Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Not yet answed Marked out of 5.00 Flag question Company Z is a US-Based company that prepares its consolidated financial statements in accordance

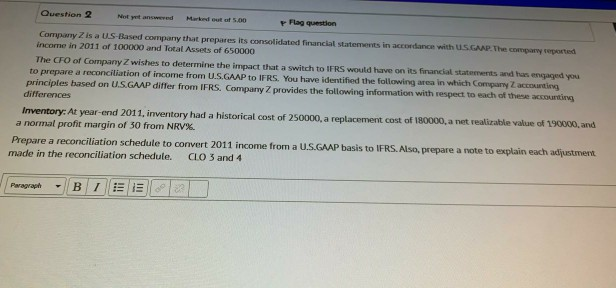

Question 2 Not yet answed Marked out of 5.00 Flag question Company Z is a US-Based company that prepares its consolidated financial statements in accordance with US GAAP. The company reported income in 2011 of 100000 and Total Assets of 650000 The CFO of Company Z wishes to determine the impact that a switch to IFRS would have on its financial statements and has engaged you to prepare a reconciliation of income from U.S.GAAP to IFRS. You have identified the following area in which company accounting principles based on US.GAP differ from IFRS. Company provides the following information with respect to each of these accounting differences Inventory: At year-end 2011. inventory had a historical cost of 250000, a replacement cost of 180000,a net realizable value of 190000, and a normal profit margin of 30 from NRV% Prepare a reconciliation schedule to convert 2011 income from a U.S.GAAP basis to IFRS. Also, prepare a note to explain each adjustment made in the reconciliation schedule. CLO 3 and 4 Paragraph B / PIE Question 2 Not yet answed Marked out of 5.00 Flag question Company Z is a US-Based company that prepares its consolidated financial statements in accordance with US GAAP. The company reported income in 2011 of 100000 and Total Assets of 650000 The CFO of Company Z wishes to determine the impact that a switch to IFRS would have on its financial statements and has engaged you to prepare a reconciliation of income from U.S.GAAP to IFRS. You have identified the following area in which company accounting principles based on US.GAP differ from IFRS. Company provides the following information with respect to each of these accounting differences Inventory: At year-end 2011. inventory had a historical cost of 250000, a replacement cost of 180000,a net realizable value of 190000, and a normal profit margin of 30 from NRV% Prepare a reconciliation schedule to convert 2011 income from a U.S.GAAP basis to IFRS. Also, prepare a note to explain each adjustment made in the reconciliation schedule. CLO 3 and 4 Paragraph B / PIE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started