Answered step by step

Verified Expert Solution

Question

1 Approved Answer

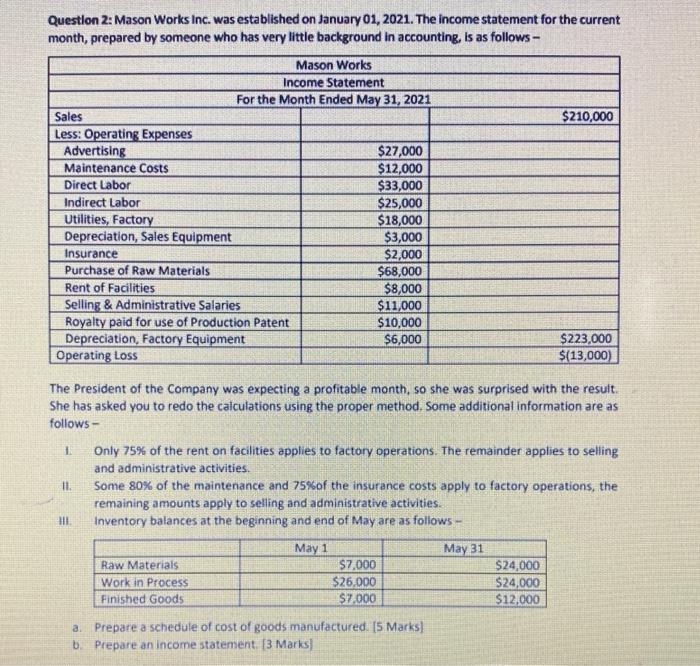

Question 2: Mason Works Inc. was established on January 01, 2021. The income statement for the current month, prepared by someone who has very

Question 2: Mason Works Inc. was established on January 01, 2021. The income statement for the current month, prepared by someone who has very little background in accounting, is as follows - Sales Less: Operating Expenses Advertising Maintenance Costs Direct Labor Indirect Labor Utilities, Factory Depreciation, Sales Equipment Insurance Purchase of Raw Materials Rent of Facilities Selling & Administrative Salaries Royalty paid for use of Production Patent Depreciation, Factory Equipment Operating Loss 11. Mason Works Income Statement For the Month Ended May 31, 2021 III. The President of the Company was expecting a profitable month, so she was surprised with the result. She has asked you to redo the calculations using the proper method. Some additional information are as follows- 15 $27,000 $12,000 $33,000 $25,000 $18,000 $3,000 $2,000 $68,000 $8,000 $11,000 $10,000 $6,000 Raw Materials Work in Process Finished Goods Only 75% of the rent on facilities applies to factory operations. The remainder applies to selling and administrative activities. $7,000 $26,000 $7.000 $210,000 Some 80% of the maintenance and 75% of the insurance costs apply to factory operations, the remaining amounts apply to selling and administrative activities. Inventory balances at the beginning and end of May are as follows - May 1 May 31 $223,000 $(13,000) a. Prepare a schedule of cost of goods manufactured. [5 Marks] b. Prepare an income statement. (3 Marks] $24,000 $24,000 $12,000

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The Schedule of Cost of Goods Manufactured outlines all the costs incurred by a company dur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started