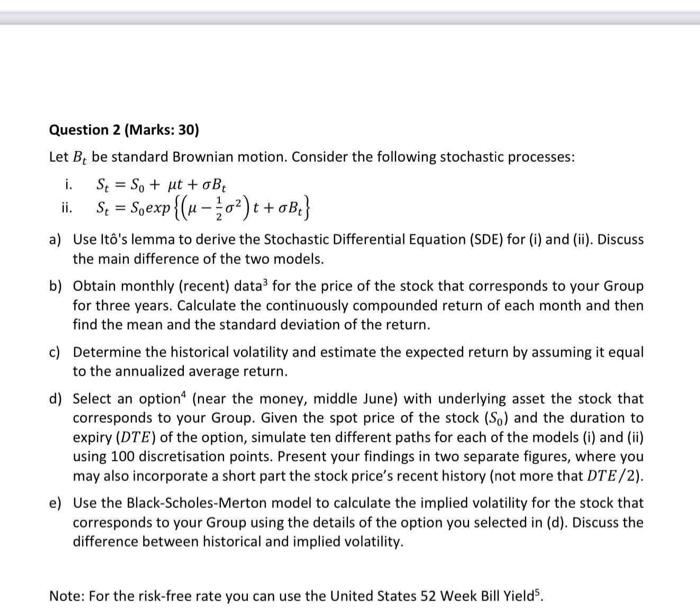

Question 2 (Marks: 30) Let B, be standard Brownian motion. Consider the following stochastic processes: i. St Sout+oBt ii. St = Soexp{(u-0) t+oB} a) Use It's lemma to derive the Stochastic Differential Equation (SDE) for (i) and (ii). Discuss the main difference of the two models. b) Obtain monthly (recent) data for the price of the stock that corresponds to your Group for three years. Calculate the continuously compounded return of each month and then find the mean and the standard deviation of the return. c) Determine the historical volatility and estimate the expected return by assuming it equal to the annualized average return. d) Select an option (near the money, middle June) with underlying asset the stock that corresponds to your Group. Given the spot price of the stock (So) and the duration to expiry (DTE) of the option, simulate ten different paths for each of the models (i) and (ii) using 100 discretisation points. Present your findings in two separate figures, where you may also incorporate a short part the stock price's recent history (not more that DTE/2). e) Use the Black-Scholes-Merton model to calculate the implied volatility for the stock that corresponds to your Group using the details of the option you selected in (d). Discuss the difference between historical and implied volatility. Note: For the risk-free rate you can use the United States 52 Week Bill Yields. Question 2 (Marks: 30) Let B, be standard Brownian motion. Consider the following stochastic processes: i. St Sout+oBt ii. St = Soexp{(u-0) t+oB} a) Use It's lemma to derive the Stochastic Differential Equation (SDE) for (i) and (ii). Discuss the main difference of the two models. b) Obtain monthly (recent) data for the price of the stock that corresponds to your Group for three years. Calculate the continuously compounded return of each month and then find the mean and the standard deviation of the return. c) Determine the historical volatility and estimate the expected return by assuming it equal to the annualized average return. d) Select an option (near the money, middle June) with underlying asset the stock that corresponds to your Group. Given the spot price of the stock (So) and the duration to expiry (DTE) of the option, simulate ten different paths for each of the models (i) and (ii) using 100 discretisation points. Present your findings in two separate figures, where you may also incorporate a short part the stock price's recent history (not more that DTE/2). e) Use the Black-Scholes-Merton model to calculate the implied volatility for the stock that corresponds to your Group using the details of the option you selected in (d). Discuss the difference between historical and implied volatility. Note: For the risk-free rate you can use the United States 52 Week Bill Yields