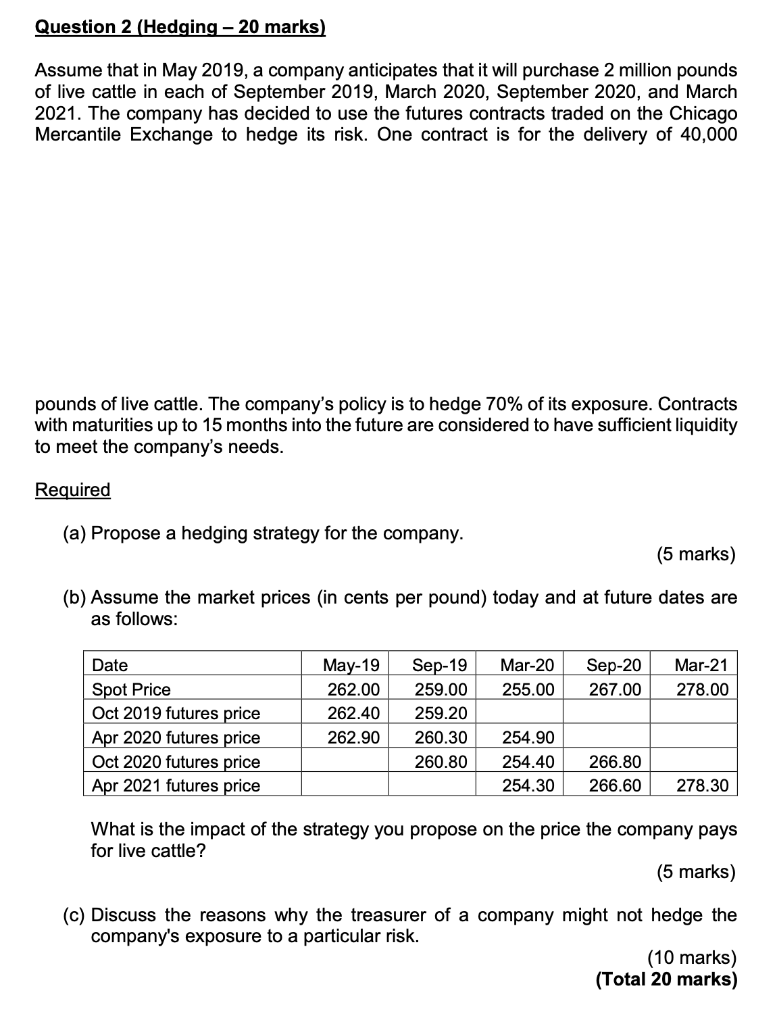

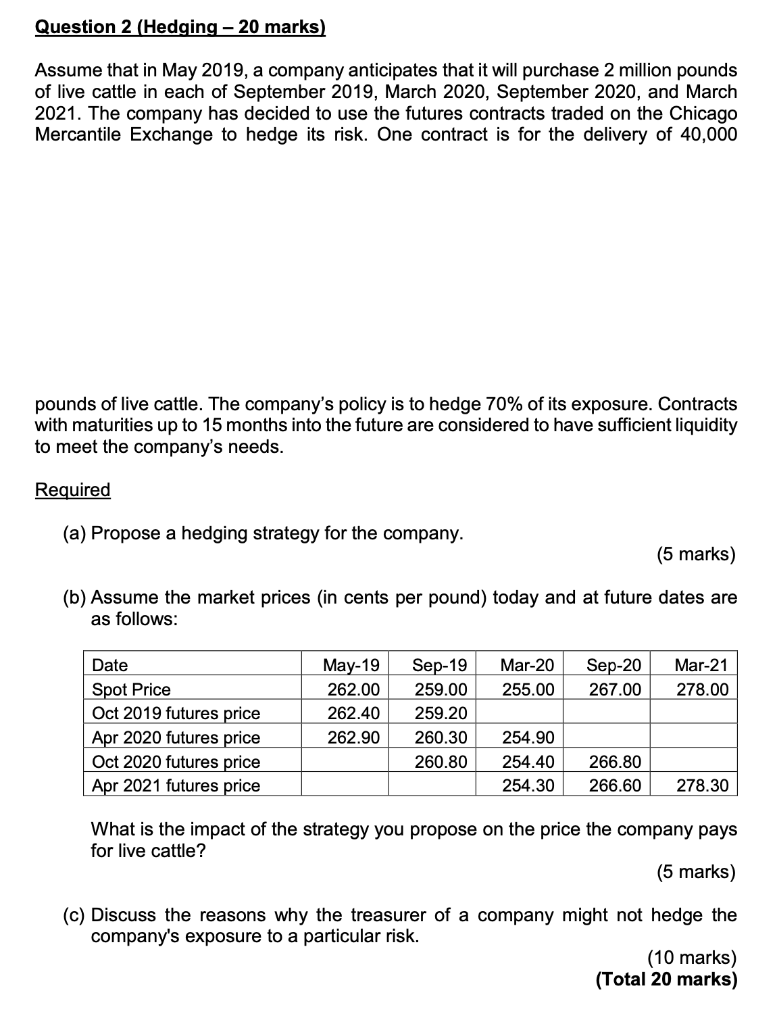

Question 2 (Hedging - 20 marks) Assume that in May 2019, a company anticipates that it will purchase 2 million pounds of live cattle in each of September 2019, March 2020, September 2020, and March 2021. The company has decided to use the futures contracts traded on the Chicago Mercantile Exchange to hedge its risk. One contract is for the delivery of 40,000 pounds of live cattle. The company's policy is to hedge 70% of its exposure. Contracts with maturities up to 15 months into the future are considered to have sufficient liquidity to meet the company's needs. Required (a) Propose a hedging strategy for the company. (5 marks) (b) Assume the market prices (in cents per pound) today and at future dates are as follows: Date Mar-20 Mar-21 May-19 262.00 Sep-19 259.00 Sep-20 267.00 255.00 278.00 262.40 259.20 Spot Price Oct 2019 futures price Apr 2020 futures price Oct 2020 futures price Apr 2021 futures price 262.90 260.30 254.90 260.80 254.40 266.80 254.30 266.60 278.30 What is the impact of the strategy you propose on the price the company pays for live cattle? (5 marks) (c) Discuss the reasons why the treasurer of a company might not hedge the company's exposure to a particular risk. (10 marks) (Total 20 marks) Question 2 (Hedging - 20 marks) Assume that in May 2019, a company anticipates that it will purchase 2 million pounds of live cattle in each of September 2019, March 2020, September 2020, and March 2021. The company has decided to use the futures contracts traded on the Chicago Mercantile Exchange to hedge its risk. One contract is for the delivery of 40,000 pounds of live cattle. The company's policy is to hedge 70% of its exposure. Contracts with maturities up to 15 months into the future are considered to have sufficient liquidity to meet the company's needs. Required (a) Propose a hedging strategy for the company. (5 marks) (b) Assume the market prices (in cents per pound) today and at future dates are as follows: Date Mar-20 Mar-21 May-19 262.00 Sep-19 259.00 Sep-20 267.00 255.00 278.00 262.40 259.20 Spot Price Oct 2019 futures price Apr 2020 futures price Oct 2020 futures price Apr 2021 futures price 262.90 260.30 254.90 260.80 254.40 266.80 254.30 266.60 278.30 What is the impact of the strategy you propose on the price the company pays for live cattle? (5 marks) (c) Discuss the reasons why the treasurer of a company might not hedge the company's exposure to a particular risk. (10 marks) (Total 20 marks)