QUESTION 2

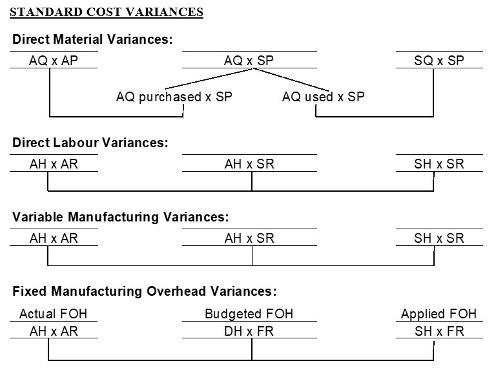

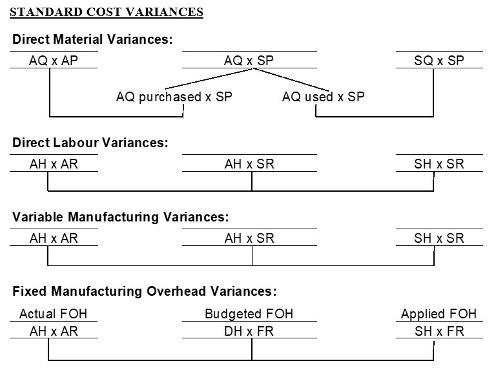

Hanya Tree Club operates a small manufacturing division that produces various souvenir products with the resort's logo. One of these products is a beach blanket, which uses standard casting. You have been asked to evaluate the blanket's production data using the following information Actual Data: Standard Data: Material purchased 18,000 meters Material 20 meters per blariket @ $0.90 per meter Material used 19 meters/blanket Labour 4 hours per blanket @ $15.00 per hour Direct Labour 4.2 hours blanket Overhead - Fixed 4 hours per blanket @ 1.25 per hour Total Manufacturing OH $10,980 500 beach blankets were produced during the period. Variable overhead is based on direct labour hours. The total predetermined overhead rate is $5.25 per hour and the denominator level of activity is 2,400. Variances: Material Price Variance $900 Unfavourable Total Labour Variance $1,125 Unfavourable Total Fixed Overhead Variance $700 Unfavourable Required: 1) Calculate the following by completing all production variances LIST your answers in the following format: No marks will be given for answers not shown in this format: a) The actual price per meter of direct material purchased b) Direct material quantity variance c) Direct labour eficiency variance d) Direct labour rate variance c) Actual direct labour rate Variable overhead efficiency variance 8) Variable overhead spending variance h) Total actual variable overhead 1) Fixed overhead: 2. Total actual fixed overhead b. Total budgeted fixed overhead c. Total applied fixed overhead d. Budget variance e. Volume variance 2) a) Explain possible causes for 3 of the above variances (your choice) b) What was the total cost of production, and the cost per blanket? STANDARD COST VARIANCES Direct Material Variances: AQ X AP AQ x SP SQ x SP AQ purchased x SP AQ used x SP Direct Labour Variances: AH XAR AH X SR SH X SR Variable Manufacturing Variances: AH XAR AH X SR SH X SR Fixed Manufacturing Overhead Variances: Actual FOH Budgeted FOH AH XAR DHX FR Applied FOH SHX FR Hanya Tree Club operates a small manufacturing division that produces various souvenir products with the resort's logo. One of these products is a beach blanket, which uses standard casting. You have been asked to evaluate the blanket's production data using the following information Actual Data: Standard Data: Material purchased 18,000 meters Material 20 meters per blariket @ $0.90 per meter Material used 19 meters/blanket Labour 4 hours per blanket @ $15.00 per hour Direct Labour 4.2 hours blanket Overhead - Fixed 4 hours per blanket @ 1.25 per hour Total Manufacturing OH $10,980 500 beach blankets were produced during the period. Variable overhead is based on direct labour hours. The total predetermined overhead rate is $5.25 per hour and the denominator level of activity is 2,400. Variances: Material Price Variance $900 Unfavourable Total Labour Variance $1,125 Unfavourable Total Fixed Overhead Variance $700 Unfavourable Required: 1) Calculate the following by completing all production variances LIST your answers in the following format: No marks will be given for answers not shown in this format: a) The actual price per meter of direct material purchased b) Direct material quantity variance c) Direct labour eficiency variance d) Direct labour rate variance c) Actual direct labour rate Variable overhead efficiency variance 8) Variable overhead spending variance h) Total actual variable overhead 1) Fixed overhead: 2. Total actual fixed overhead b. Total budgeted fixed overhead c. Total applied fixed overhead d. Budget variance e. Volume variance 2) a) Explain possible causes for 3 of the above variances (your choice) b) What was the total cost of production, and the cost per blanket? STANDARD COST VARIANCES Direct Material Variances: AQ X AP AQ x SP SQ x SP AQ purchased x SP AQ used x SP Direct Labour Variances: AH XAR AH X SR SH X SR Variable Manufacturing Variances: AH XAR AH X SR SH X SR Fixed Manufacturing Overhead Variances: Actual FOH Budgeted FOH AH XAR DHX FR Applied FOH SHX FR