Answered step by step

Verified Expert Solution

Question

1 Approved Answer

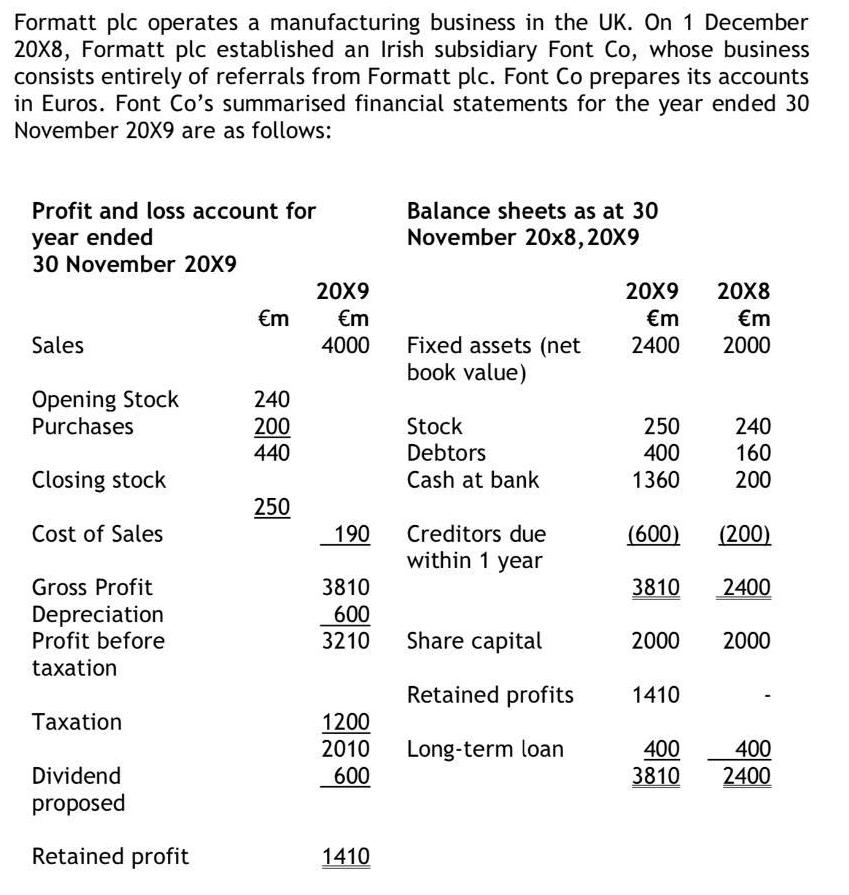

Formatt plc operates a manufacturing business in the UK. On 1 December 20X8, Formatt plc established an Irish subsidiary Font Co, whose business consists

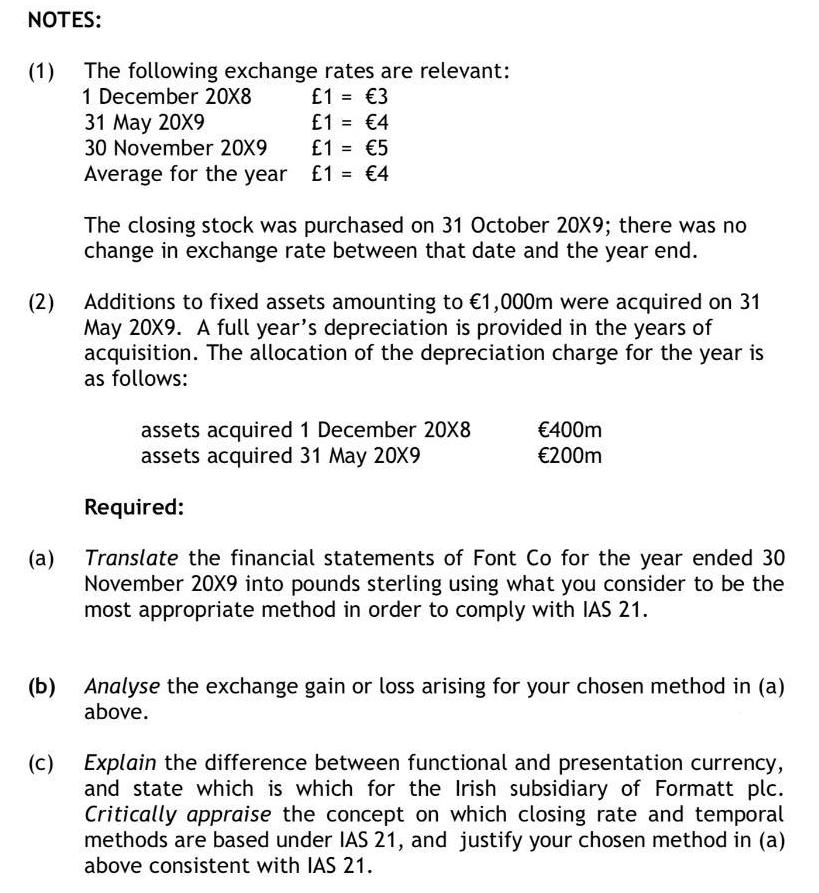

Formatt plc operates a manufacturing business in the UK. On 1 December 20X8, Formatt plc established an Irish subsidiary Font Co, whose business consists entirely of referrals from Formatt plc. Font Co prepares its accounts in Euros. Font Co's summarised financial statements for the year ended 30 November 20X9 are as follows: Profit and loss account for Balance sheets as at 30 year ended 30 November 20X9 November 20x8,20X9 20X9 20X9 20X8 m m m m Fixed assets (net book value) Sales 4000 2400 2000 Opening Stock Purchases 240 200 440 Stock Debtors Cash at bank 240 160 250 400 Closing stock 1360 200 250 Cost of Sales 190 Creditors due within 1 year (600) (200) Gross Profit 3810 3810 2400 Depreciation Profit before 600 3210 Share capital 2000 2000 taxation Retained profits 1410 1200 2010 ation 400 3810 400 2400 Long-term loan Dividend 600 proposed Retained profit 1410 NOTES: (1) The following exchange rates are relevant: 1 December 20X8 1 = 3 1 = 4 1 = 5 Average for the year 1 = 4 31 y 20X9 30 November 20X9 %3! %3D The closing stock was purchased on 31 October 20X9; there was no change in exchange rate between that date and the year end. (2) Additions to fixed assets amounting to 1,000m were acquired on 31 May 20X9. A full year's depreciation is provided in the years of acquisition. The allocation of the depreciation charge for the year is as follows: assets acquired 1 December 20X8 assets acquired 31 May 20X9 400m 200m Required: Translate the financial statements of Font Co for the year ended 30 () November 20X9 into pounds sterling using what you consider to be the most appropriate method in order to comply with IAS 21. (b) Analyse the exchange gain or loss arising for your chosen method in (a) above. Explain the difference between functional and presentation currency, (c) and state which is which for the Irish subsidiary of Formatt plc. Critically appraise the concept on which closing rate and temporal methods are based under IAS 21, and justify your chosen method in (a) above consistent with IAS 21.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Soln The financial statements of Font coFor the year ended BONOvembe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started