Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Hujan Renyai Berhad (Hujan Renyai) wishes to evaluate the following two alternatives available to acquire a machine. Lease Alternative Hujan Renyai can

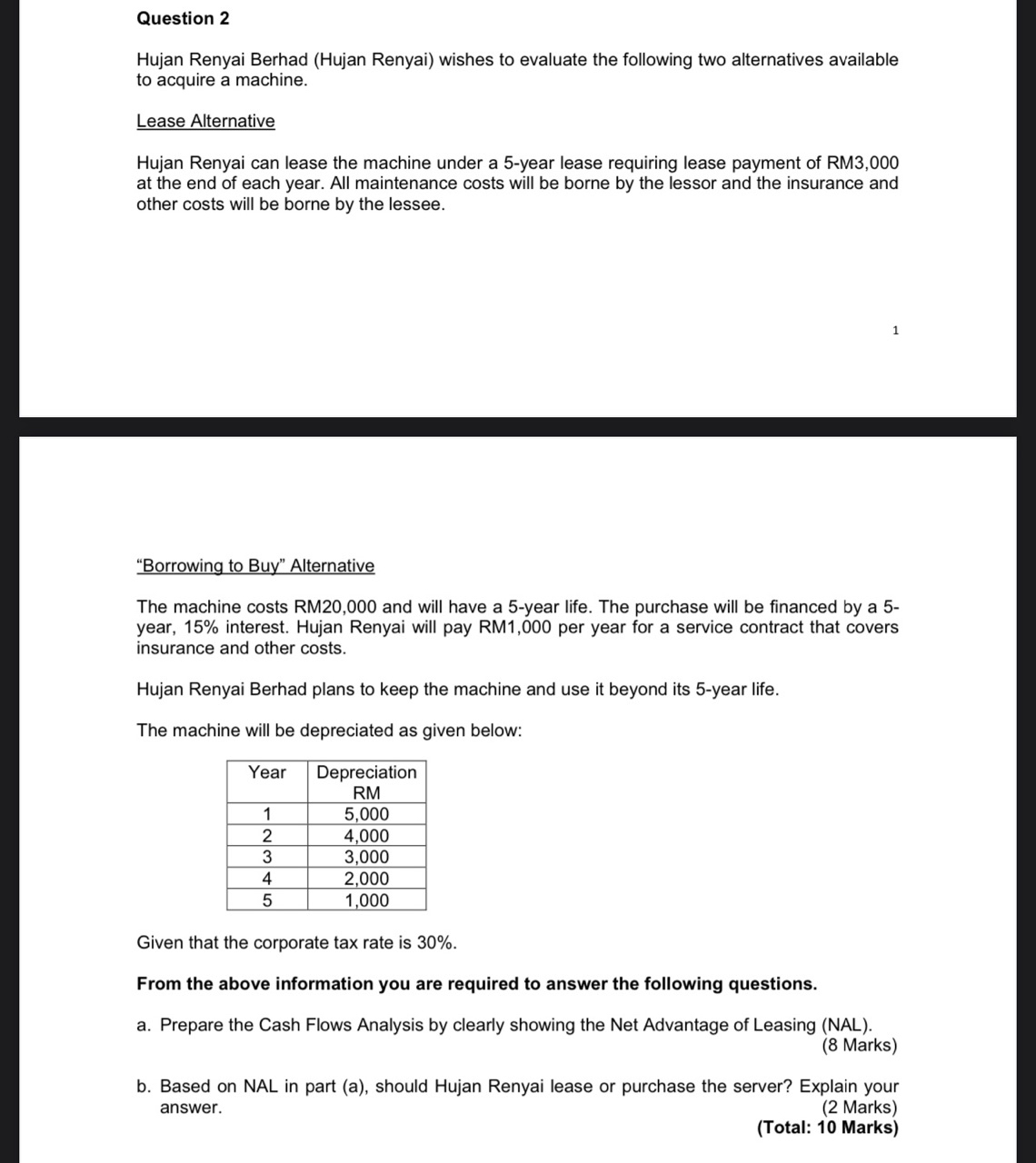

Question 2 Hujan Renyai Berhad (Hujan Renyai) wishes to evaluate the following two alternatives available to acquire a machine. Lease Alternative Hujan Renyai can lease the machine under a 5-year lease requiring lease payment of RM3,000 at the end of each year. All maintenance costs will be borne by the lessor and the insurance and other costs will be borne by the lessee. 1 "Borrowing to Buy" Alternative The machine costs RM20,000 and will have a 5-year life. The purchase will be financed by a 5- year, 15% interest. Hujan Renyai will pay RM1,000 per year for a service contract that covers insurance and other costs. Hujan Renyai Berhad plans to keep the machine and use it beyond its 5-year life. The machine will be depreciated as given below: Year Depreciation RM 1 5,000 2 4,000 3 3,000 4 2,000 5 1,000 Given that the corporate tax rate is 30%. From the above information you are required to answer the following questions. a. Prepare the Cash Flows Analysis by clearly showing the Net Advantage of Leasing (NAL). (8 Marks) b. Based on NAL in part (a), should Hujan Renyai lease or purchase the server? Explain your answer. (2 Marks) (Total: 10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started