Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 - JANUARY 2019 (Question 4 Amended) Arklow plc prepares its financial statements to 31 December each year. Before the financial statements for the

QUESTION 2 - JANUARY 2019 (Question 4 Amended)

Arklow plc prepares its financial statements to 31 December each year. Before the financial statements for the year ended 31 December 2018 can be finalised, a number of outstanding issues need to be resolved.

Issue 1:

Closing inventory of Arklow plc at 31 December 2018 includes 100 items carried at cost 5,000 each. New safety regulations were announced on 5 April 2019 with immediate effect. The items of inventory do not comply with these regulations. As a result, the net realisable value of the inventory is only 4,500 each.

Issue 2:

On 10 January 2019, a customer, Otis Limited, commenced legal action against Arklow plc alleging that work completed in November 2018 had not been carried out in accordance with the terms of the contract. The directors of Arklow plc intend to defend the allegations vigorously and Arklow plcs legal advisors estimate that the company has an 80% chance of successfully defending the claim. If Otis Limited is successful, penalties and legal fees are expected to amount to 300,000. If Arklow plc wins the case, non-recoverable legal fees of 60,000 are likely to have been incurred. The directors of Arklow plc are proposing to omit reference to the legal action in the financial statements for the year ended 31 December 2018 as the writ was not issued until January 2019.

Issue 3:

A customer, Bedford Limited, which owed Arklow plc 240,000 at 31 December 2018 was declared bankrupt on 6 January 2019. It is expected that only 20 pence in the pound will be recovered. A further 30,000 of credit sales had been made to Bedford Limited during the period 1-5 January 2019.

Issue 4:

On 6 January 2019, Arklow plc advised its legal advisors to commence an action against its major supplier claiming damages of 500,000 in respect of losses sustained as a result of the supply of faulty goods during 2018. According to the legal advice, Arklow plc has a very good chance of winning the case.

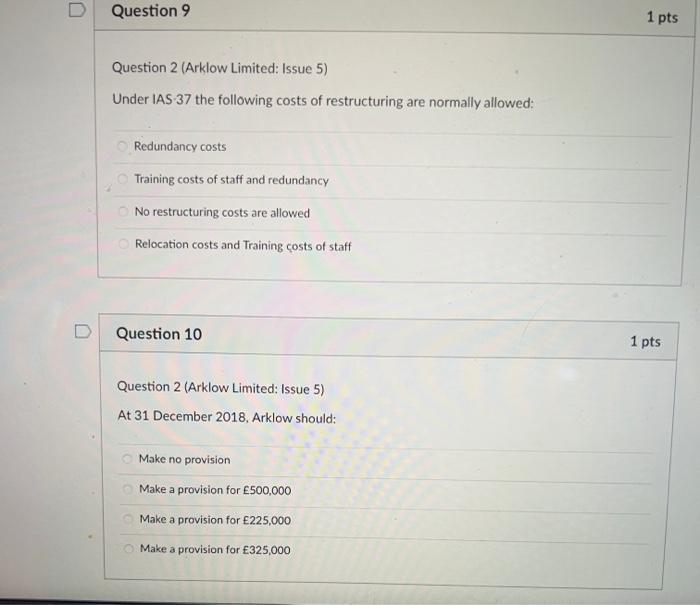

Issue 5:

Arklow plc expects to incur trading losses during the year ended 31 December 2019. Consequently, the companys finance director believes that it would be prudent to recognise a provision for 365,000 in the financial statements for the year ended 31 December 2018 in respect of the anticipated trading losses. Restructuring plans are at present being formulated and Arklow plcs finance director believes that these will result in expenditure amounting to 500,000 in 2019. An analysis of the expenditure arising from the decision to restructure is as follows:

Training of staff 100,000

Relocation of staff 175,000

Redundancy 225,000

While a formal plan has been drawn up in relation to the restructuring, an announcement has not yet been made to those affected nor has any substantial action been taken in relation to the restructuring.

The finance director is still unsure as to how to deal with this issue in the financial statements of Arklow plc for the year ended 31 December 2018.

Requirement

Prepare a memorandum to the directors of Arklow plc which explains how each of the above issues should be accounted for in the financial statements of Arklow plc for the year ended 31 December 2018, showing clearly any accounting adjustments required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started