Question: Question 2. (I5 points) Central Valley Transit Ine. (CVT) has just sign manufacturer in Germany for e Lecember. Because the contract is in euros rather

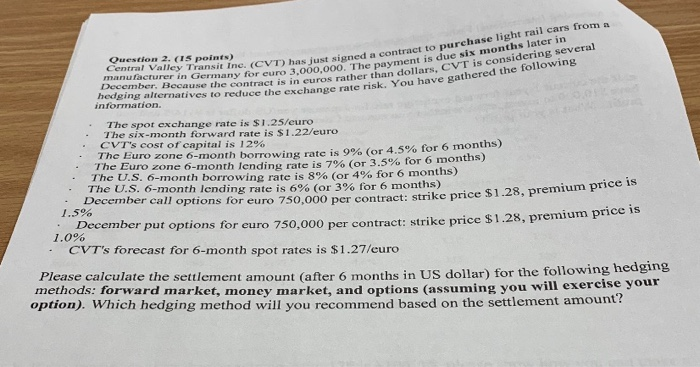

Question 2. (I5 points) Central Valley Transit Ine. (CVT) has just sign manufacturer in Germany for e Lecember. Because the contract is in euros rather than dollar hedeing alternatives to reduce the exchange rate risk. You have Bad information. wey Transit Ine. (CVT) has iust signed a contract to purchase urchase light rail cars from a crater in Germany for curo 3.000.000. The payment is due is The payment is due six months later in rather than dollars, CVT is considering several ate risk. You have gathered the following The spot exchange rate is $1.25/euro The six-month forward rate is $1.22/euro CVT's cost of capital is 12% The Euro zone 6-month borrowing rate is 9% (or 4.5% for 6 months) The Euro zone 6-month lending rate is 79% (or 3.5% for 6 months) The U.S. 6-month borrowine rate is 8% (or 4% for 6 months) The U.S. 6-month lending rate is 6% (or 3% for 6 months) December call options for euro 750,000 er can options for euro 750,000 per contract: strike price $1.28, premium 1.5% December pur options for euro 750.000 per contract: strike price $1.28, premium 1.0% CVT's forecast for 6-month spot rates is $1.27/euro Please calculate the settlement amount (after 6 months in US dollar) for the following u s methods: forward market, money market, and options (assuming you will exercise you option). Which hedging method will you recommend based on the settlement amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts