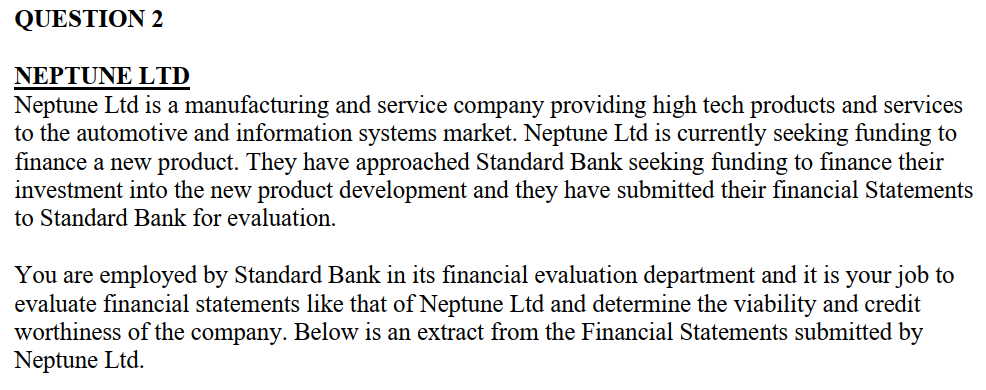

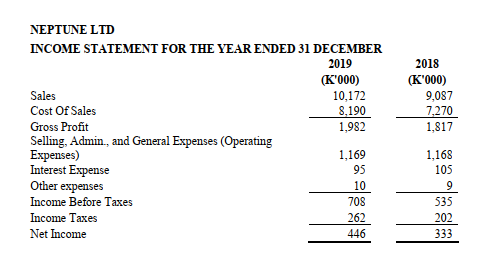

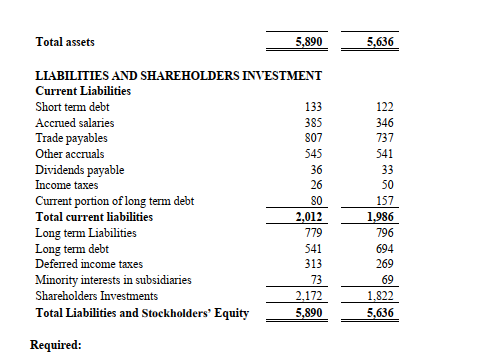

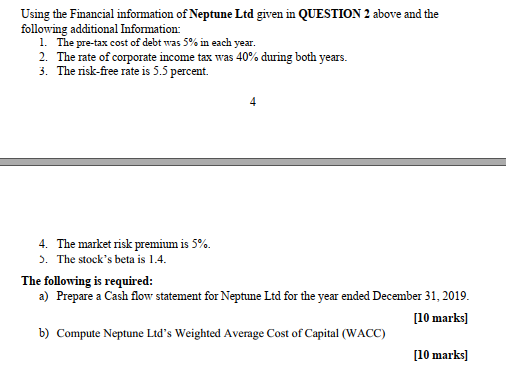

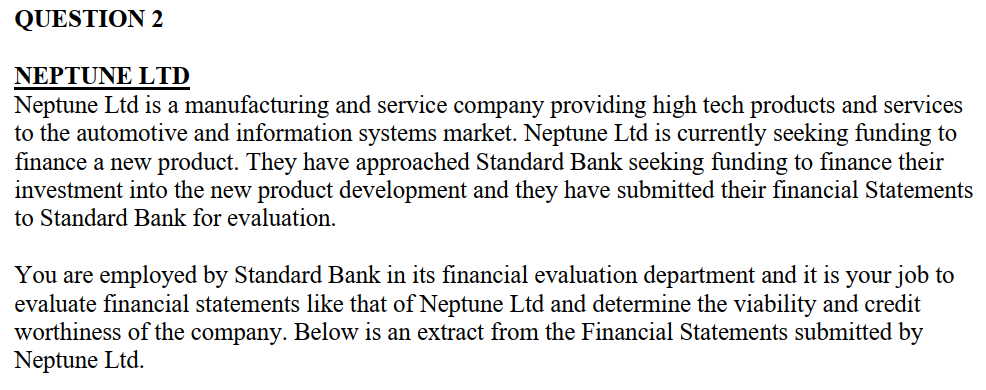

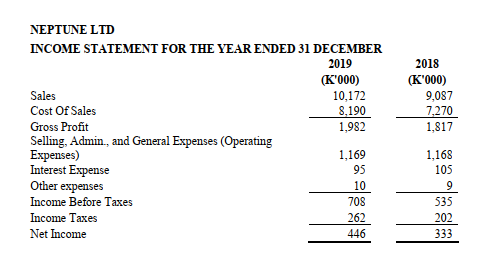

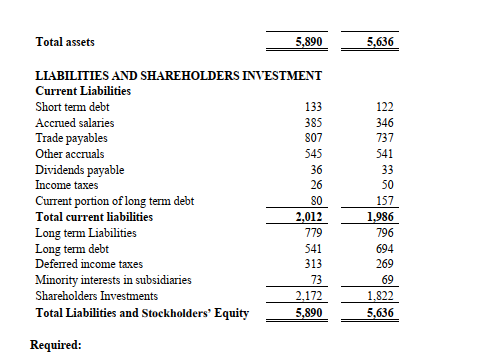

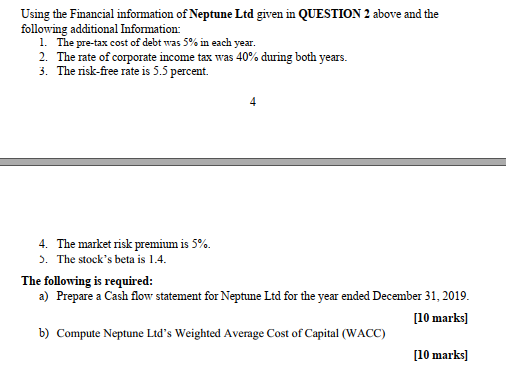

QUESTION 2 NEPTUNE LTD Neptune Ltd is a manufacturing and service company providing high tech products and services to the automotive and information systems market. Neptune Ltd is currently seeking funding to finance a new product. They have approached Standard Bank seeking funding to finance their investment into the new product development and they have submitted their financial Statements to Standard Bank for evaluation. You are employed by Standard Bank in its financial evaluation department and it is your job to evaluate financial statements like that of Neptune Ltd and determine the viability and credit worthiness of the company. Below is an extract from the Financial Statements submitted by Neptune Ltd. Sales NEPTUNE LTD INCOME STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2019 (K'000) 10,172 Cost Of Sales 8.190 Gross Profit 1,982 Selling, Admin., and General Expenses (Operating Expenses) 1.169 Interest Expense 95 Other expenses 10 Income Before Taxes 708 Income Taxes 262 Net Income 446 2018 (K'000) 9,087 7,270 1,817 1,168 105 9 535 202 333 Total assets 5,890 5,636 LIABILITIES AND SHAREHOLDERS INVESTMENT Current Liabilities Short term debt 133 Accrued salaries 385 Trade payables 807 Other accruals 545 Dividends payable 36 Income taxes 26 Current portion of long term debt 80 Total current liabilities 2,012 Long term Liabilities 779 Long term debt 541 Deferred income taxes 313 Minority interests in subsidiaries 73 Shareholders Investments 2,172 Total Liabilities and Stockholders' Equity 5,890 122 346 737 541 33 50 157 1,986 796 694 269 69 1.822 5,636 Required: Using the Financial information of Neptune Ltd given in QUESTION 2 above and the following additional Information: 1. The pre-tax cost of debt was 5% in each year. 2. The rate of corporate income tax was 40% during both years. 3. The risk-free rate is 5.5 percent. 