Answered step by step

Verified Expert Solution

Question

1 Approved Answer

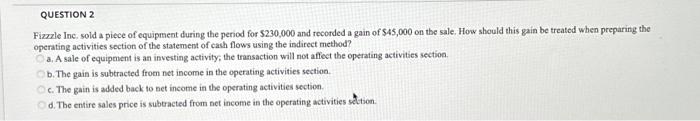

QUESTION 2 Fizzzle Inc. sold a piece of equipment during the period for $230,000 and recorded a gain of $45,000 on the sale. How should

QUESTION 2 Fizzzle Inc. sold a piece of equipment during the period for $230,000 and recorded a gain of $45,000 on the sale. How should this gain be treated when preparing the operating activities section of the statement of cash flows using the indirect method? O a. A sale of equipment is an investing activity; the transaction will not affect the operating activities section. Ob. The gain is subtracted from net income in the operating activities section. Oc. The gain is added back to net income in the operating activities section. Od. The entire sales price is subtracted from net income in the operating activities section.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started