Answered step by step

Verified Expert Solution

Question

1 Approved Answer

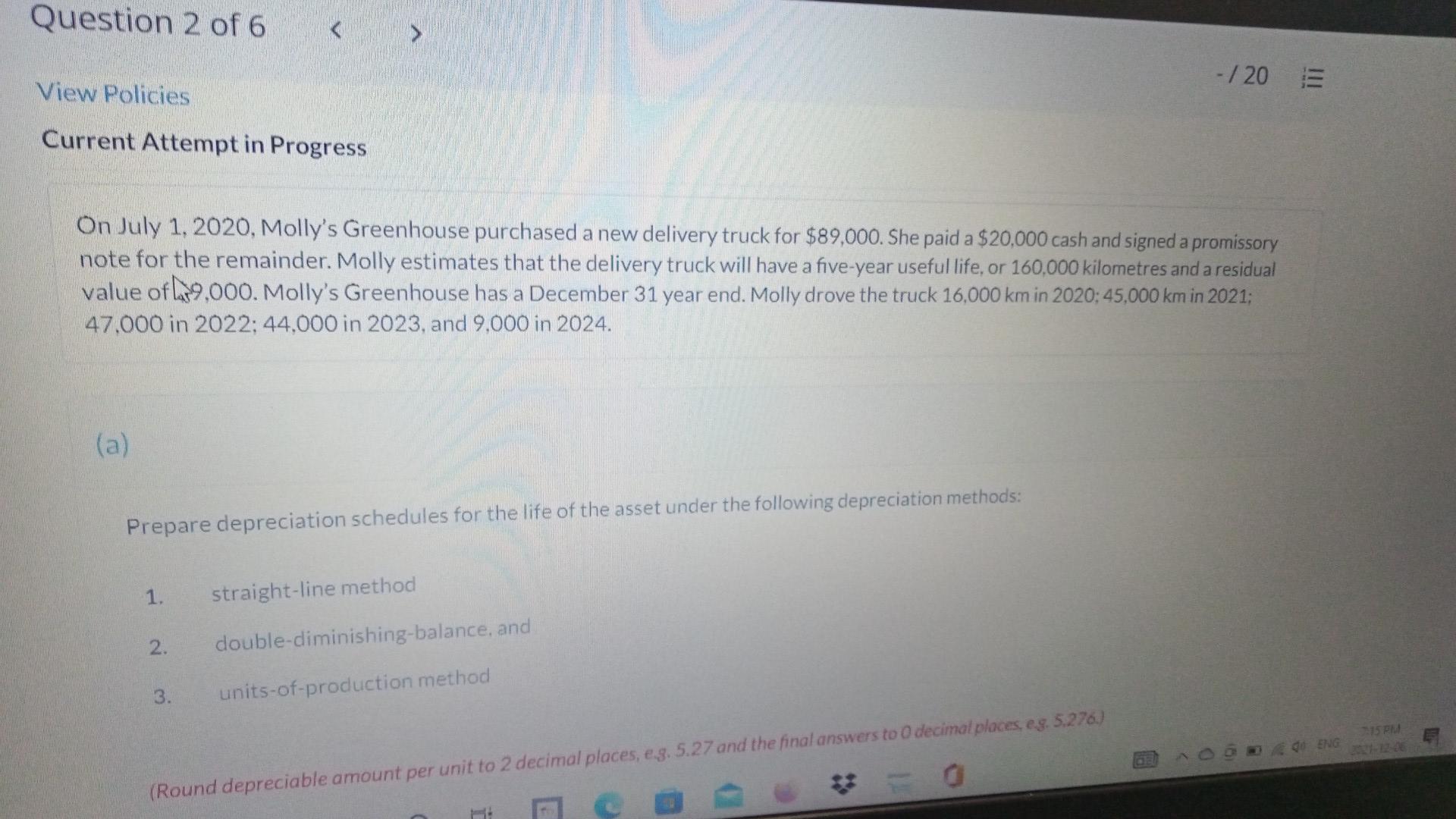

Question 2 of 6 K -/20 E View Policies Current Attempt in Progress On July 1, 2020, Molly's Greenhouse purchased a new delivery truck for

