Answered step by step

Verified Expert Solution

Question

1 Approved Answer

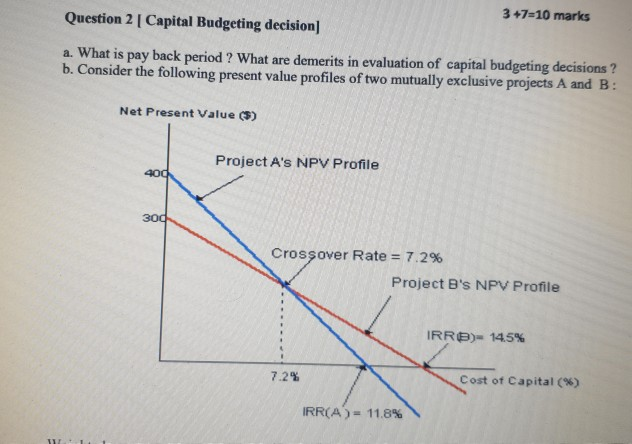

Question 2 [ Capital Budgeting decision] 3 +7=10 marks a. What is pay back period ? What are demerits in evaluation of capital budgeting decisions

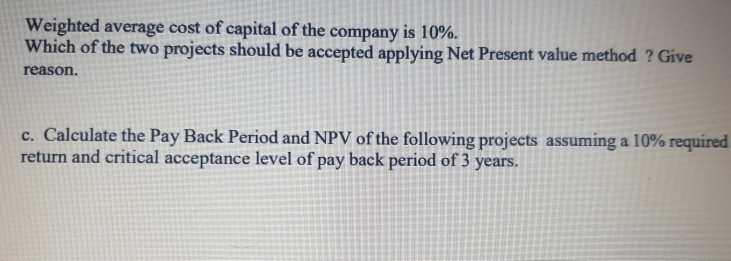

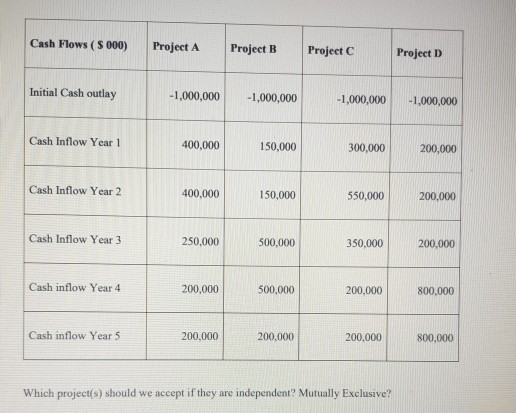

Question 2 [ Capital Budgeting decision] 3 +7=10 marks a. What is pay back period ? What are demerits in evaluation of capital budgeting decisions ? b. Consider the following present value profiles of two mutually exclusive projects A and B : Net Present Value ($) Project A's NPV Profile 400 30d Crossover Rate = 7.2% Project B's NPV Profile IRRO) 14.5% 7.2% Cost of Capital (%) IRR(A) = 11.8% Weighted average cost of capital of the company is 10%. Which of the two projects should be accepted applying Net Present value method ? Give reason. c. Calculate the Pay Back Period and NPV of the following projects assuming a 10% required return and critical acceptance level of pay back period of 3 years. Cash Flows ( S 000) Project A Project B Project C Project D Initial Cash outlay -1,000,000 -1,000,000 -1,000,000 -1,000,000 Cash Inflow Year 1 400,000 150,000 300,000 200,000 Cash Inflow Year 2 400,000 150,000 550,000 200,000 Cash Inflow Year 3 250,000 500,000 350,000 200,000 Cash inflow Year 4 200,000 500,000 200,000 800,000 Cash inflow Year 5 200,000 200,000 200,000 800,000 Which project() should we accept if they are independent? Mutually Exclusive

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started