Answered step by step

Verified Expert Solution

Question

1 Approved Answer

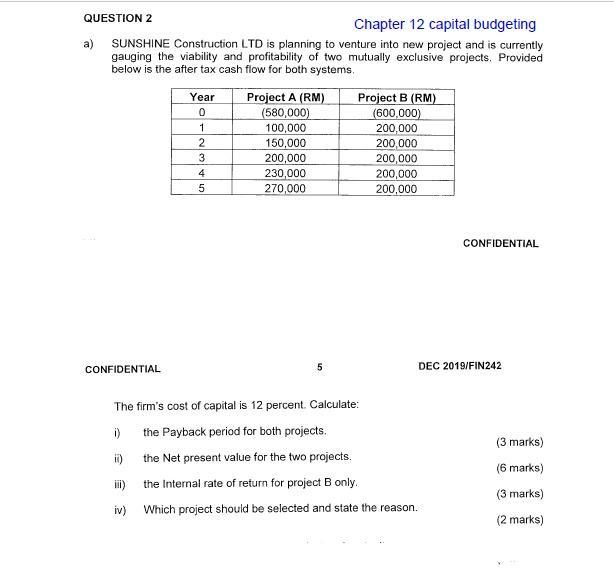

QUESTION 2 Chapter 12 capital budgeting a) SUNSHINE Construction LTD is planning to venture into new project and is currently gauging the viability and

QUESTION 2 Chapter 12 capital budgeting a) SUNSHINE Construction LTD is planning to venture into new project and is currently gauging the viability and profitability of two mutually exclusive projects. Provided below is the after tax cash flow for both systems. CONFIDENTIAL Year 0 1 2 3 4 5 Project A (RM) (580,000) 100,000 150,000 200,000 230,000 270,000 5 Project B (RM) (600,000) 200,000 200,000 200,000 200,000 200,000 CONFIDENTIAL DEC 2019/FIN242 The firm's cost of capital is 12 percent. Calculate: i) the Payback period for both projects. ii) the Net present value for the two projects. the Internal rate of return for project B only. iv) Which project should be selected and state the reason. (3 marks) (6 marks) (3 marks) (2 marks)

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer Payback Period The Payback period is the time in which the investor gets back the exact amoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started