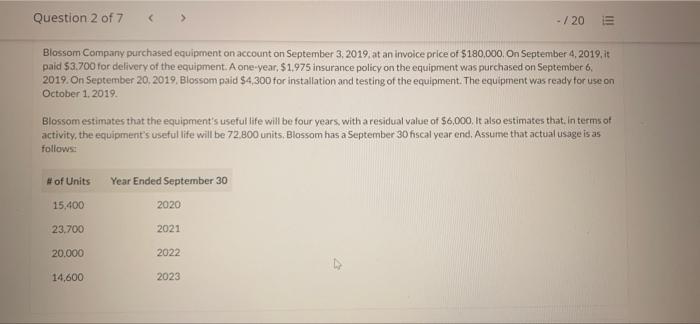

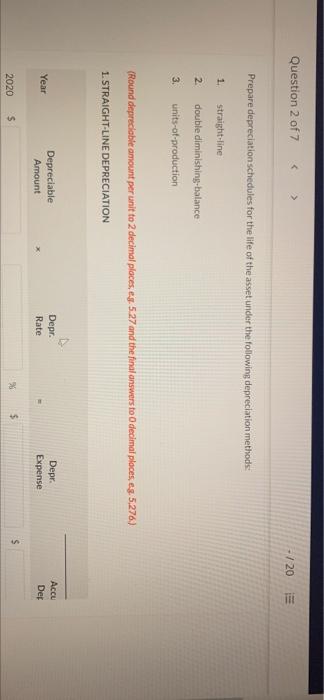

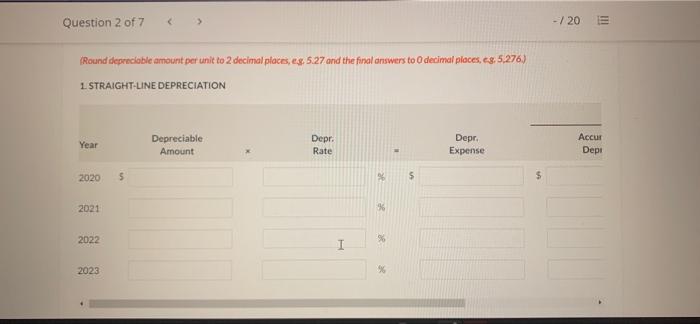

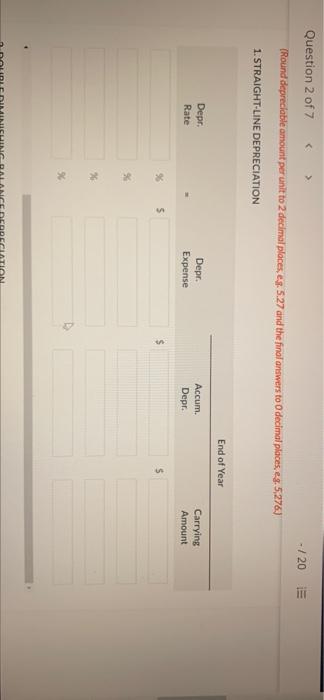

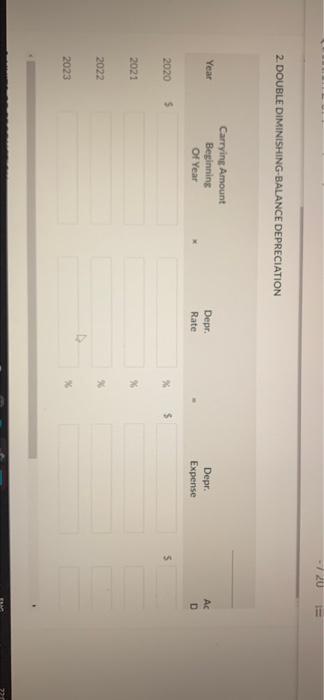

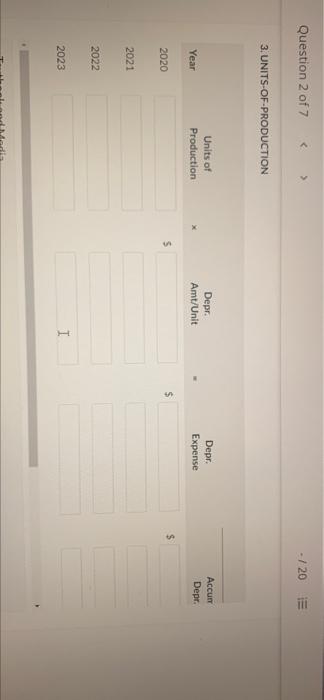

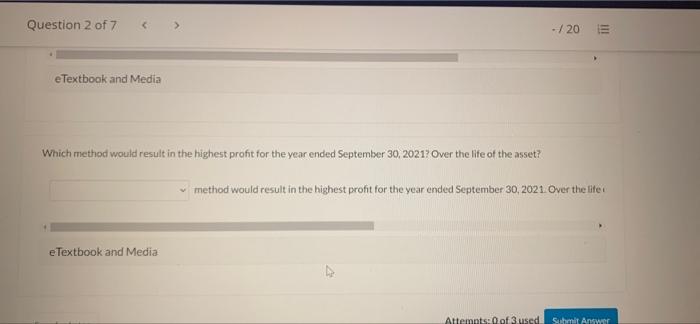

Question 2 of 7 > - / 20 E Blossom Company purchased equipment on account on September 3, 2019. at an invoice price of $180,000. On September 4, 2019, it paid $3.700 for delivery of the equipment. A one-year $1,975 insurance policy on the equipment was purchased on September 6, 2019. on September 20,2019, Blossom paid $4,300 for installation and testing of the equipment. The equipment was ready for use on October 1, 2019 Blossom estimates that the equipment's useful life will be four years, with a residual value of $6,000. It also estimates that in terms of activity, the equipment's useful life will be 72.800 units. Blossom has a September 30 fiscal year end, Assume that actual usage is as follows: #of Units Year Ended September 30 15,400 2020 23.700 2021 20.000 2022 14,600 2023 Question 2 of 7 - / 20 III Determine the cost of the equipment Costot equipments e Textbook and Media Prepare depreciation schedules for the life of the asset under the following depreciation methods 1 straight-line 2 double diminishing-balance Question 2 of 7 - /20 Prepare depreciation schedules for the life of the asset under the following