Answered step by step

Verified Expert Solution

Question

1 Approved Answer

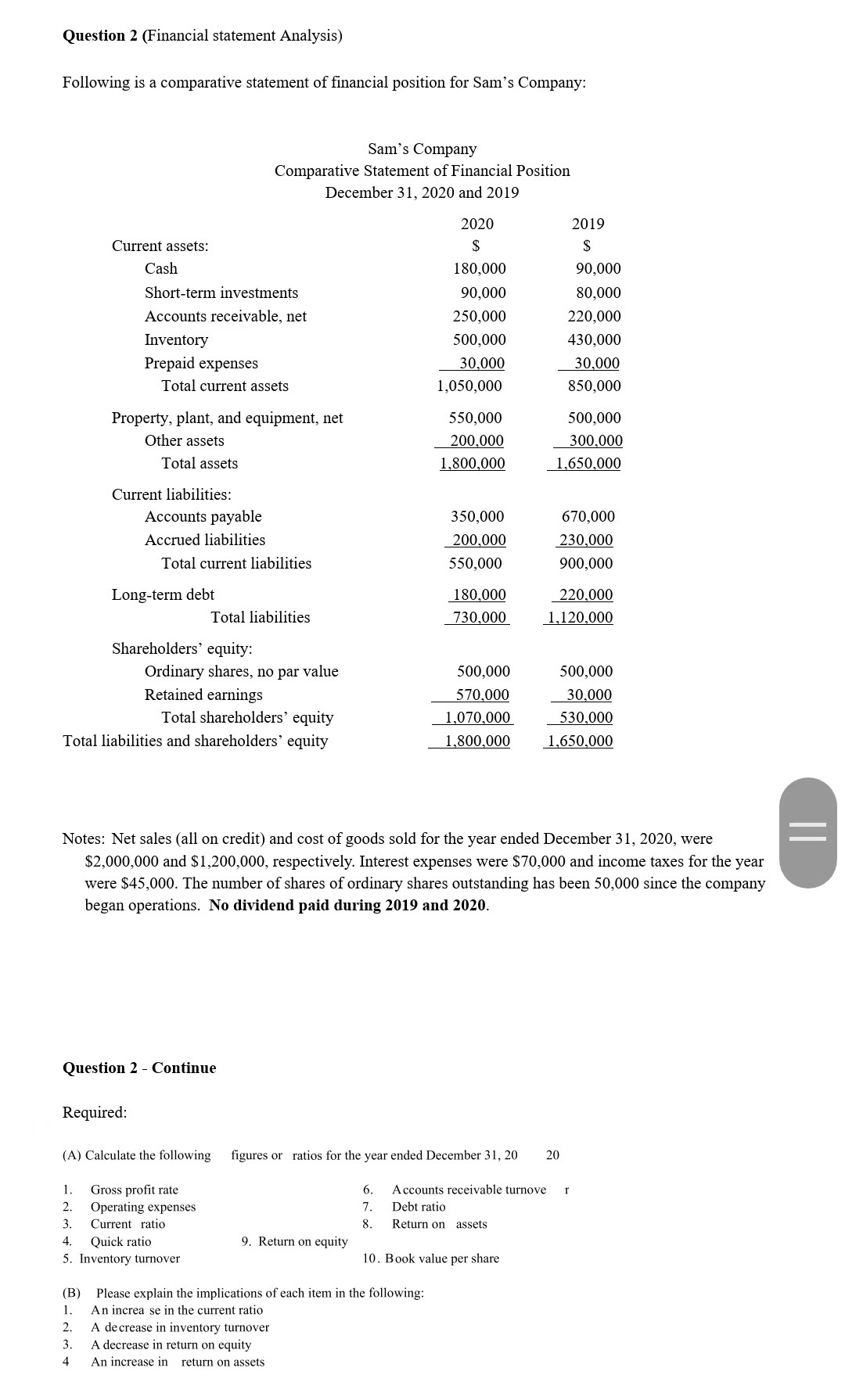

Question 2 (Financial statement Analysis) Following is a comparative statement of financial position for Sam's Company: Sam's Company Comparative Statement of Financial Position December

Question 2 (Financial statement Analysis) Following is a comparative statement of financial position for Sam's Company: Sam's Company Comparative Statement of Financial Position December 31, 2020 and 2019 2020 2019 Current assets: $ Cash 180,000 90,000 Short-term investments 90,000 80,000 Accounts receivable, net 250,000 220,000 Inventory 500,000 430,000 Prepaid expenses 30,000 30,000 Total current assets 1,050,000 850,000 Property, plant, and equipment, net 550,000 500,000 Other assets 200,000 300,000 1,800,000 1,650,000 Total assets Current liabilities: Accounts payable 350,000 670,000 Accrued liabilities 200,000 230,000 Total current liabilities 550,000 900,000 Long-term debt 180,000 220,000 Total liabilities 730,000 1,120,000 Shareholders' equity: Ordinary shares, no par value 500,000 500,000 Retained earnings 570,000 30,000 Total shareholders' equity 1,070,000 530,000 Total liabilities and shareholders' equity 1,800,000 1,650,000 Notes: Net sales (all on credit) and cost of goods sold for the year ended December 31, 2020, were $2,000,000 and $1,200,000, respectively. Interest expenses were $70,000 and income taxes for the year were $45,000. The number of shares of ordinary shares outstanding has been 50,000 since the company began operations. No dividend paid during 2019 and 2020. Question 2 - Continue Required: (A) Calculate the following figures or ratios for the year ended December 31, 20 20 1. Gross profit rate 6. 2. Operating expenses 7. Accounts receivable turnove Debt ratio r 3. Current ratio 8. Return on assets 4. Quick ratio 9. Return on equity 5. Inventory turnover 10. Book value per share (B) Please explain the implications of each item in the following: 1. An increase in the current ratio 2. A decrease in inventory turnover 3. A decrease in return on equity 4 An increase in return on assets ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Computation of 1 Gross profit rate Gross profit Sales X 100 Amount of Gross profit 2000000 1200000 800000 dollars 800000 2000000 X 100 40 2 Operatin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started