Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2: Piggly-Wiggly Inc., owns a parcel of land that is not zoned for grocery store operations. The company is loathed to let the

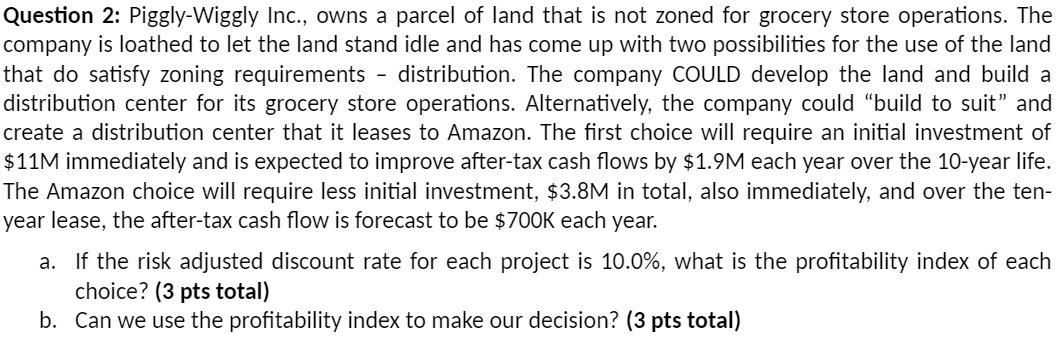

Question 2: Piggly-Wiggly Inc., owns a parcel of land that is not zoned for grocery store operations. The company is loathed to let the land stand idle and has come up with two possibilities for the use of the land that do satisfy zoning requirements distribution. The company COULD develop the land and build a distribution center for its grocery store operations. Alternatively, the company could "build to suit" and create a distribution center that it leases to Amazon. The first choice will require an initial investment of $11M immediately and is expected to improve after-tax cash flows by $1.9M each year over the 10-year life. The Amazon choice will require less initial investment, $3.8M in total, also immediately, and over the ten- year lease, the after-tax cash flow is forecast to be $700K each year. - a. If the risk adjusted discount rate for each project is 10.0%, what is the profitability index of each choice? (3 pts total) b. Can we use the profitability index to make our decision? (3 pts total)

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the profitability index for each choice we divide the present value of expected cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started