Answered step by step

Verified Expert Solution

Question

1 Approved Answer

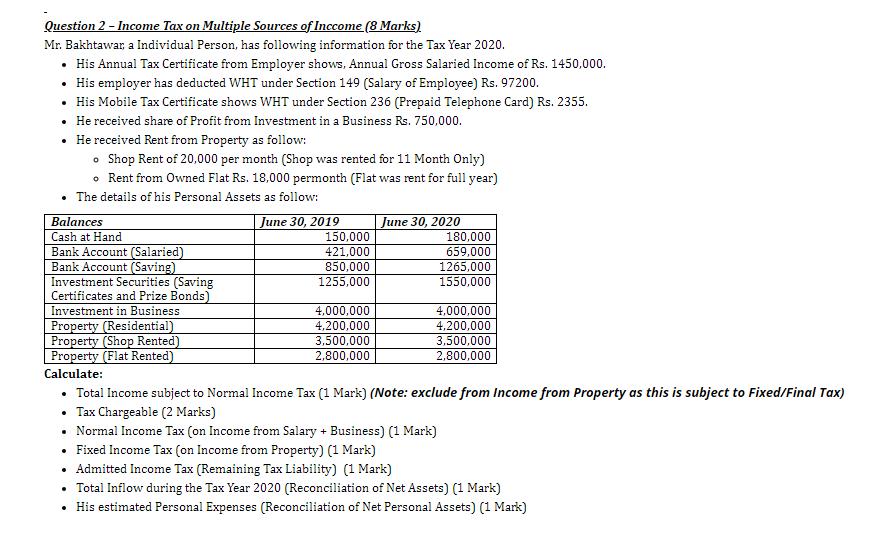

Question 2 - Income Tax on Multiple Sources of Inccome (8 Marks) Mr. Bakhtawar, a Individual Person, has following information for the Tax Year

Question 2 - Income Tax on Multiple Sources of Inccome (8 Marks) Mr. Bakhtawar, a Individual Person, has following information for the Tax Year 2020. His Annual Tax Certificate from Employer shows, Annual Gross Salaried Income of Rs. 1450,000. His employer has deducted WHT under Section 149 (Salary of Employee) Rs. 97200. His Mobile Tax Certificate shows WHT under Section 236 (Prepaid Telephone Card) Rs. 2355. He received share of Profit from Investment in a Business Rs. 750,000. He received Rent from Property as follow: o Shop Rent of 20,000 per month (Shop was rented for 11 Month Only) Rent from Owned Flat Rs. 18,000 permonth (Flat was rent for full year) The details of his Personal Assets as follow: June 30, 2019 Balances Cash at Hand Bank Account (Salaried) Bank Account (Saving) Investment Securities (Saving Certificates and Prize Bonds) Investment in Business Property (Residential) Property (Shop Rented) Property (Flat Rented) Calculate: 150,000 421,000 850,000 1255,000 4,000,000 4,200,000 3,500,000 2,800,000 June 30, 2020 180,000 659,000 1265,000 1550,000 4,000,000 4,200,000 3,500,000 2,800,000 Total Income subject to Normal Income Tax (1 Mark) (Note: exclude from Income from Property as this is subject to Fixed/Final Tax) Tax Chargeable (2 Marks) Normal Income Tax (on Income from Salary + Business) (1 Mark) Fixed Income Tax (on Income from Property) (1 Mark) . Admitted Income Tax (Remaining Tax Liability) (1 Mark) Total Inflow during the Tax Year 2020 (Reconciliation of Net Assets) (1 Mark) His estimated Personal Expenses (Reconciliation of Net Personal Assets) (1 Mark)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Please refer below tax calculator for answer 1 5 questions Tax Liability of Mr Bakhtawar Particulars Amount Amount Remarks Income from Salary 1450000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started