Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 John Hanson is a senior executive with Buxton Plc. His annual salary for the tax year 2020/21 is 110,000. In addition to

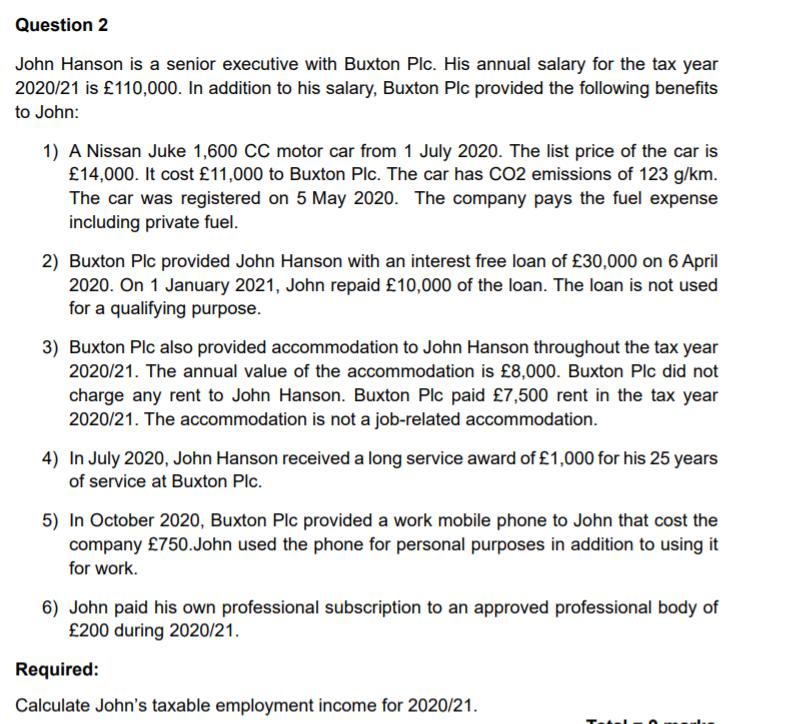

Question 2 John Hanson is a senior executive with Buxton Plc. His annual salary for the tax year 2020/21 is 110,000. In addition to his salary, Buxton Plc provided the following benefits to John: 1) A Nissan Juke 1,600 CC motor car from 1 July 2020. The list price of the car is 14,000. It cost 11,000 to Buxton Plc. The car has CO2 emissions of 123 g/km. The car was registered on 5 May 2020. The company pays the fuel expense including private fuel. 2) Buxton Plc provided John Hanson with an interest free loan of 30,000 on 6 April 2020. On 1 January 2021, John repaid 10,000 of the loan. The loan is not used for a qualifying purpose. 3) Buxton Plc also provided accommodation to John Hanson throughout the tax year 2020/21. The annual value of the accommodation is 8,000. Buxton Plc did not charge any rent to John Hanson. Buxton Plc paid 7,500 rent in the tax year 2020/21. The accommodation is not a job-related accommodation. 4) In July 2020, John Hanson received a long service award of 1,000 for his 25 years of service at Buxton Plc. 5) In October 2020, Buxton Plc provided a work mobile phone to John that cost the company 750.John used the phone for personal purposes in addition to using it for work. 6) John paid his own professional subscription to an approved professional body of 200 during 2020/21. Required: Calculate John's taxable employment income for 2020/21.

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

calculation of the taxable income of John for 202021 all figures in particulars amount basic salary ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started