Question

Question 2 of 2 (question 1 solved- question 2 Unsolved) ABC Soda Company is preparing their 2020 budget. They want to prepare a flexible budget

Question 2 of 2 (question 1 solved- question 2 Unsolved)

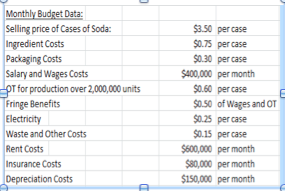

ABC Soda Company is preparing their 2020 budget. They want to prepare a flexible budget for use each month. They estimate sales/production will be between 1,700,000 and 2,200,000 cases of soda per month. Assume that all units produced in a month are also sold in that month. ABC Soda Company unit of production/sales is a case. Note on Overtime (OT): If production is below the level specified, there is no overtime needed. If production is above the level specified, there will be overtime costs only for the units produced above that level. Monthly Budget Data: Selling price of Cases of Soda: Ingredient Costs Packaging Costs Salary and Wages Costs OT for production Question 1(solved) - Prepare a flexible budget in Excel for ABC Soda Company: a) Show the flexible budget based on 1,700,000 units (cases) produced. b) Show the flexible budget based on 2,200,000 units (cases) produced this scenario will have OT. c) Show the flexible budget cost formula(s) for ABC Soda Company: d) Explain the benefit of flexible budgets and when they should be used.

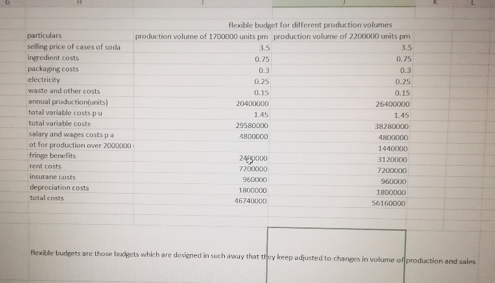

Question 1 Solved by Chegg (the pic posted by Chegg is not very clear)- Flexible Budget For different production volumes

UNSOLVED _ Question 2:

Question 2: The months of January and February 2020 are complete, and ABC Soda Company wants to compare their FLEXIBLE budget to their actual results. Actual results are shown in the table above.

Additional data for question 2: 1) January Actual & 2) February Actual

1) January Actual:

Production: 1,850,500 cases

Sales: $6,486,850

Ingredient costs: $1,343,000

Packing Costs: $540,000

Salary & wages costs: $395,000

OT for production: $15,000

Fringe Benefits: $205,000

Electricity: $465,000

Waste & other costs: $299,750

Rent Costs: $600,000

Insurance Costs: $80,000

Depreciation costs: $180,000

2) February Actual

Production: 2,185,700 cases

Sales: $7,593,400

Ingredient costs: $1,599,470

Packing Costs: $660,000

Salary & wages costs: $407,000

OT for production: $435,000

Fringe Benefits: $421,000

Electricity: $545,500

Waste & other costs: $382,500

Rent Costs: $600,000

Insurance Costs: $82,000

Depreciation costs: $180,000

Required:

a) Create the flexible budgets based on actual units produced for each month Jan & Feb. Note: These flexible budgets should be based on the actual units produced. These are not the same numbers as in Question 1 because actual production is different than those original scenarios.

b) Compare actual results to budgeted results (Favorable or Unfavorable with amounts) for each month and each category.

c) Provide possible explanations for the favorable and unfavorable variances for each line item. Be sure that each explanation is logical for whether the variance is favorable or unfavorable.

d) Was net operating income better or worse than budget? Write a letter to the CFO providing recommendations for ABC Soda Company. What should they change in order to improve performance?

Monthly Budget Data: Selling price of Cases of Soda: Ingredient Costs Packaging Costs Salary and Wages Costs PT for production over 2,000,000 units Fringe Benefits Electricity Waste and Other Costs Rent Costs Insurance Costs Depreciation Costs $3.50 per case $0.75 per case $0.30 per case $400,000 per month $0.60 per case $0.50 of Wages and OT $0.25 per case $0.15 percase $600,000 per month $80,000 per month $150,000 per month 0.75 0.15 0.15 flexible budget for different production volumes particulars production volume of 1700000 units pm production volume of 2200000 units pm selling price of cases of soda ingredient costs 0.75 packaging costs electricity 0.25 0.25 waste and other costs annual production units) 20400000 26400000 total variable costs pu total variable costs 29580000 38280000 salary and wages costs pa 4900000 480000 ot for production over 2000000 1440000 fringe benefits 2000 3120000 7200000 7200000 insuran costs 960000 960000 depreciation costs 100000 1800000 46740000 56160000 flexible burpets are those badgets which are designed in such a way that they keep adjusted to changes in volume of production and salesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started