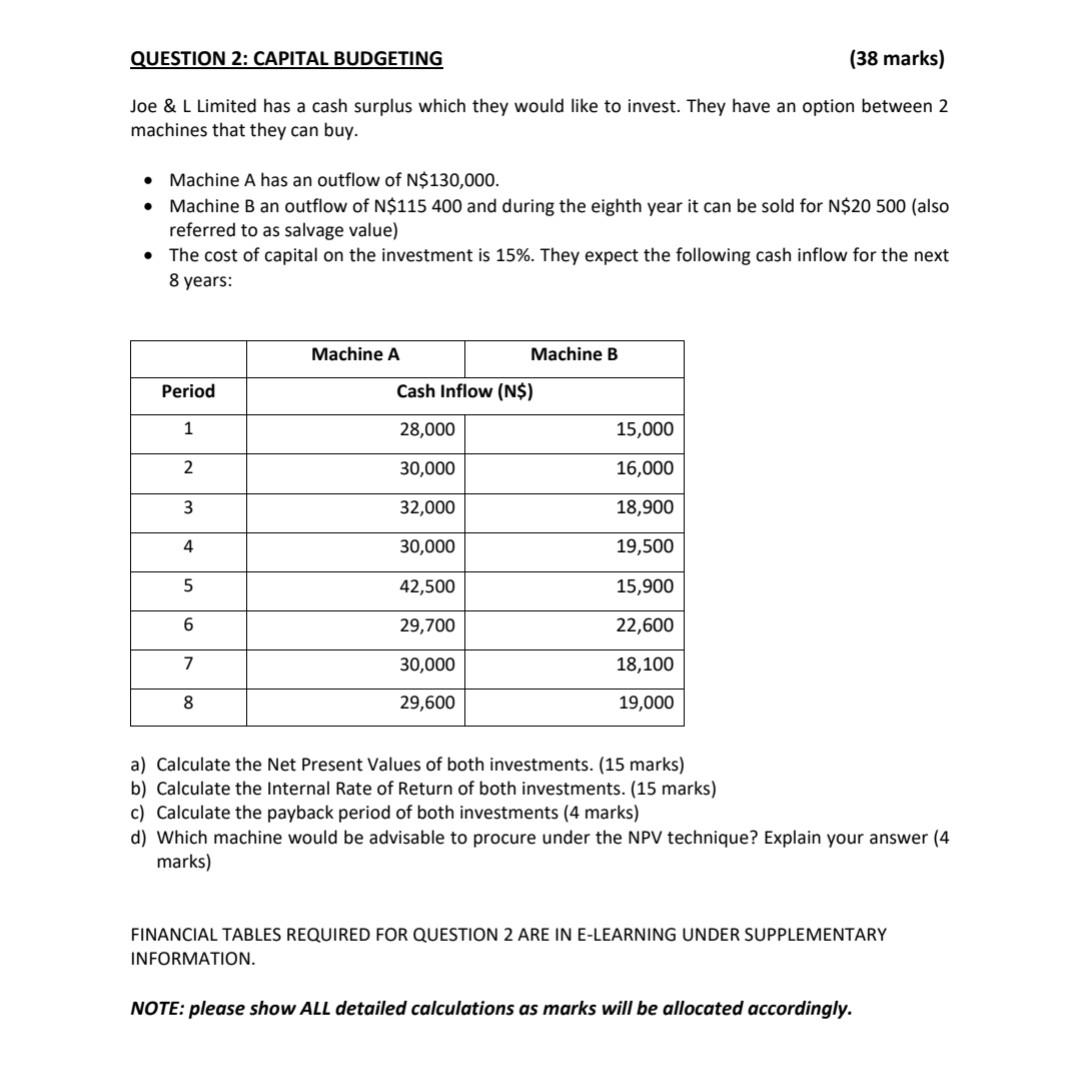

QUESTION 2: CAPITAL BUDGETING (38 marks) Joe \& L Limited has a cash surplus which they would like to invest. They have an option between 2 machines that they can buy. - Machine A has an outflow of N$130,000. - Machine B an outflow of N$115400 and during the eighth year it can be sold for N$20500 (also referred to as salvage value) - The cost of capital on the investment is 15%. They expect the following cash inflow for the next 8 years: a) Calculate the Net Present Values of both investments. ( 15 marks) b) Calculate the Internal Rate of Return of both investments. (15 marks) c) Calculate the payback period of both investments ( 4 marks) d) Which machine would be advisable to procure under the NPV technique? Explain your answer (4 marks) FINANCIAL TABLES REQUIRED FOR QUESTION 2 ARE IN E-LEARNING UNDER SUPPLEMENTARY INFORMATION. NOTE: please show ALL detailed calculations as marks will be allocated accordingly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started