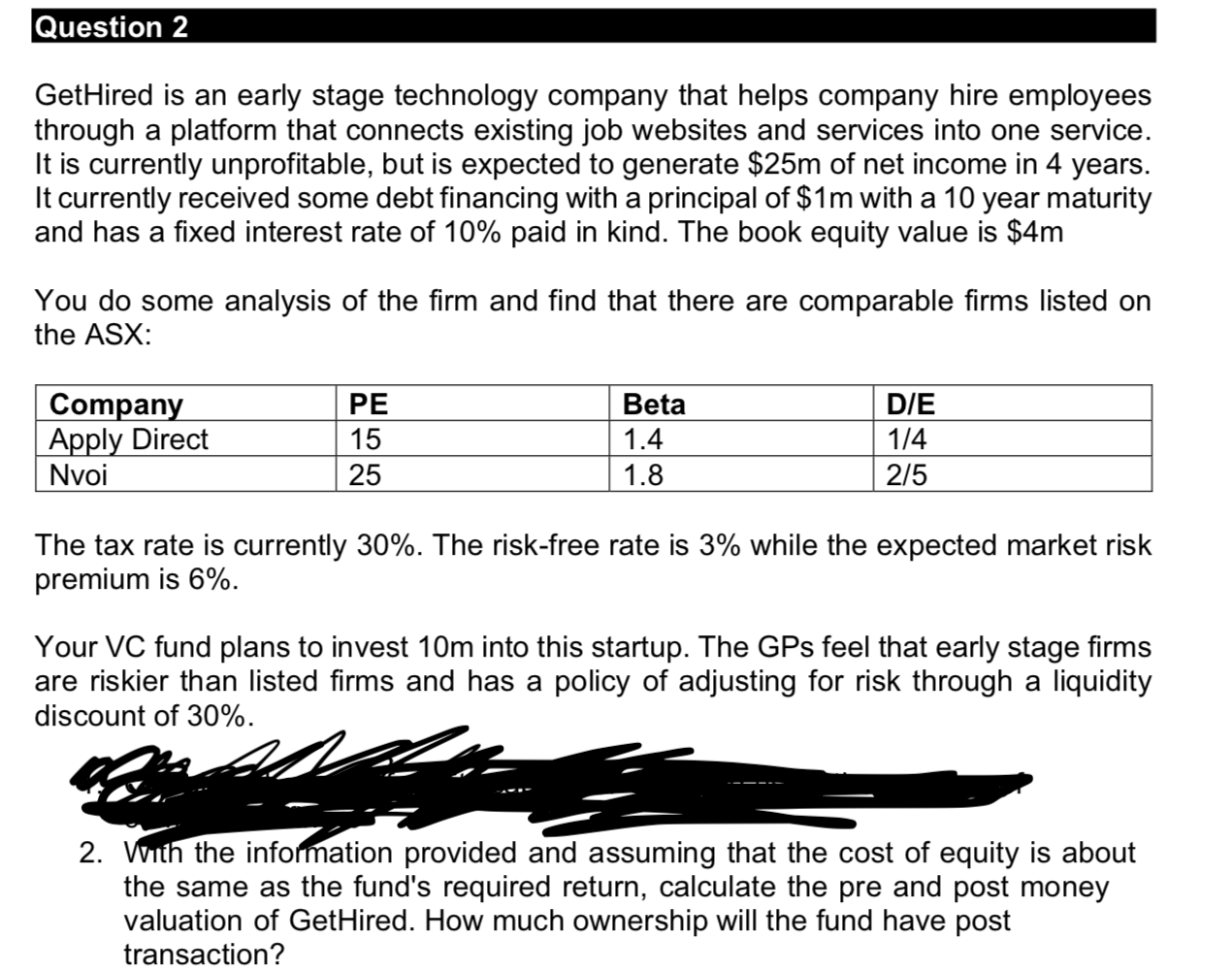

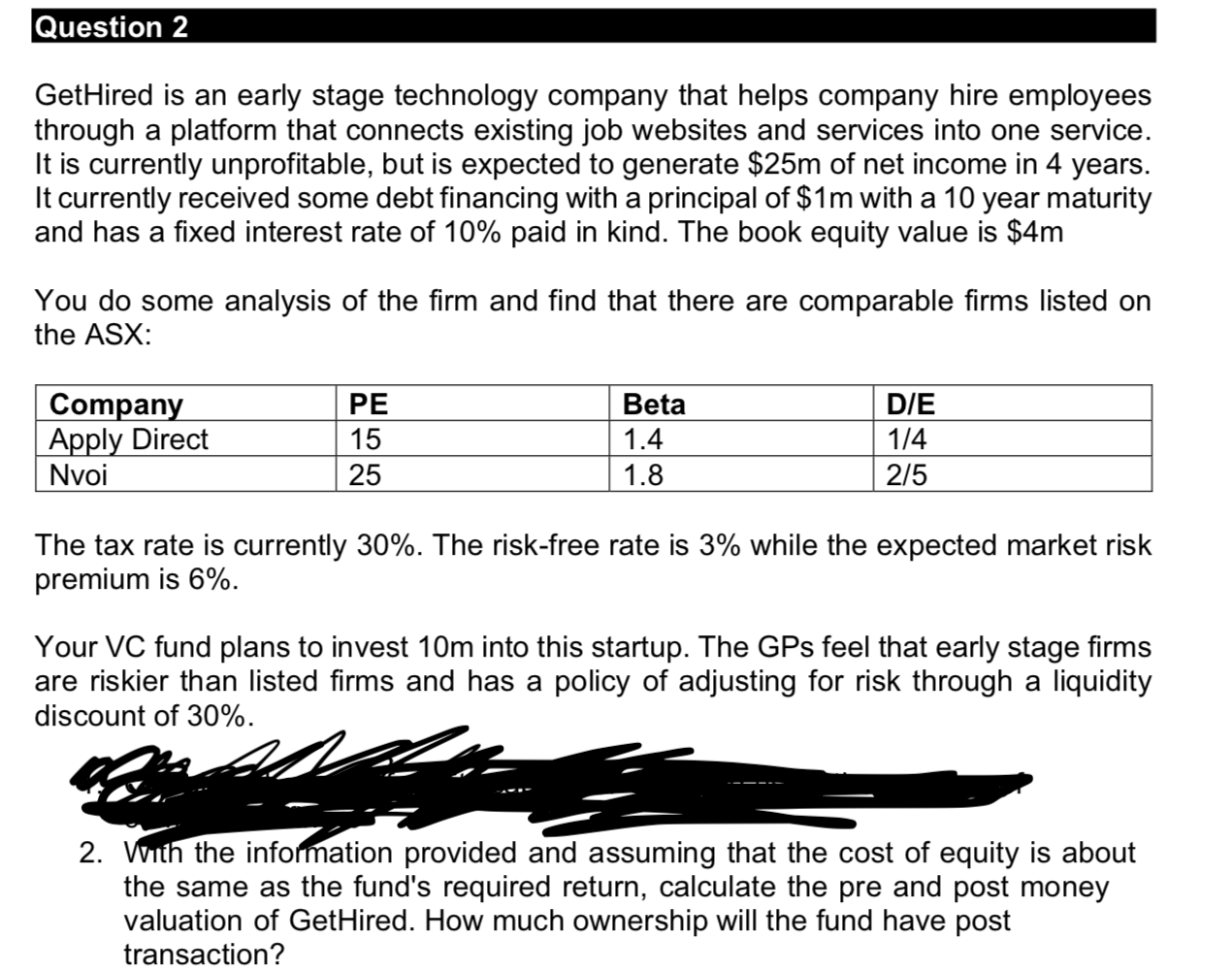

Question 2 GetHired is an early stage technology company that helps company hire employees through a platform that connects existing job websites and services into one service. It is currently unprofitable, but is expected to generate $25m of net income in 4 years. It currently received some debt financing with a principal of $1m with a 10 year maturity and has a fixed interest rate of 10% paid in kind. The book equity value is $4m You do some analysis of the firm and find that there are comparable firms listed on the ASX: PE Company Apply Direct Nvoi 15 25 Beta 1.4 1.8 D/E 1/4 2/5 The tax rate is currently 30%. The risk-free rate is 3% while the expected market risk premium is 6%. Your VC fund plans to invest 10m into this startup. The GPs feel that early stage firms are riskier than listed firms and has a policy of adjusting for risk through a liquidity discount of 30%. 2. With the information provided and assuming that the cost of equity is about the same as the fund's required return, calculate the pre and post money valuation of GetHired. How much ownership will the fund have post transaction? Question 2 GetHired is an early stage technology company that helps company hire employees through a platform that connects existing job websites and services into one service. It is currently unprofitable, but is expected to generate $25m of net income in 4 years. It currently received some debt financing with a principal of $1m with a 10 year maturity and has a fixed interest rate of 10% paid in kind. The book equity value is $4m You do some analysis of the firm and find that there are comparable firms listed on the ASX: PE Company Apply Direct Nvoi 15 25 Beta 1.4 1.8 D/E 1/4 2/5 The tax rate is currently 30%. The risk-free rate is 3% while the expected market risk premium is 6%. Your VC fund plans to invest 10m into this startup. The GPs feel that early stage firms are riskier than listed firms and has a policy of adjusting for risk through a liquidity discount of 30%. 2. With the information provided and assuming that the cost of equity is about the same as the fund's required return, calculate the pre and post money valuation of GetHired. How much ownership will the fund have post transaction