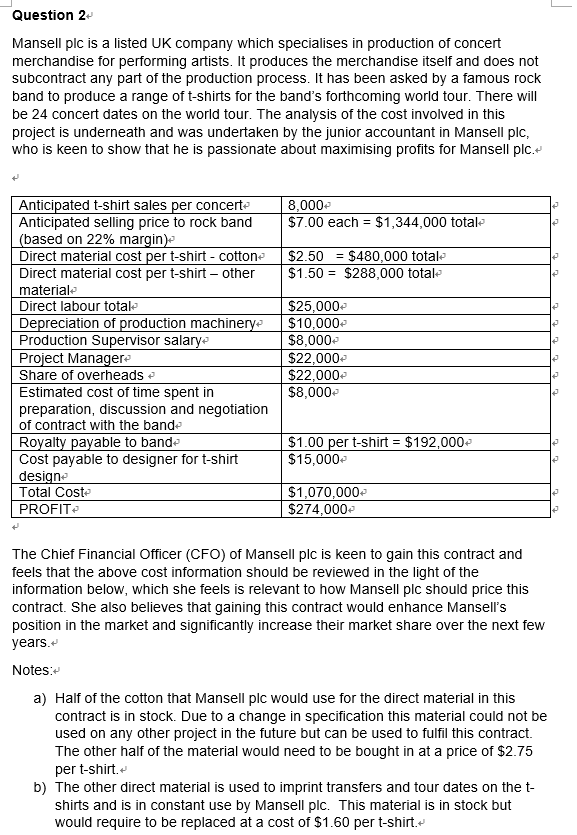

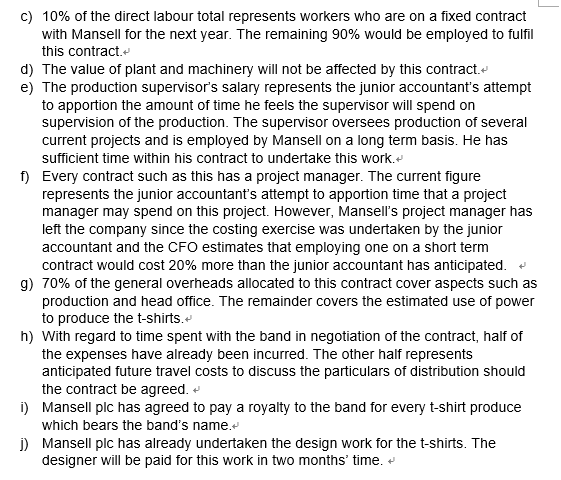

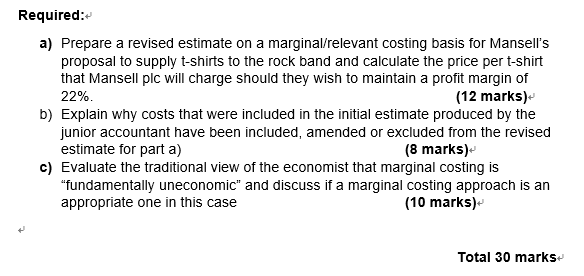

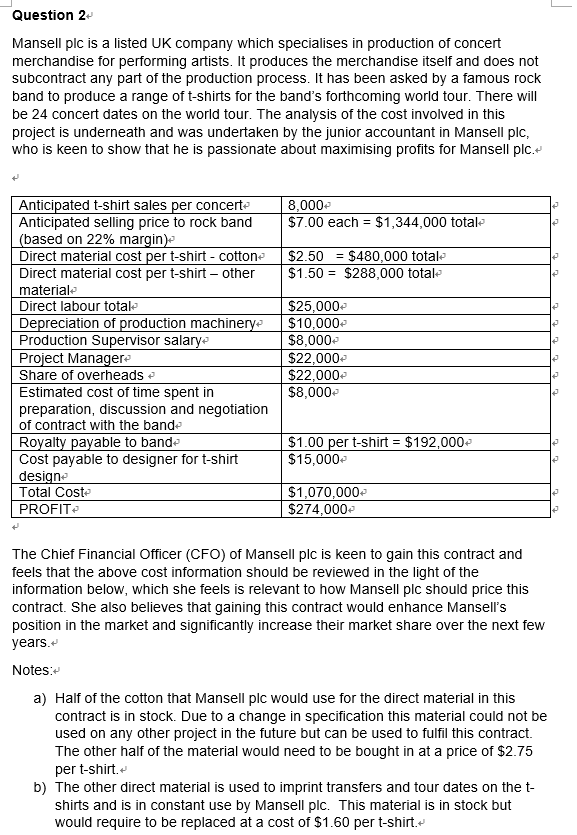

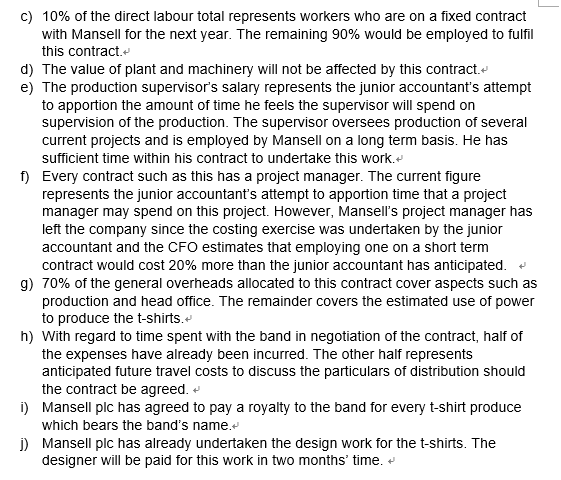

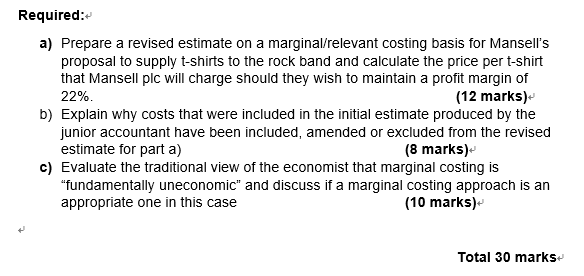

Question 2 Mansell plc is a listed UK company which specialises in production of concert merchandise for performing artists. It produces the merchandise itself and does not subcontract any part of the production process. It has been asked by a famous rock band to produce a range of t-shirts for the band's forthcoming world tour. There will be 24 concert dates on the world tour. The analysis of the cost involved in this project is underneath and was undertaken by the junior accountant in Mansell plc, who is keen to show that he is passionate about maximising profits for Mansell plc. t 8,000 $7.00 each = $1,344,000 total $2.50 = $480,000 totale $1.50 = $288,000 totale Anticipated t-shirt sales per concerte Anticipated selling price to rock band (based on 22% margin- Direct material cost per t-shirt - cottone Direct material cost per t-shirt - other materiale Direct labour totale Depreciation of production machinerye Production Supervisor salarye Project Manager Share of overheads Estimated cost of time spent in preparation, discussion and negotiation of contract with the bande Royalty payable to bande Cost payable to designer for t-shirt design- Total Cost PROFIT $25,000 $10,000+ $8,000- $22,000+ $22,000+ $8,000- $1.00 per t-shirt = $192,000+ $15,000 $1,070,000+ $274,000- The Chief Financial Officer (CFO) of Mansell plc is keen to gain this contract and feels that the above cost information should be reviewed in the light of the information below, which she feels is relevant to how Mansell plc should price this contract. She also believes that gaining this contract would enhance Mansell's position in the market and significantly increase their market share over the next few years. Notes:- a) Half of the cotton that Mansell plc would use for the direct material in this contract is in stock. Due to a change in specification this material could not be used on any other project in the future but can be used to fulfil this contract. The other half of the material would need to be bought in at a price of $2.75 per t-shirt. b) The other direct material is used to imprint transfers and tour dates on the t- shirts and is in constant use by Mansell plc. This material is in stock but would require to be replaced at a cost of $1.60 per t-shirt. C) 10% of the direct labour total represents workers who are on a fixed contract with Mansell for the next year. The remaining 90% would be employed to fulfil this contract. d) The value of plant and machinery will not be affected by this contract. e) The production supervisor's salary represents the junior accountant's attempt to apportion the amount of time he feels the supervisor will spend on supervision of the production. The supervisor oversees production of several current projects and is employed by Mansell on a long term basis. He has sufficient time within his contract to undertake this work. f) Every contract such as this has a project manager. The