Answered step by step

Verified Expert Solution

Question

1 Approved Answer

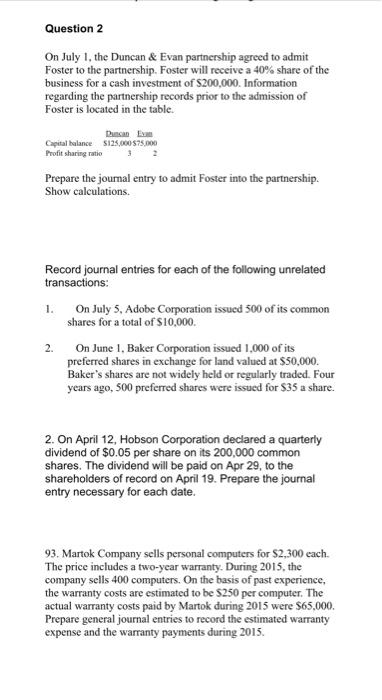

Question 2 On July 1, the Duncan & Evan partnership agreed to admit Foster to the partnership. Foster will receive a 40% share of

Question 2 On July 1, the Duncan & Evan partnership agreed to admit Foster to the partnership. Foster will receive a 40% share of the business for a cash investment of $200,000. Information regarding the partnership records prior to the admission of Foster is located in the table. Capital balance Profit sharing ratio Duncan Evan $125,000 $75,000 Prepare the journal entry to admit Foster into the partnership. Show calculations. Record journal entries for each of the following unrelated transactions: 1. 2. On July 5, Adobe Corporation issued 500 of its common shares for a total of $10,000. On June 1, Baker Corporation issued 1,000 of its preferred shares in exchange for land valued at $50,000. Baker's shares are not widely held or regularly traded. Four years ago, 500 preferred shares were issued for $35 a share. 2. On April 12, Hobson Corporation declared a quarterly dividend of $0.05 per share on its 200,000 common shares. The dividend will be paid on Apr 29, to the shareholders of record on April 19. Prepare the journal entry necessary for each date. 93. Martok Company sells personal computers for $2,300 each. The price includes a two-year warranty. During 2015, the company sells 400 computers. On the basis of past experience, the warranty costs are estimated to be $250 per computer. The actual warranty costs paid by Martok during 2015 were $65,000. Prepare general journal entries to record the estimated warranty expense and the warranty payments during 2015.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started