4 4. The market risk premium is 5%. >. The stock's beta is 1.4. The following is required: a) Prepare a Cash flow statement for Neptune Ltd for the year ended December 31, 2019. [10 marks] b) Compute Neptune Ltd's Weighted Average Cost of Capital (WACC) [10 marks] QUESTION 2 NEPTUNE LTD Neptune Ltd is a manufacturing and service company providing high tech products and services to the automotive and information systems market. Neptune Ltd is currently seeking funding to finance a new product. They have approached Standard Bank seeking funding to finance their investment into the new product development and they have submitted their financial Statements to Standard Bank for evaluation. You are employed by Standard Bank in its financial evaluation department and it is your job to evaluate financial statements like that of Neptune Ltd and determine the viability and credit worthiness of the company. Below is an extract from the Financial Statements submitted by Neptune Ltd. Sales NEPTUNE LTD INCOME STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2019 (K'000) 10,172 Cost Of Sales 8.190 Gross Profit 1,982 Selling, Admin., and General Expenses (Operating Expenses) 1.169 Interest Expense 95 Other expenses 10 Income Before Taxes 708 Income Taxes 262 Net Income 446 2018 (K'000) 9,087 7,270 1,817 1,168 105 9 535 202 333 Total assets 5,890 5,636 LIABILITIES AND SHAREHOLDERS INVESTMENT Current Liabilities Short term debt 133 Accrued salaries 385 Trade payables 807 Other accruals 545 Dividends payable 36 Income taxes 26 Current portion of long term debt 80 Total current liabilities 2,012 Long term Liabilities 779 Long term debt 541 Deferred income taxes 313 Minority interests in subsidiaries 73 Shareholders Investments 2,172 Total Liabilities and Stockholders' Equity 5,890 122 346 737 541 33 50 157 1,986 796 694 269 69 1.822 5,636 Required: Using the Financial information of Neptune Ltd given in QUESTION 2 above and the following additional Information: 1. The pre-tax cost of debt was 5% in each year. 2. The rate of corporate income tax was 40% during both years. 3. The risk-free rate is 5.5 percent. 4 4. The market risk premium is 5%. >. The stock's beta is 1.4. The following is required: a) Prepare a Cash flow statement for Neptune Ltd for the year ended December 31, 2019. [10 marks] b) Compute Neptune Ltd's Weighted Average Cost of Capital (WACC) [10 marks]