Answered step by step

Verified Expert Solution

Question

1 Approved Answer

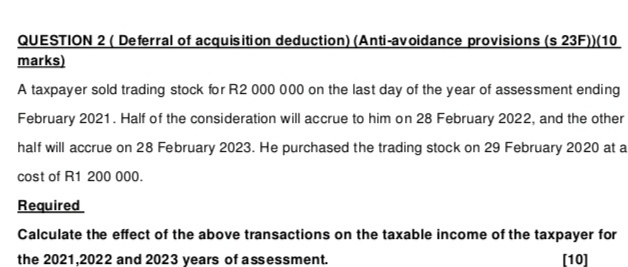

QUESTION 2 ( Deferral of acquisition deduction ) ( Anti - avoidance provisions ( s 2 3 F ) ) ( 1 0 marks )

QUESTION Deferral of acquisition deductionAntiavoidance provisions s F

marks

A taxpayer sold trading stock for R on the last day of the year of assessment ending

February Half of the consideration will accrue to him on February and the other

half will accrue on February He purchased the trading stock on February at a

cost of R

Required

Calculate the effect of the above transactions on the taxable income of the taxpayer for

the and years of assessment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started