Answered step by step

Verified Expert Solution

Question

1 Approved Answer

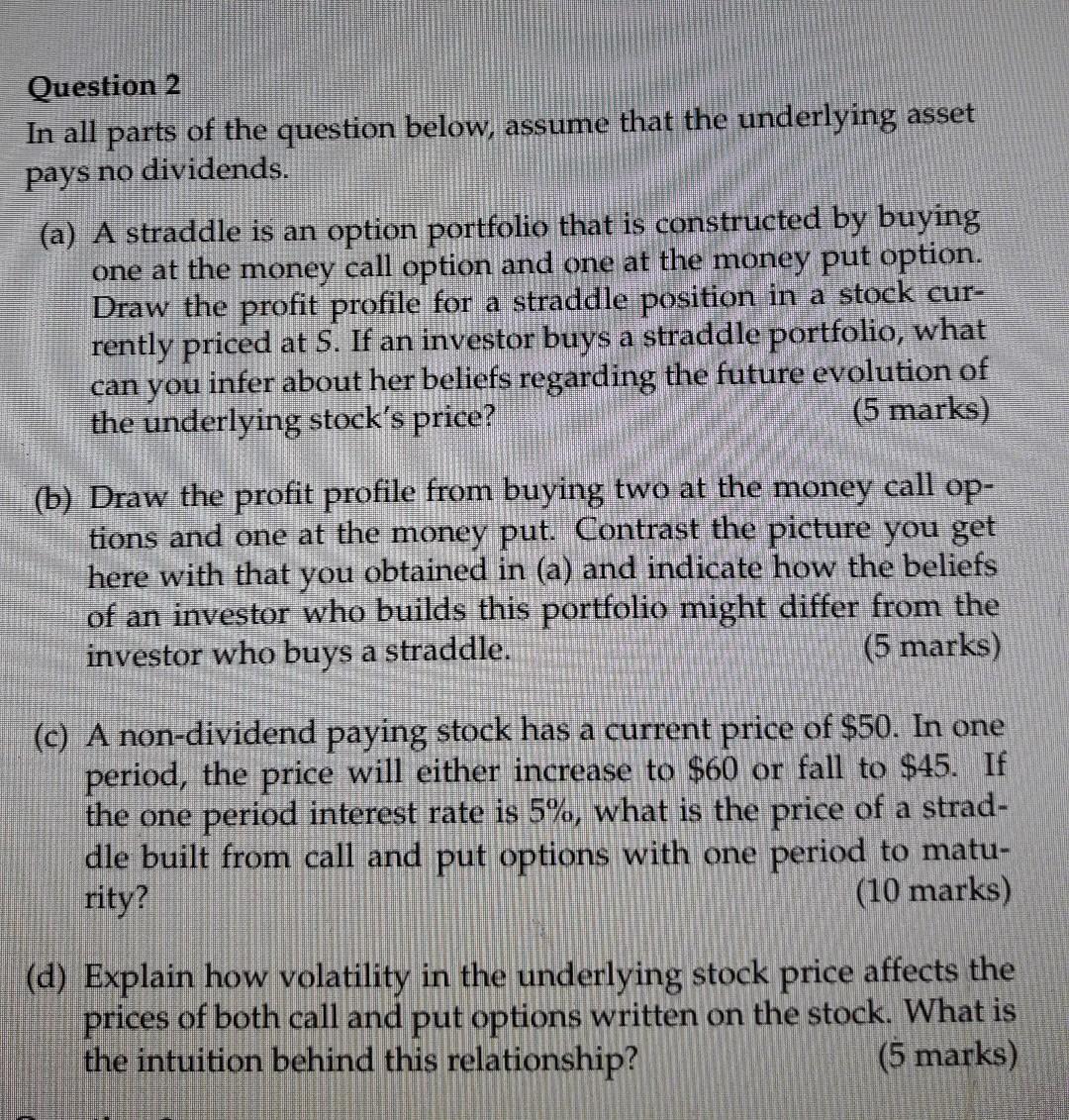

Question 2 In all parts of the question below, assume that the underlying asset pays no dividends. (a) A straddle is an option portfolio that

Question 2 In all parts of the question below, assume that the underlying asset pays no dividends. (a) A straddle is an option portfolio that is constructed by buying one at the money call option and one at the money put option. Draw the profit profile for a straddle position in a stock cur- rently priced at S. If an investor buys a straddle portfolio, what can you infer about her beliefs regarding the future evolution of the underlying stock's price? (5 marks) (b) Draw the profit profile from buying two at the money call op- tions and one at the money put. Contrast the picture you get here with that you obtained in (a) and indicate how the beliefs of an investor who builds this portfolio might differ from the investor who buys a straddle. (5 marks) (c) A non-dividend paying stock has a current price of $50. In one period, the price will either increase to $60 or fall to $45. If the one period interest rate is 5%, what is the price of a strad- dle built from call and put options with one period to matu- rity? (10 marks) (d) Explain how volatility in the underlying stock price affects the prices of both call and put options written on the stock. What is the intuition behind this relationship? (5 marks) Question 2 In all parts of the question below, assume that the underlying asset pays no dividends. (a) A straddle is an option portfolio that is constructed by buying one at the money call option and one at the money put option. Draw the profit profile for a straddle position in a stock cur- rently priced at S. If an investor buys a straddle portfolio, what can you infer about her beliefs regarding the future evolution of the underlying stock's price? (5 marks) (b) Draw the profit profile from buying two at the money call op- tions and one at the money put. Contrast the picture you get here with that you obtained in (a) and indicate how the beliefs of an investor who builds this portfolio might differ from the investor who buys a straddle. (5 marks) (c) A non-dividend paying stock has a current price of $50. In one period, the price will either increase to $60 or fall to $45. If the one period interest rate is 5%, what is the price of a strad- dle built from call and put options with one period to matu- rity? (10 marks) (d) Explain how volatility in the underlying stock price affects the prices of both call and put options written on the stock. What is the intuition behind this relationship

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started