depreciation methods 1 2 straight-line double diminishing balance units-ot-production 3. (Round depreciable amount per unit to 2 decimal places, e.g. 5.27 and the final answers to decimal places, eg,5,276) 1. STRAIGHT-LINE DEPRECIATION Accu Year Depreciable Amount Depr. Rate Depr. Expense Der $ 2020 90 Question 2 of 7 > -720 (Round depreciable amount per unit to 2 decimal places, eg: 5.27 and the final answers to decimal places, 68, 5.276) 1 STRAIGHT-LINE DEPRECIATION Year Depreciable Amount Depr. Rate Depr. Expense Accur Depi 2020 5 5 $ 2021 % 2022 I 2023 % Question 2 of 7 > - /20 III (Round depreciable amount per unit to 2 decimal places, e. 5.27 and the final answers to decimal places, eg. 5,276.) 1. STRAIGHT-LINE DEPRECIATION End of Year Depr. Rate Depr. Expense Accum. Depr. Carrying Amount 5 - 20 TI 2. DOUBLE DIMINISHING-BALANCE DEPRECIATION Year Carrying Amount Beginning Of Year Depr. Rate Depr. Expense Ac D 2020 s 2021 2022 x 2023 x Question 2 of 7 - / 20 3. UNITS-OF-PRODUCTION Units of Production Depr. Amt/Unit Depr. Expense Accur Depr. Year $ 2020 2021 2022 2023 I Question 2 of 7 - /20 I!! e Textbook and Media Which method would result in the highest profit for the year ended September 30, 20217 Over the life of the asset? sed September 30, 2021. Over the life of the asset, result in the same total depreciation expense e Textbook and Media Attempts: 0 of 3 used Submit Answer Sanofort ENG 2202 05-12-2021