Answered step by step

Verified Expert Solution

Question

1 Approved Answer

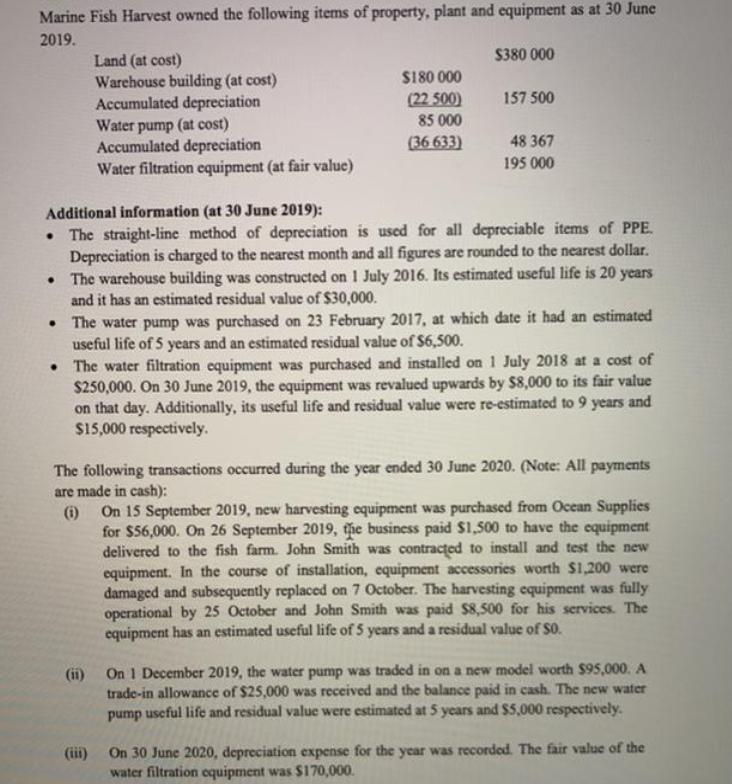

Marine Fish Harvest owned the following items of property, plant and equipment as at 30 June 2019. $380 000 Land (at cost) Warehouse building

Marine Fish Harvest owned the following items of property, plant and equipment as at 30 June 2019. $380 000 Land (at cost) Warehouse building (at cost) Accumulated depreciation Water pump (at cost) Accumulated depreciation Water filtration cquipment (at fair value) $180 000 (22 500) 157 500 85 000 (36 633) 48 367 195 000 Additional information (at 30 June 2019): The straight-line method of depreciation is used for all depreciable items of PPE. Depreciation is charged to the nearest month and all figures are rounded to the nearest dollar. The warehouse building was constructed on 1 July 2016. Its estimated useful life is 20 years and it has an estimated residual value of $30,000. The water pump was purchased on 23 February 2017, at which date it had an estimated useful life of 5 years and an estimated residual value of $6,500. The water filtration equipment was purchased and installed on 1 July 2018 at a cost of $250,000. On 30 June 2019, the equipment was revalued upwards by $8,000 to its fair value on that day. Additionally, its useful life and residual value were re-estimated to 9 years and $15,000 respectively. The following transactions occurred during the year ended 30 June 2020. (Note: All payments are made in cash): (i) On 15 September 2019, new harvesting equipment was purchased from Ocean Supplies for $56,000. On 26 September 2019, the business paid $1,500 to have the equipment delivered to the fish farm. John Smith was contracted to install and test the new equipment. In the course of installation, equipment accessories worth $1,200 were damaged and subsequently replaccd on 7 October. The harvesting equipment was fully operational by 25 October and John Smith was paid $8,500 for his services. The equipment has an estimated useful life of 5 years and a residual value of $0. (ii) On 1 December 2019, the water pump was traded in on a new model worth $95,000. A trade-in allowance of $25,000 was received and the balance paid in cash. The new water pump useful life and residual value were estimated at 5 years and $5,000 respectively. On 30 June 2020, depreciation expense for the year was recorded. The fair value of the water filtration cquipment was $170,000. (iii) Question 2 continued Required: Prepare general journal entries to record the transactions and events for the period 1 July 2019 to 30 June 2020 in relation to the assets mentioned above. Show all workings and round amounts to the nearest dollar.

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries SNo Particulars Debit Credit 1 Depreciation Expense DR 750000 To Accumulated Depreciation 750000 Recording of Depreciation on Warehous...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started