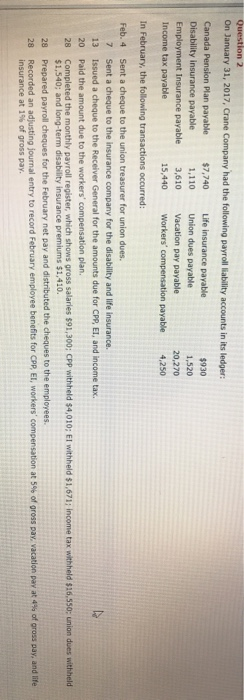

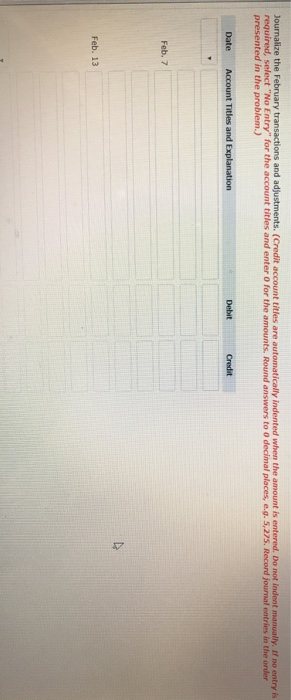

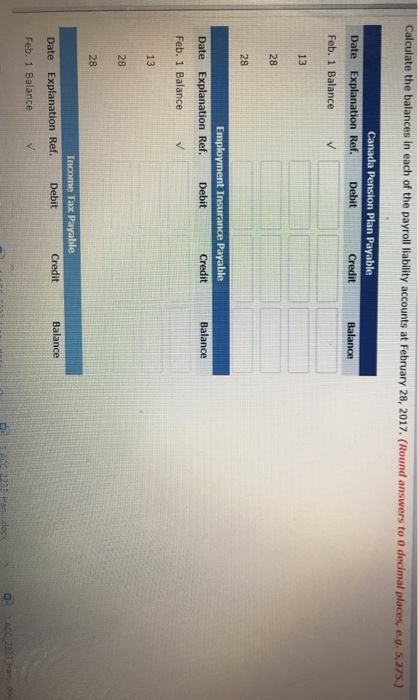

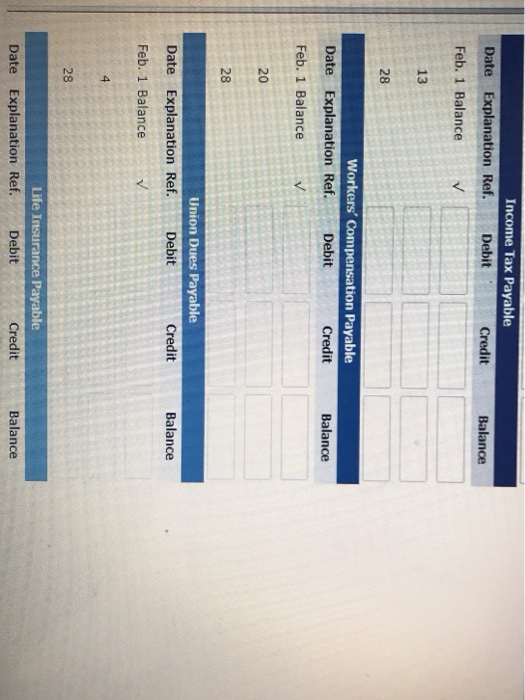

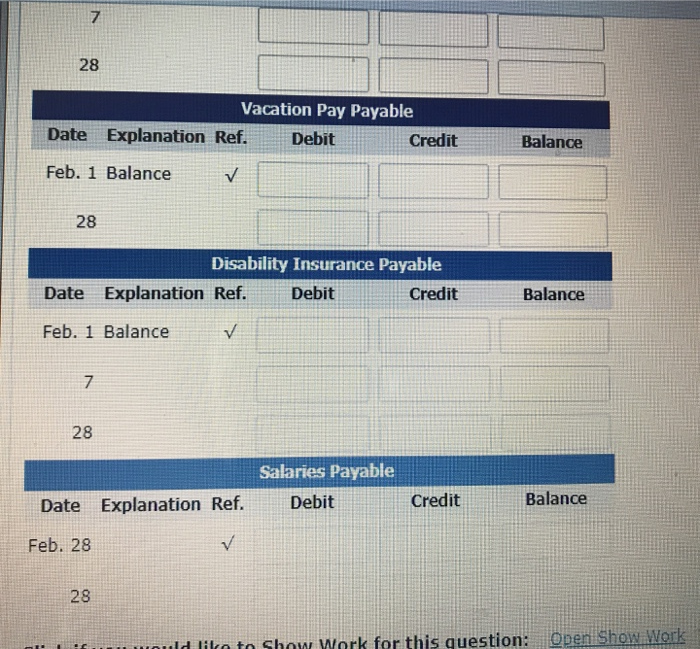

Question 2 On January 31, 2017, Crane Company had the following payroll liability accounts in its ledger Canada Pension Plan payable $7,740 Life Insurance payable Disability insurance payable 1,110 Union dues payable Employment Insurance payable 3,610 Vacation pay payable 20,270 Income tax payable 15,440 Workers' compensation payable 4,250 $930 1,520 In February, the following transactions occurred: Feb. 4 13 20 28 Sent a cheque to the union treasurer for union dues. Sent a cheque to the insurance company for the disability and life insurance. Issued a cheque to the Receiver General for the amounts due for CPP, EI, and income tax. Paid the amount due to the workers' compensation plan. Completed the monthly payroll register, which shows gross salaries $91,300: CPP withheld $4,010; El withheld $1,671; income tax withheld $16.550: union dues withheld $1,540; and long-term disability insurance premiums $1,410. Prepared payroll cheques for the February net pay and distributed the cheques to the employees Recorded an adjusting journal entry to record February employee benefits for CPP, EI, workers' compensation at 5% of gross pay, vacation pay at 4% of gross pay, and life insurance at 156 of gross pay. 28 28 Journalize the February transactions and adjustments. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round answers to decimal places, eg. 5,275. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Feb. 7 Feb. 13 Calculate the balances in each of the payroll liability accounts at February 28, 2017. (Round answers to o decimal places... 5.275.) Canada Pension Plan Payable Date Explanation Ref. Debit Credit Feb. 1 Balance Balance Employment Insurance Payable Explanation Ref. Debit Credit Date Balance Feb. 1 Balance 13 28 Balance Income Tax Payable Date Explanation Ref. Debit Credit Feb. 1 Balance ACC Handocx 1 ACC 2233 Hando Income Tax Payable Date Explanation Ref. Debit Credit Feb. 1 Balance Balance 13 Workers' Compensation Payable Date Explanation Ref. Debit Credit Feb. 1 Balance Balance 28 Union Dues Payable Explanation Ref. Debit Credit Date Balance Feb. 1 Balance Life Insurance Payable Date Explanation Ref. Debit Credit Balance 28 Vacation Pay Payable Date Explanation Ref. Debit Credit Balance Feb. 1 Balance 28 Disability Insurance Payable Explanation Ref. Debit Credit Date Balance Feb. 1 Balance 28 Salaries Payable Debit Date Explanation Ref. Credit Balance Feb. 28 28 liko to Show Work for this question: Open Show Work