Answered step by step

Verified Expert Solution

Question

1 Approved Answer

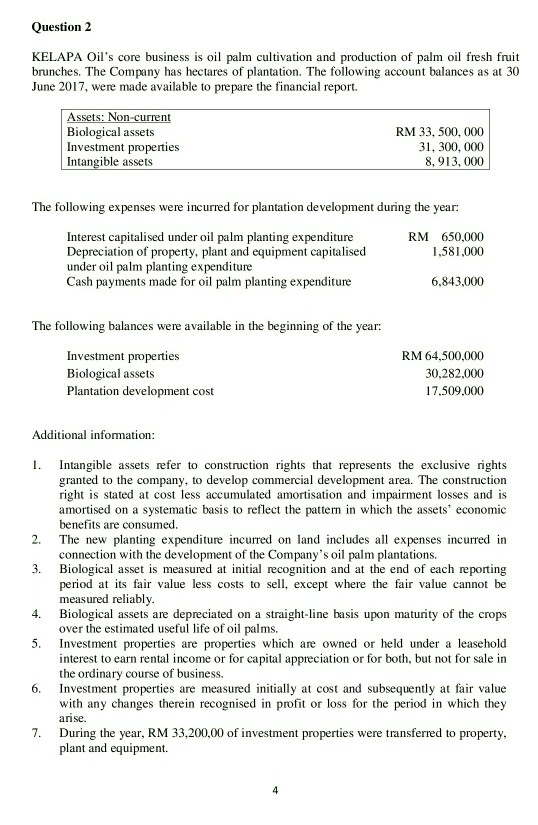

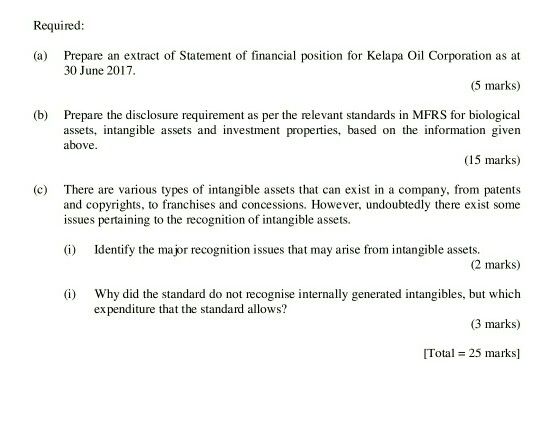

Question 2 KELAPA Oil's core business is oil palm cultivation and production of palm oil fresh fruit brunches. The Company has hectares of plantation. The

Question 2 KELAPA Oil's core business is oil palm cultivation and production of palm oil fresh fruit brunches. The Company has hectares of plantation. The following account balances as at 30 June 2017, were made available to prepare the financial report. ssets: Non Biological assets Investment properties Intangible assets RM 33, 500, 000 31, 300, 000 8, 913, 000 The following expenses were incurred for plantation development during the year: RM 650,000 1,581,000 Interest capitalised under oil palm planting expenditure Depreciation of property, plant and equipment capitalised under oil palm planting expenditure Cash payments made for oil palm planting expenditure 6,843,000 The following balances were available in the beginning of the year: Investment properties Biological assets Plantation development cost RM 64,500,000 30,282,000 17.509.000 Additional information: . Intangible assets refer to construction rights that represents the exclusive rights granted to the company, to develop commercial development area. The construction right is stated at cost less accumulated amortisation and impairment losses and is amortised on a systematic basis to reflect the pattern in which the assets' economic benefits are consumed The new planting expenditure incurred on land includes all expenses incurred in connection with the development of t Biological asset is measured at initial recognition and at the end of each reporting period at its fair value less costs to sell except where the fair value cannot be measured reliably Biological assets are depreciated on a straight-line basis upon maturity of the crops over the estimated useful life of oil palms. Investment properties are properties which are owned or held under a leasehold interest to earn rental income or for capital appreciation or for both, but not for sale in the ordinary course of business. Investment properties are measured initially at cost and subsequently at fair value with any changes therein recognised in profit or loss for the period in which they 2. he Company' s oil palm plantations 3. 4. 5. 6. anse. 7. During the year, RM 33,200,00 of investment properties were transferred to property plant and equipment. Question 2 KELAPA Oil's core business is oil palm cultivation and production of palm oil fresh fruit brunches. The Company has hectares of plantation. The following account balances as at 30 June 2017, were made available to prepare the financial report. ssets: Non Biological assets Investment properties Intangible assets RM 33, 500, 000 31, 300, 000 8, 913, 000 The following expenses were incurred for plantation development during the year: RM 650,000 1,581,000 Interest capitalised under oil palm planting expenditure Depreciation of property, plant and equipment capitalised under oil palm planting expenditure Cash payments made for oil palm planting expenditure 6,843,000 The following balances were available in the beginning of the year: Investment properties Biological assets Plantation development cost RM 64,500,000 30,282,000 17.509.000 Additional information: . Intangible assets refer to construction rights that represents the exclusive rights granted to the company, to develop commercial development area. The construction right is stated at cost less accumulated amortisation and impairment losses and is amortised on a systematic basis to reflect the pattern in which the assets' economic benefits are consumed The new planting expenditure incurred on land includes all expenses incurred in connection with the development of t Biological asset is measured at initial recognition and at the end of each reporting period at its fair value less costs to sell except where the fair value cannot be measured reliably Biological assets are depreciated on a straight-line basis upon maturity of the crops over the estimated useful life of oil palms. Investment properties are properties which are owned or held under a leasehold interest to earn rental income or for capital appreciation or for both, but not for sale in the ordinary course of business. Investment properties are measured initially at cost and subsequently at fair value with any changes therein recognised in profit or loss for the period in which they 2. he Company' s oil palm plantations 3. 4. 5. 6. anse. 7. During the year, RM 33,200,00 of investment properties were transferred to property plant and equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started