current figure represents the junior accountant's attempt to apportion time that a project manager may spend on this project. However, Mansell's project manager has left the company since the costing exercise was undertaken by the junior accountant and the CFO estimates that employing one on a short term contract would cost 20% more than the junior accountant has anticipated. g) 70% of the general overheads allocated to this contract cover aspects such as production and head office. The remainder covers the estimated use of power to produce the t-shirts. h) With regard to time spent with the band in negotiation of the contract, half of the expenses have already been incurred. The other half represents anticipated future travel costs to discuss the particulars of distribution should the contract be agreed. + 1) Mansell plc has agreed to pay a royalty to the band for every t-shirt produce which bears the band's name.- 1) Mansell plc has already undertaken the design work for the t-shirts. The designer will be paid for this work in two months' time. Required: a) Prepare a revised estimate on a marginal/relevant costing basis for Mansell's proposal to supply t-shirts to the rock band and calculate the price per t-shirt that Mansell plc will charge should they wish to maintain a profit margin of 22% (12 marks) b) Explain why costs that were included in the initial estimate produced by the junior accountant have been included, amended or excluded from the revised estimate for parta) (8 marks) c) Evaluate the traditional view of the economist that marginal costing is "fundamentally uneconomic" and discuss if a marginal costing approach is an appropriate one in this case (10 marks) Total 30 marks Question 2 Mansell plc is a listed UK company which specialises in production of concert merchandise for performing artists. It produces the merchandise itself and does not subcontract any part of the production process. It has been asked by a famous rock band to produce a range of t-shirts for the band's forthcoming world tour. There will be 24 concert dates on the world tour. The analysis of the cost involved in this project is underneath and was undertaken by the junior accountant in Mansell plc, who is keen to show that he is passionate about maximising profits for Mansell plc. t 8,000 $7.00 each = $1,344,000 total $2.50 = $480,000 totale $1.50 = $288,000 totale Anticipated t-shirt sales per concerte Anticipated selling price to rock band (based on 22% margin- Direct material cost per t-shirt - cottone Direct material cost per t-shirt - other materiale Direct labour totale Depreciation of production machinerye Production Supervisor salarye Project Manager Share of overheads Estimated cost of time spent in preparation, discussion and negotiation of contract with the bande Royalty payable to bande Cost payable to designer for t-shirt design- Total Cost PROFIT $25,000 $10,000+ $8,000- $22,000+ $22,000+ $8,000- $1.00 per t-shirt = $192,000+ $15,000 $1,070,000+ $274,000- The Chief Financial Officer (CFO) of Mansell plc is keen to gain this contract and feels that the above cost information should be reviewed in the light of the information