Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2: Company Taxation: Share Repurchases NineNinety Ltd (NNL) has 1,000,000 fully paid ordinary shares which are held by the following shareholders: Chris Eli

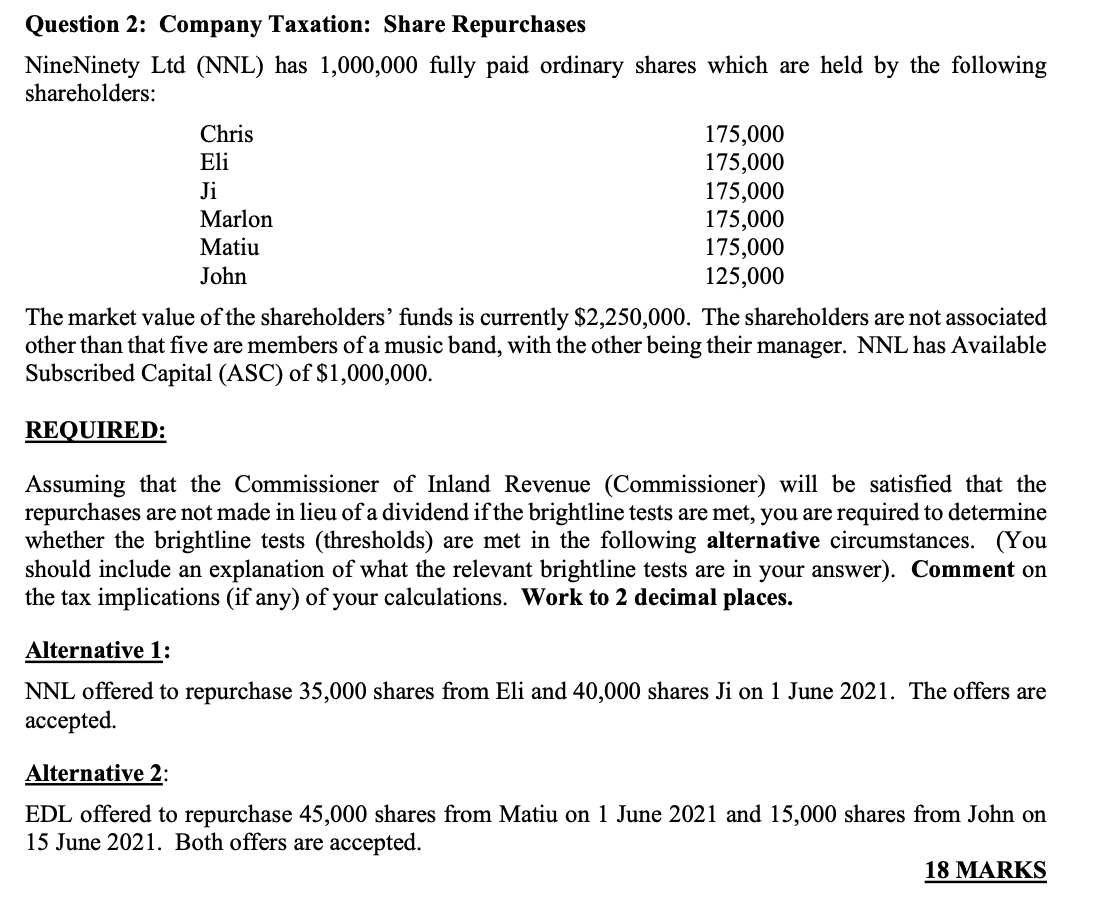

Question 2: Company Taxation: Share Repurchases NineNinety Ltd (NNL) has 1,000,000 fully paid ordinary shares which are held by the following shareholders: Chris Eli Ji Marlon Matiu John 175,000 175,000 175,000 175,000 175,000 125,000 The market value of the shareholders' funds is currently $2,250,000. The shareholders are not associated other than that five are members of a music band, with the other being their manager. NNL has Available Subscribed Capital (ASC) of $1,000,000. REQUIRED: Assuming that the Commissioner of Inland Revenue (Commissioner) will be satisfied that the repurchases are not made in lieu of a dividend if the brightline tests are met, you are required to determine whether the brightline tests (thresholds) are met in the following alternative circumstances. (You should include an explanation of what the relevant brightline tests are in your answer). Comment on the tax implications (if any) of your calculations. Work to 2 decimal places. Alternative 1: NNL offered to repurchase 35,000 shares from Eli and 40,000 shares Ji on 1 June 2021. The offers are accepted. Alternative 2: EDL offered to repurchase 45,000 shares from Matiu on 1 June 2021 and 15,000 shares from John on 15 June 2021. Both offers are accepted. 18 MARKS

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether the brightline tests thresholds are met in the given alternative circumstances we need to calculate the relevant thresholds and c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started