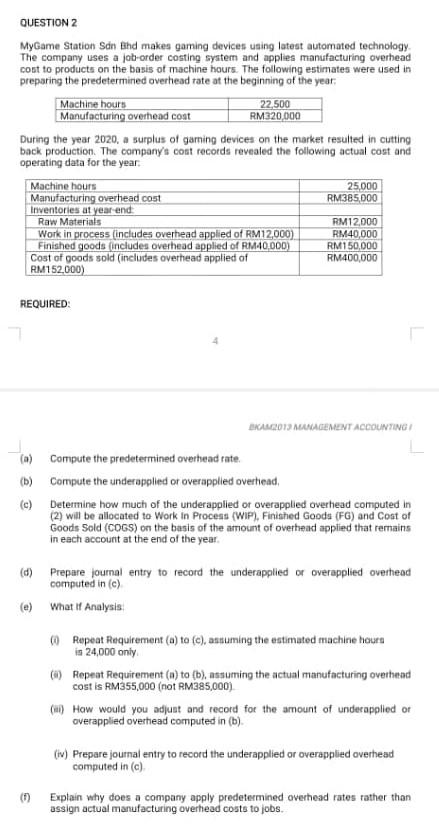

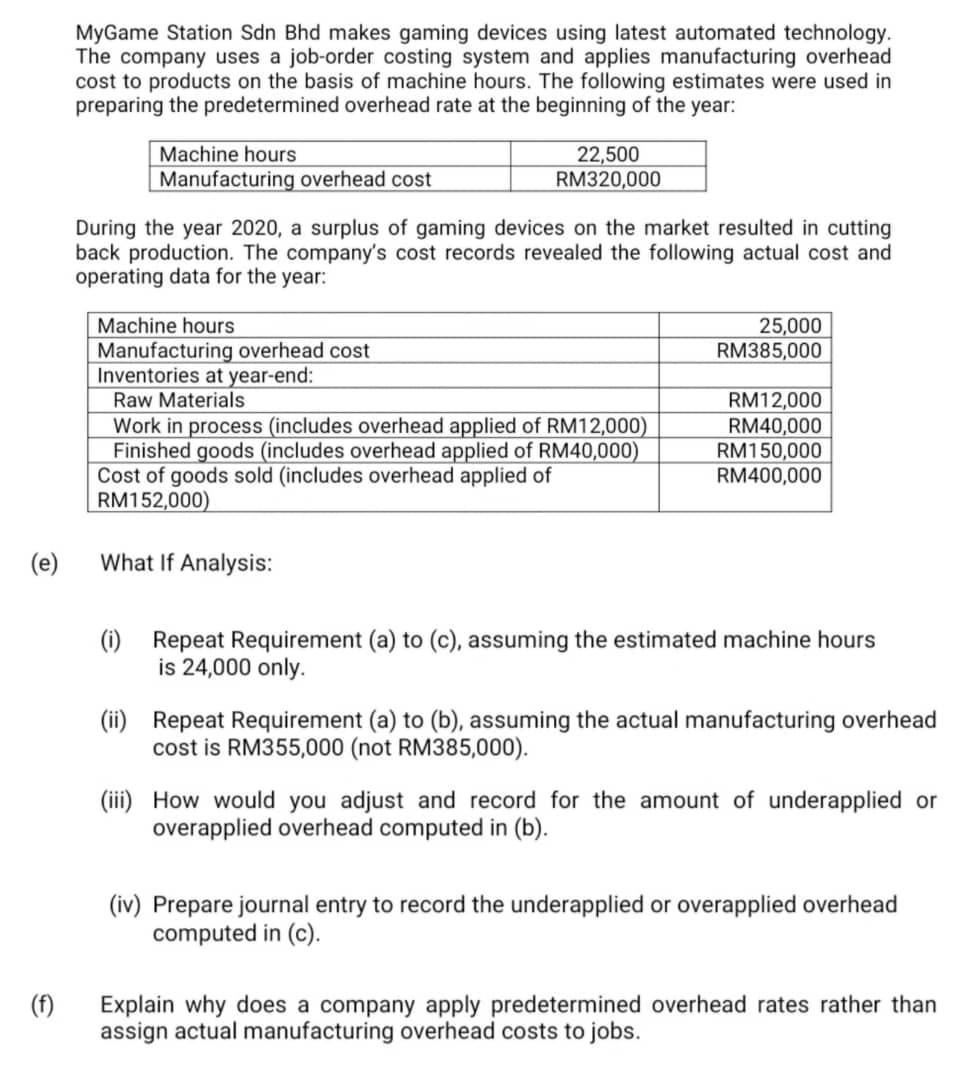

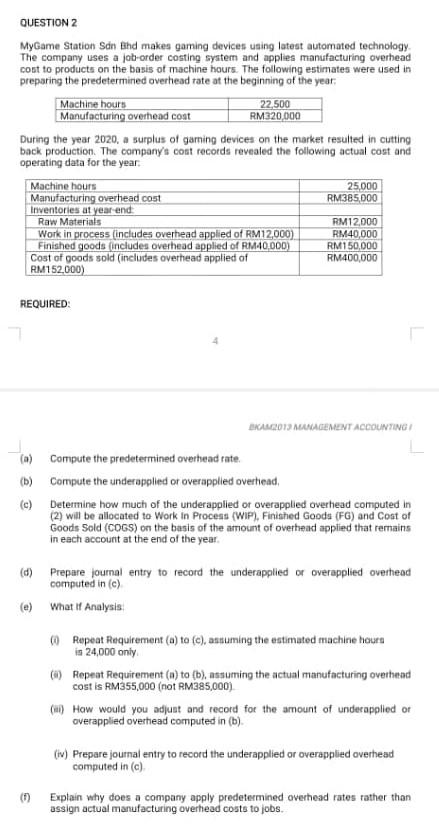

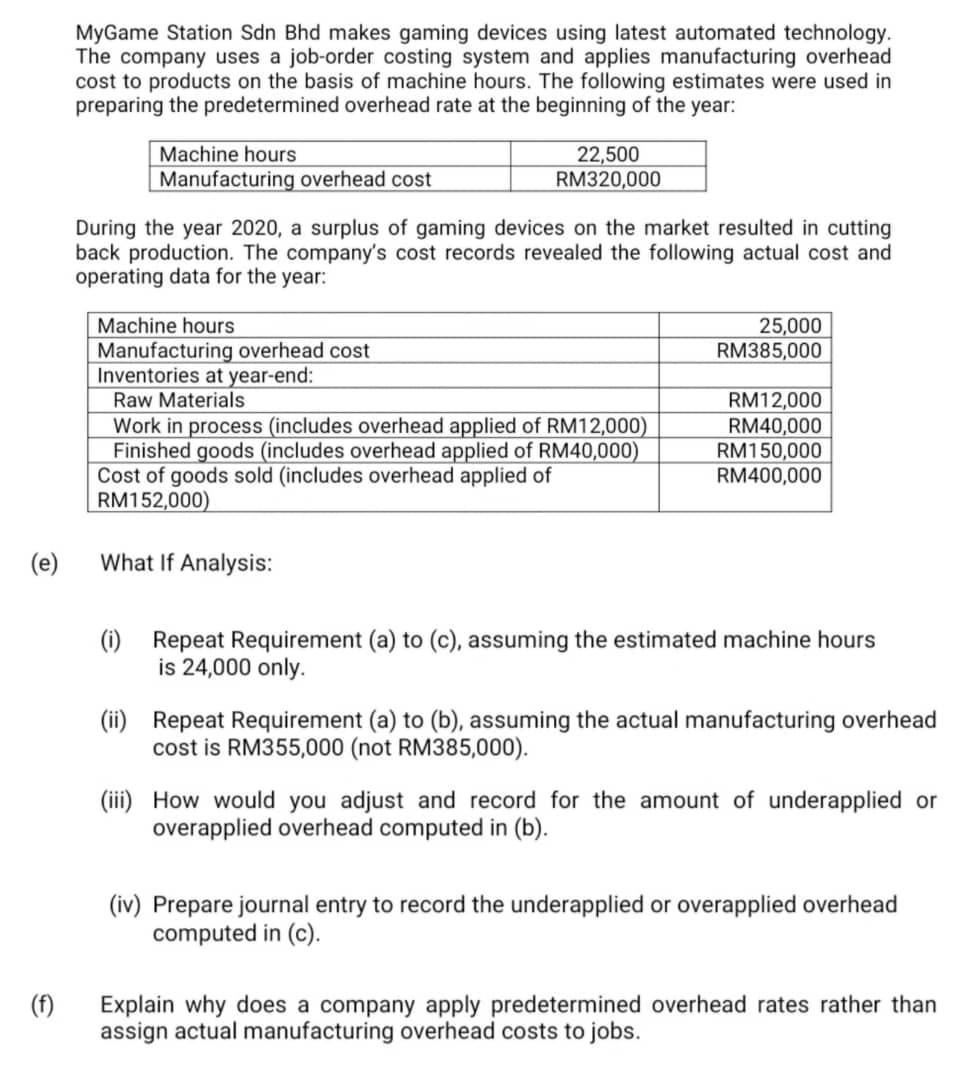

QUESTION 2 My Game Station Sdn Bhd makes gaming devices using latest automated technology The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine hours. The following estimates were used in preparing the predetermined overhead tate at the beginning of the year Machine hours 22,500 Manufacturing overhead cost RM320,000 During the year 2020, a surplus of gaming devices on the market resulted in cutting back production. The company's cost records revealed the following actual cost and operating data for the year Machine hours 25,000 Manufacturing overhead cost RM385,000 Inventories at year-end Raw Materials RM12,000 Work in process (includes overhead applied of RM12,000) RM40,000 Finished goods includes overhead applied of RM40.000) RM150,000 Cost of goods sold includes overhead applied of RM400.000 RM152,000) REQUIRED HAAGO13 MANAGEMENT ACCOUNTING Compute the predetermined overhead ente. (b) Compute the underapplied or overapplied overhead (c) Determine how much of the underapplied or overapplied overhead computed in (2) will be allocated to Work in Process (WIP), Finished Goods (FG) and Cost of Goods Sold (COGS) on the basis of the amount of overtread applied that remains in each account at the end of the year (d) Prepare journal entry to record the underapplied or overapplied overhead computed in (e) What if Analysis (e) (Repeat Requirement () to (e), assuming the estimated machine hours is 24,000 only () Repeat Requirement (n) to (b) assuming the actual manufacturing overhead cost is RM355,000 (not RM285,000) (H) How would you adjust and record for the amount of underapplied or overapplied overhead computed in (b) (iv) Prepare journal entry to record the underapplied or overapplied overhead computed in (c) Explain why does a company apply predetermined overhead rates rather than assign actual manufacturing overhead costs to jobs. MyGame Station Sdn Bhd makes gaming devices using latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine hours. The following estimates were used in preparing the predetermined overhead rate at the beginning of the year: Machine hours Manufacturing overhead cost 22,500 RM320,000 During the year 2020, a surplus of gaming devices on the market resulted in cutting back production. The company's cost records revealed the following actual cost and operating data for the year: 25,000 RM385,000 Machine hours Manufacturing overhead cost Inventories at year-end: Raw Materials Work in process (includes overhead applied of RM12,000) Finished goods (includes overhead applied of RM40,000) Cost of goods sold (includes overhead applied of RM152,000) RM12,000 RM40,000 RM150,000 RM400,000 (e) What If Analysis: (i) Repeat Requirement (a) to (c), assuming the estimated machine hours is 24,000 only. (ii) Repeat Requirement (a) to (b), assuming the actual manufacturing overhead cost is RM355,000 (not RM385,000). (iii) How would you adjust and record for the amount of underapplied or overapplied overhead computed in (b). (iv) Prepare journal entry to record the underapplied or overapplied overhead computed in (c). (f) Explain why does a company apply predetermined overhead rates rather than assign actual manufacturing overhead costs to jobs