below, which she feels is relevant to how Mansell plc should price this contract. She also believes that gaining this contract would enhance Mansell's position in the market and significantly increase their market share over the next few years. Notes:- a) Half of the cotton that Mansell plc would use for the direct material in this contract is in stock. Due to a change in specification this material could not be used on any other project in the future but can be used to fulfil this contract. The other half of the material would need to be bought in at a price of $2.75 per t-shirt. b) The other direct material is used to imprint transfers and tour dates on the t- shirts and is in constant use by Mansell plc. This material is in stock but would require to be replaced at a cost of $1.60 per t-shirt. C) 10% of the direct labour total represents workers who are on a fixed contract with Mansell for the next year. The remaining 90% would be employed to fulfil this contract. d) The value of plant and machinery will not be affected by this contract. e) The production supervisor's salary represents the junior accountant's attempt to apportion the amount of time he feels the supervisor will spend on supervision of the production. The supervisor oversees production of several current projects and is employed by Mansell on a long term basis. He has sufficient time within his contract to undertake this work. f) Every contract such as this has a project manager. The current figure represents the junior accountant's attempt to apportion time that a project manager may spend on this project. However, Mansell's project manager has left the company since the costing exercise was undertaken by the junior accountant and the CFO estimates that employing one on a short term contract would cost 20% more than the junior accountant has anticipated. g) 70% of the general overheads allocated to this contract cover aspects such as production and head office. The remainder covers the estimated use of power to produce the t-shirts. h) With regard to time spent with the band in negotiation of the contract, half of the expenses have already been incurred. The other half represents anticipated future travel costs to discuss the particulars of distribution should the contract be agreed. + 1) Mansell plc has agreed to pay a royalty to the band for every t-shirt produce which bears the band's name.- 1) Mansell plc has already undertaken the design work for the t-shirts. The designer will be paid for this work in two months' time. Required: a) Prepare a revised estimate on a marginal/relevant costing basis for Mansell's proposal to supply t-shirts to the rock band and calculate the price per t-shirt that Mansell plc will charge should they wish to maintain a profit margin of 22% (12 marks) b) Explain why costs that were included in the initial estimate produced by the junior accountant have been included, amended or excluded from the revised estimate for parta) (8 marks) c) Evaluate the traditional view of the economist that marginal costing is "fundamentally uneconomic" and discuss if a marginal costing approach is an appropriate one in this case (10 marks) Total 30 marks