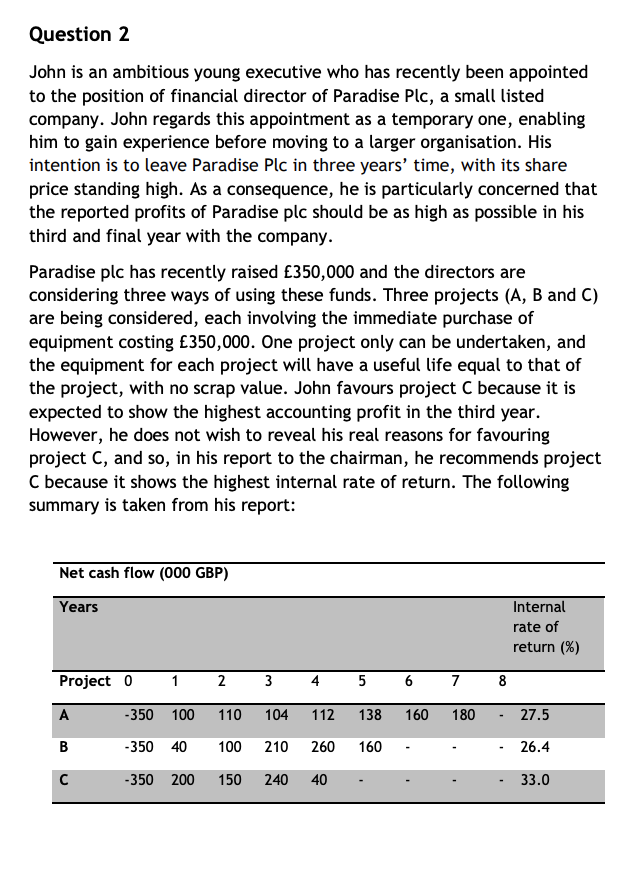

Question 2 John is an ambitious young executive who has recently been appointed to the position of financial director of Paradise Plc, a small listed company. John regards this appointment as a temporary one, enabling him to gain experience before moving to a larger organisation. His intention is to leave Paradise Plc in three years' time, with its share price standing high. As a consequence, he is particularly concerned that the reported profits of Paradise plc should be as high as possible in his third and final year with the company. Paradise plc has recently raised 350,000 and the directors are considering three ways of using these funds. Three projects (A, B and C) are being considered, each involving the immediate purchase of equipment costing 350,000. One project only can be undertaken, and the equipment for each project will have a useful life equal to that of the project, with no scrap value. John favours project C because it is expected to show the highest accounting profit in the third year. However, he does not wish to reveal his real reasons for favouring project C, and so, in his report to the chairman, he recommends project C because it shows the highest internal rate of return. The following summary is taken from his report: Net cash flow (000 GBP) Years Internal rate of return (%) Project 0 1 2 3 4 5 6 7 8 A -350 100 110 104 112 138 160 180 27.5 B -350 40 100 210 260 160 26.4 -350 200 150 240 40 33.0 The chairman of the company is accustomed to projects being appraised in terms of payback period and NPV, and he is consequently suspicious of the use of internal rate of return as a method of project selection. Accordingly, the chairman has asked for an independent report on the choice of project. The company's typical required rate of return (hurdle rate or discount rate) is 3% accounting for inflation + 17% for profit, i.e. 20% in total. (a) Calculate the payback period of each project. (6 marks) (b) Calculate the NPV for each project, where the NPV equation needs to be written out for at least one of the calculated projects. (20 marks) (c) Prepare a report for the chairman with a trade-off discussion on the methods used and their results; and a final recommendation which project to choose. (24 marks) [50 marks]