Answered step by step

Verified Expert Solution

Question

1 Approved Answer

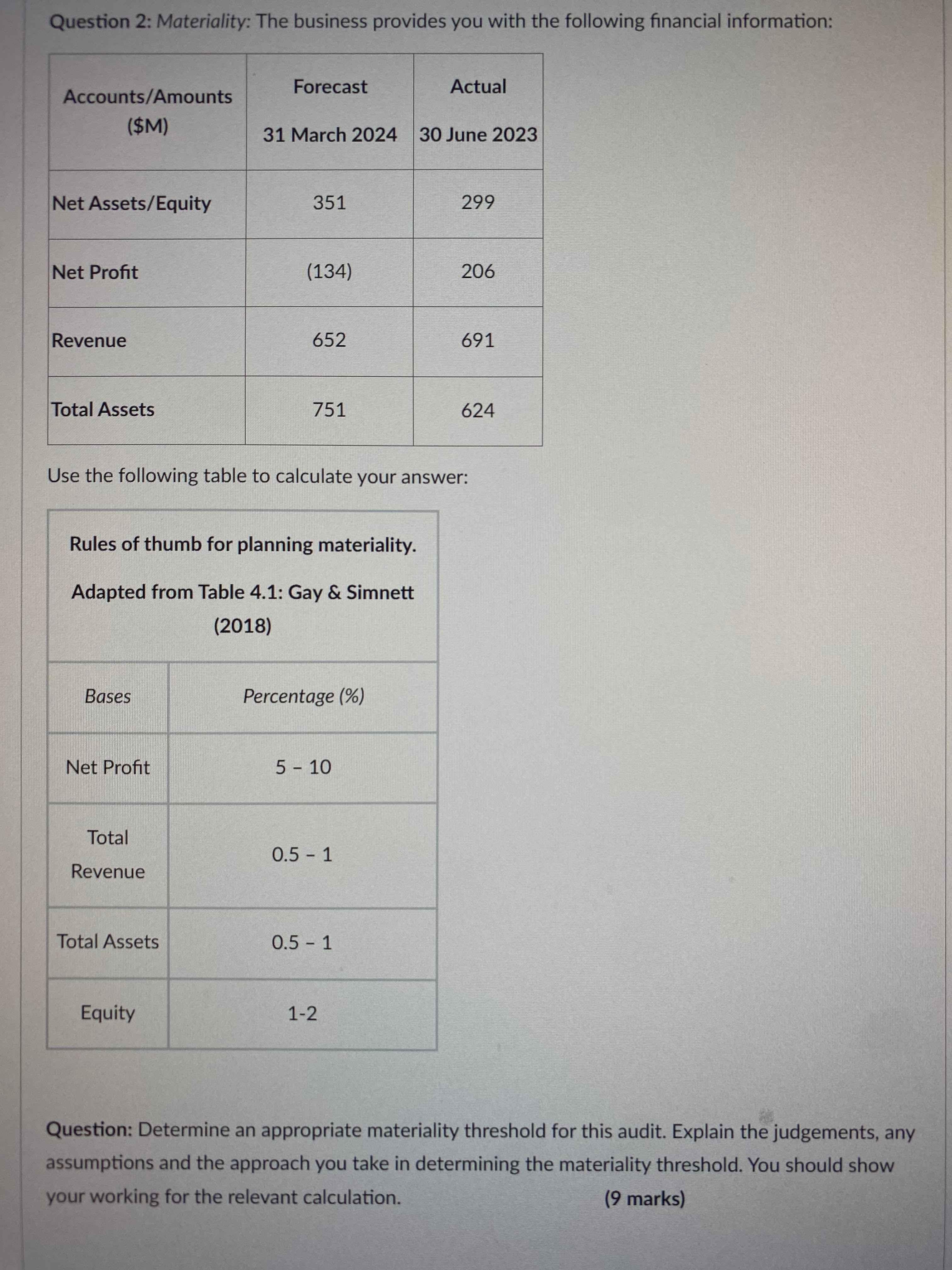

Question 2: Materiality: The business provides you with the following financial information: Forecast Actual Accounts/Amounts ($M) 31 March 2024 30 June 2023 Net Assets/Equity

Question 2: Materiality: The business provides you with the following financial information: Forecast Actual Accounts/Amounts ($M) 31 March 2024 30 June 2023 Net Assets/Equity Net Profit Revenue Total Assets 351 299 (134) 206 652 691 751 Use the following table to calculate your answer: Rules of thumb for planning materiality. Adapted from Table 4.1: Gay & Simnett Bases (2018) Percentage (%) Net Profit 5-10 Total Revenue 0.5-1 Total Assets 0.5-1 Equity 1-2 624 Question: Determine an appropriate materiality threshold for this audit. Explain the judgements, any assumptions and the approach you take in determining the materiality threshold. You should show your working for the relevant calculation. (9 marks)

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Determining Materiality Threshold Approach We will consider multiple bases Net Profit Revenue Total Assets Equity and their corresponding percentage r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started