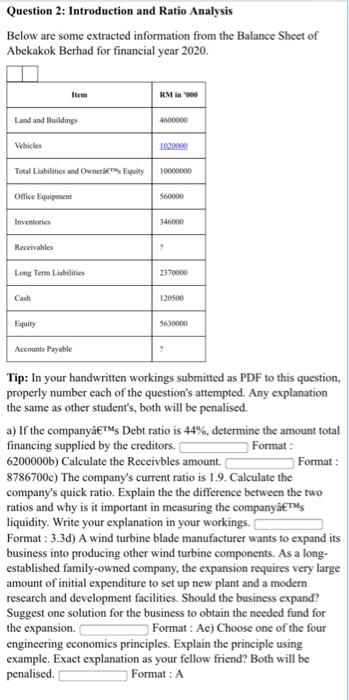

Question 2: Introduction and Ratio Analysis Below are some extracted information from the Balance Sheet of Abekakok Berhad for financial year 2020. Item RM IN Land and Buildings 4000000 10000 1000000 Total Liabilities and Owners Equity Office Equipment 560000 Inventories Receivables Long Term Liabilities 2370000 Cash 120500 Equity 5630000 Accounts Payable Tip: In your handwritten workings submitted as PDF to this question, properly number each of the question's attempted. Any explanation the same as other student's, both will be penalised. a) If the companyTMs Debt ratio is 44%, determine the amount total financing supplied by the creditors. Format : 6200000b) Calculate the Receivbles amount. Format : 8786700c) The company's current ratio is 1.9. Calculate the company's quick ratio. Explain the the difference between the two ratios and why is it important in measuring the companyats liquidity. Write your explanation in your workings. Format : 3.3d) A wind turbine blade manufacturer wants to expand its business into producing other wind turbine components. As a long- established family-owned company, the expansion requires very large amount of initial expenditure to set up new plant and a modern research and development facilities. Should the business expand? Suggest one solution for the business to obtain the needed fund for the expansion Format : Ae) Choose one of the four engineering economics principles. Explain the principle using example. Exact explanation as your fellow friend? Both will be penalised Format: A Question 2: Introduction and Ratio Analysis Below are some extracted information from the Balance Sheet of Abekakok Berhad for financial year 2020. Item RM IN Land and Buildings 4000000 10000 1000000 Total Liabilities and Owners Equity Office Equipment 560000 Inventories Receivables Long Term Liabilities 2370000 Cash 120500 Equity 5630000 Accounts Payable Tip: In your handwritten workings submitted as PDF to this question, properly number each of the question's attempted. Any explanation the same as other student's, both will be penalised. a) If the companyTMs Debt ratio is 44%, determine the amount total financing supplied by the creditors. Format : 6200000b) Calculate the Receivbles amount. Format : 8786700c) The company's current ratio is 1.9. Calculate the company's quick ratio. Explain the the difference between the two ratios and why is it important in measuring the companyats liquidity. Write your explanation in your workings. Format : 3.3d) A wind turbine blade manufacturer wants to expand its business into producing other wind turbine components. As a long- established family-owned company, the expansion requires very large amount of initial expenditure to set up new plant and a modern research and development facilities. Should the business expand? Suggest one solution for the business to obtain the needed fund for the expansion Format : Ae) Choose one of the four engineering economics principles. Explain the principle using example. Exact explanation as your fellow friend? Both will be penalised Format: A