Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Additional information 1. Stock on 31 December 2019 was P2 800. 2. P60 of the carriage is for carriage inwards. 3. Depreciation of fixtures and

Additional information

Additional information

1. Stock on 31 December 2019 was P2 800.

2. P60 of the carriage is for carriage inwards.

3. Depreciation of fixtures and fittings at 10%.

4. Interest at 5% on partners’ capital.

5. Partnership salary P500 to James.

6. Wages accrued P 400.

7. Residue of profit to be shared equally.

8. Provision for bad debts to equal 10 percent of debtors.

Required to prepare:

a) Trading and profit and loss appropriation account.

b) Partners’ capital account.

c) A balance sheet for the year ended 31 December 2019.

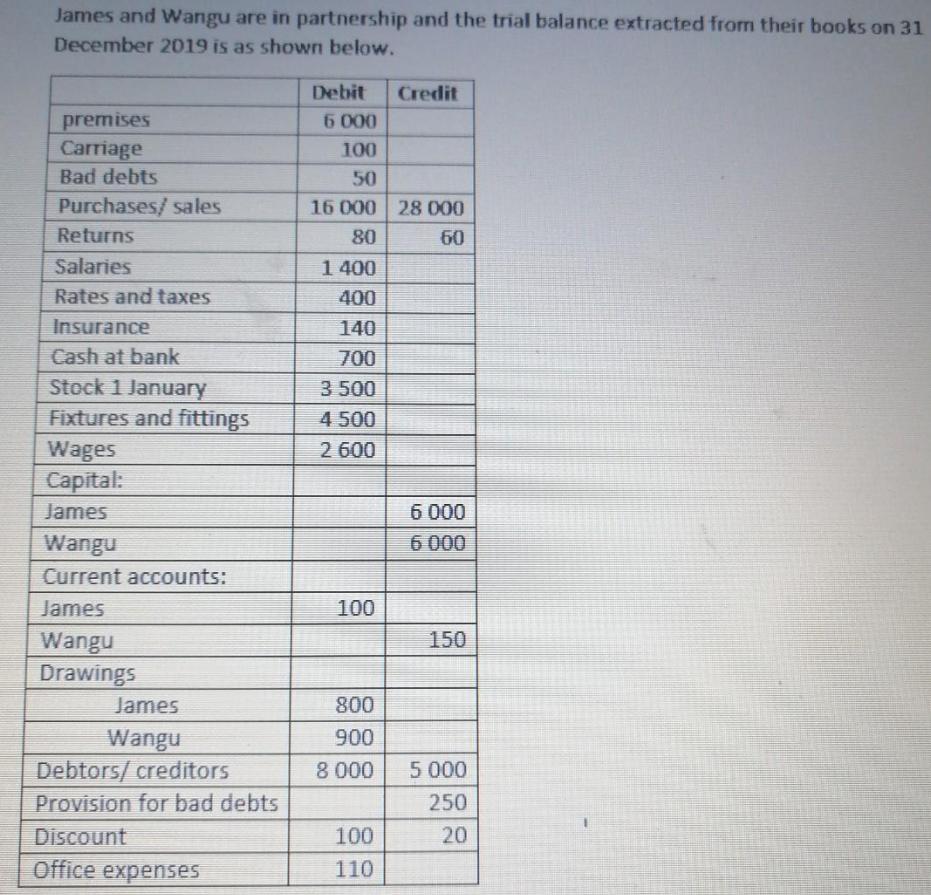

James and Wangu are in partnership and the trial balance extracted from their books on 31 December 2019 is as shown below. Debit Credit 6 00 0 premises Carriage 100 Bad debts 50 Purchases/ sales 16 000 28 000 Returns 80 60 Salaries 1 400 Rates and taxes 400 Insurance 140 Cash at bank 700 Stock 1 January Fixtures and fittings 3 500 4 500 2 600 Wages Capital: James 6 000 Wangu 6 000 Current accounts: James 100 Wangu 150 Drawings James 800 Wangu Debtors/ creditors Provision for bad debts 900 8 000 5 000 250 Discount 100 20 Office expenses 110

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A Trading AC For the year ended December 31 2019 Particular Amount Amount Particular Amount Amount S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started