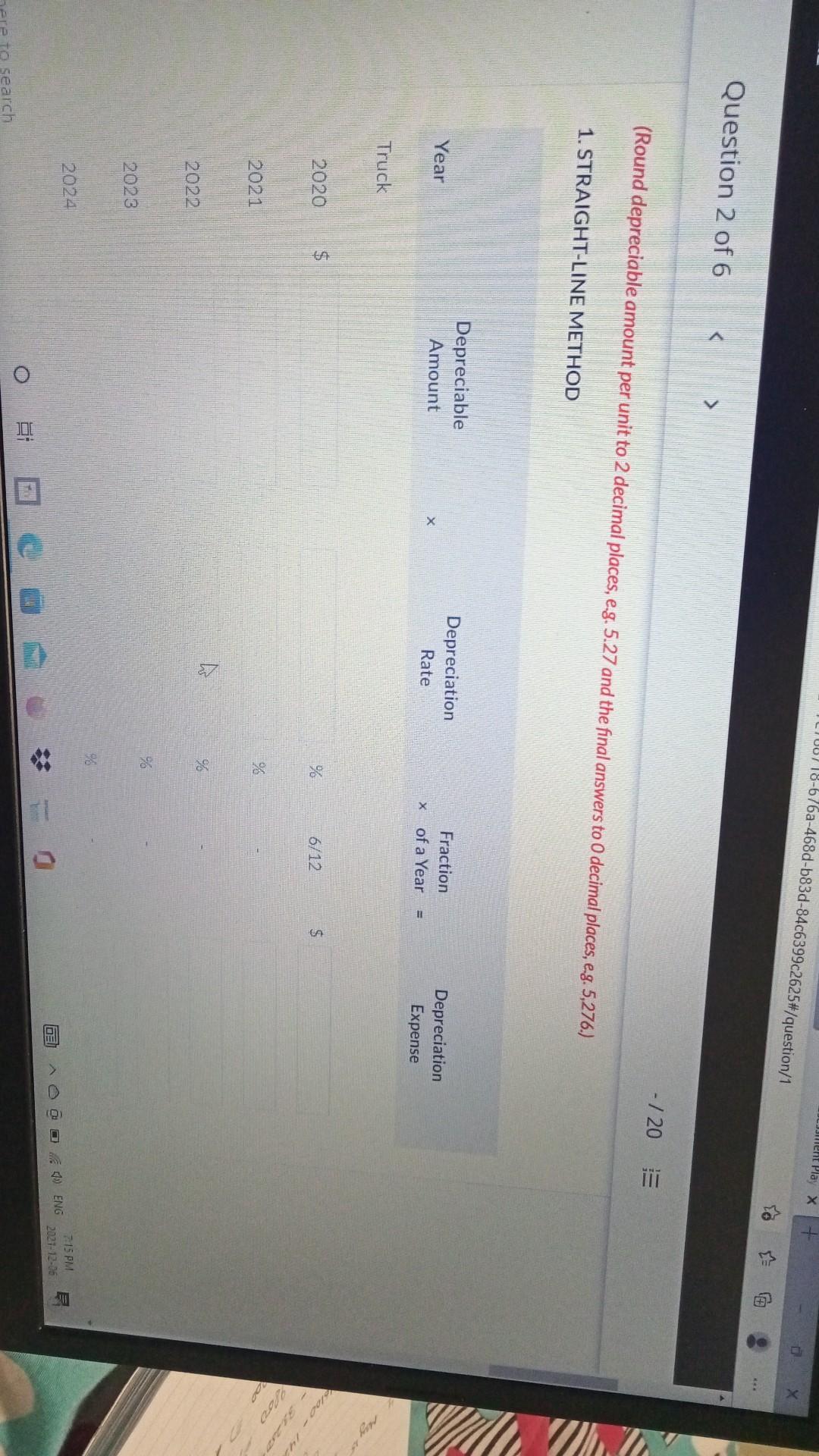

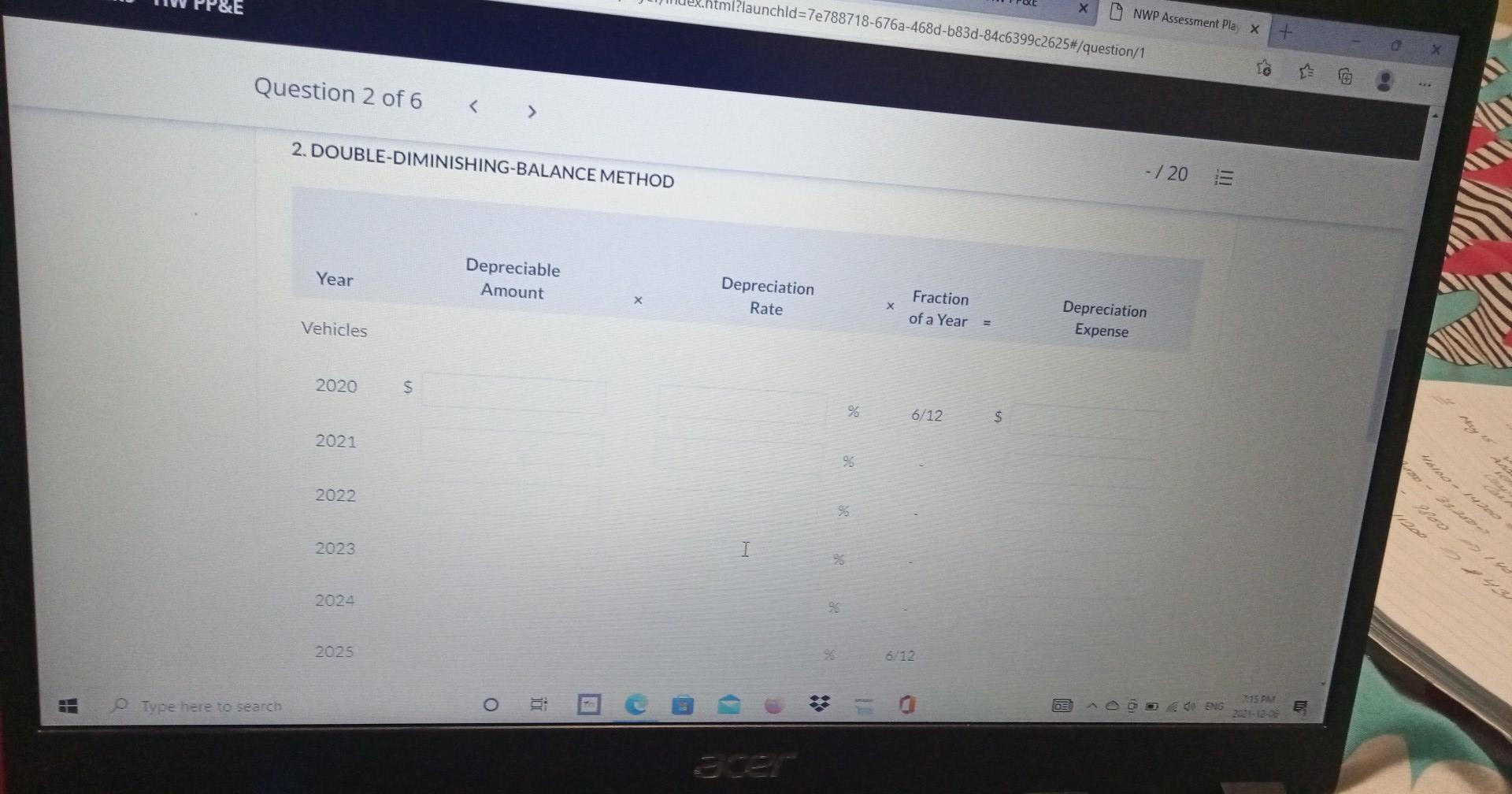

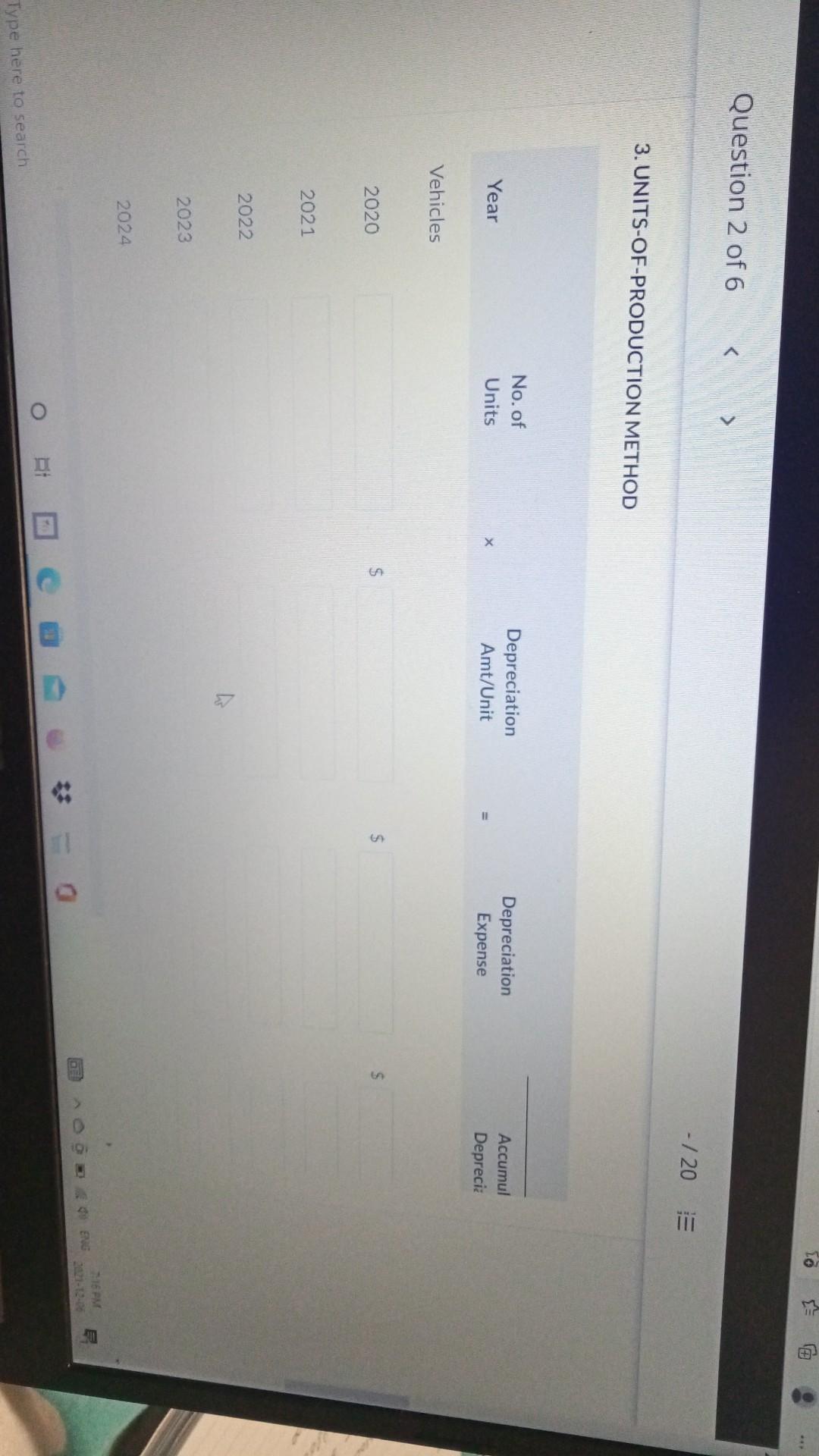

Question 2 of 6 K -/20 E View Policies Current Attempt in Progress On July 1, 2020, Molly's Greenhouse purchased a new delivery truck for $89,000. She paid a $20,000 cash and signed a promissory note for the remainder. Molly estimates that the delivery truck will have a five-year useful life, or 160,000 kilometres and a residual value of 0.19.000. Molly's Greenhouse has a December 31 year end. Molly drove the truck 16,000 km in 2020; 45,000 km in 2021; 47.000 in 2022: 44,000 in 2023, and 9,000 in 2024. (a) Prepare depreciation schedules for the life of the asset under the following depreciation methods: 1. straight-line method 2. double-diminishing-balance, and 3. units-of-production method 215 PM go ENG (Round depreciable amount per unit to 2 decimal places, e.g. 5.27 and the final answers to 0 decimal places, eg. 5.276.) TU03/18-676a-468d-b83d-84c6399c2625#/question/1 ment Play X + x Question 2 of 6 2. DOUBLE-DIMINISHING-BALANCE METHOD -/20 = Year Depreciable Amount Depreciation Rate X Fraction of a Year Vehicles Depreciation Expense 2020 $ % 6/12 S 2021 96 to-1410 por 2022 se loo 2023 I 95 2024 BB 2025 6.12 o Type here to search ** 5:15 PM - I SE ENG Question 2 of 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started