Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Owner's withdrawal of assets from the business is limited to cash only. True False Previous 1 pts Next Question 3 Investment by

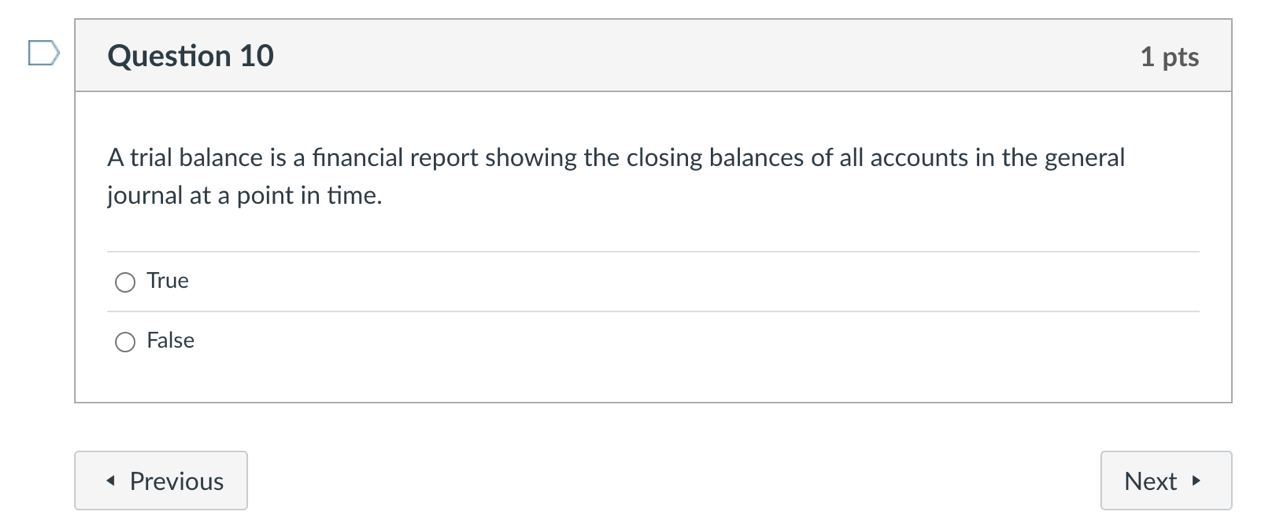

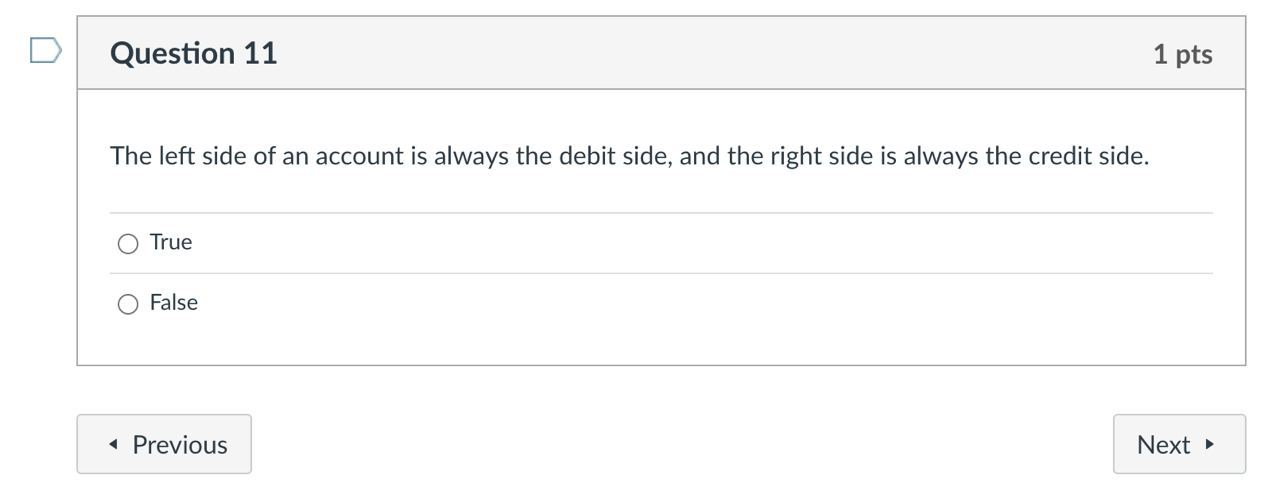

Question 2 Owner's withdrawal of assets from the business is limited to cash only. True False Previous 1 pts Next Question 3 Investment by an owner to his business would not require any journal entry to record the said investment. True False Previous 1 pts Next Question 4 The process of transferring records from the journal to the ledger is known as posting. True False Previous 1 pts Next 0 Question 5 Debit means increase and credit means decrease. True O False < Previous 1 pts Next Question 6 Transactions that cannot be accommodated by special journals for recording purposes should be recorded in the general journal. True False 1 pts Previous Next Question 7 Purchase of asset is recorded using its historical cost. True False Previous 1 pts Next Question 8 Payment of expenses will lead to decrease in the amount of net income for the period. True False < Previous 1 pts Next Question 9 Preparation of the trial balance determines that total debits equal total credits. O True O False Previous 1 pts Next Question 10 A trial balance is a financial report showing the closing balances of all accounts in the general journal at a point in time. O True False Previous 1 pts Next Question 11 The left side of an account is always the debit side, and the right side is always the credit side. True False < Previous 1 pts Next

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 2 False Owners can withdraw assets from the business in forms other than cash such as equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started