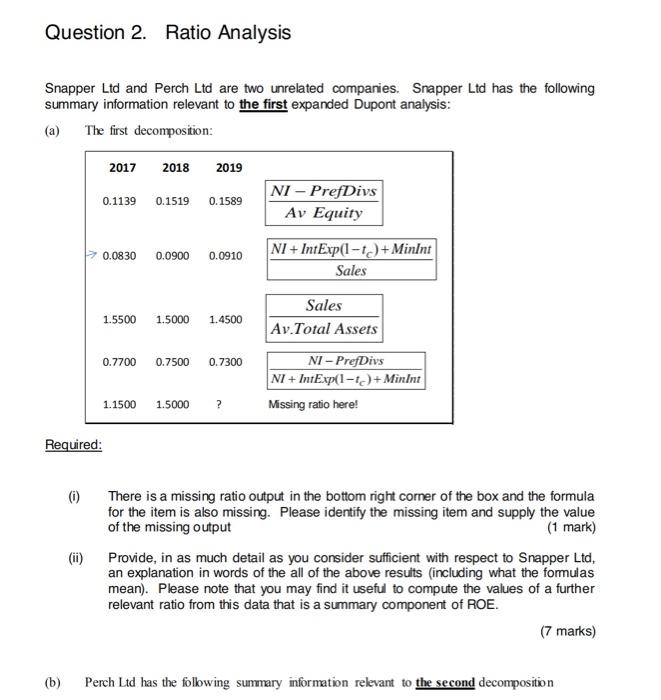

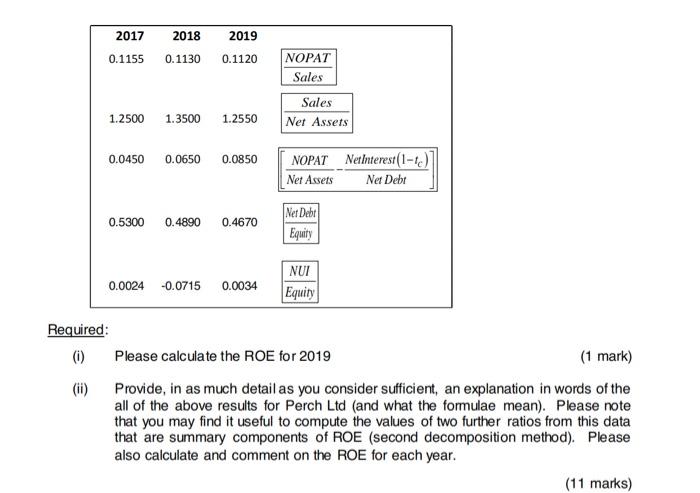

Question 2. Ratio Analysis Snapper Ltd and Perch Ltd are two unrelated companies. Snapper Ltd has the following summary information relevant to the first expanded Dupont analysis: (a) The first decomposition: 2017 2018 2019 0.1139 0.1519 0.1589 NI - PrefDivs Av Equity 0.0830 0.0900 0.0910 NI + IntExp(1-1) + Minint Sales 1.5500 1.5000 1.4500 Sales Av.Total Assets 0.7700 0.7500 0.7300 NI - PrefDivs NI + IntExp(1-1) + Minint Missing ratio here! 1.1500 1.5000 ? Required: 0 There is a missing ratio output in the bottom right corner of the box and the formula for the item is also missing. Please identify the missing item and supply the value of the missing output (1 mark) (1) Provide, in as much detail as you consider sufficient with respect to Snapper Ltd, an explanation in words of the all of the above results (including what the formulas mean). Please note that you may find it useful to compute the values of a further relevant ratio from this data that is a summary component of ROE. (7 marks) (b) Perch Ltd has the following summary information relevant to the second decomposition 2017 2018 2019 0.1155 0.1130 0.1120 NOPAT Sales 1.2500 1.3500 1.2550 Sales Net Assets 0.0450 0.0650 0.0850 NOPAT NetInterest (1-1) Net Assets Net Debt 0.5300 0.4890 0.4670 Net Debt Equity 0.0024 -0.0715 0.0034 NUI Equity Required: () Please calculate the ROE for 2019 (1 mark) (ii) Provide, in as much detail as you consider sufficient, an explanation in words of the all of the above results for Perch Ltd (and what the formulae mean). Please note that you may find it useful to compute the values of two further ratios from this data that are summary components of ROE (second decomposition method). Please also calculate and comment on the ROE for each year. (11 marks) Question 2. Ratio Analysis Snapper Ltd and Perch Ltd are two unrelated companies. Snapper Ltd has the following summary information relevant to the first expanded Dupont analysis: (a) The first decomposition: 2017 2018 2019 0.1139 0.1519 0.1589 NI - PrefDivs Av Equity 0.0830 0.0900 0.0910 NI + IntExp(1-1) + Minint Sales 1.5500 1.5000 1.4500 Sales Av.Total Assets 0.7700 0.7500 0.7300 NI - PrefDivs NI + IntExp(1-1) + Minint Missing ratio here! 1.1500 1.5000 ? Required: 0 There is a missing ratio output in the bottom right corner of the box and the formula for the item is also missing. Please identify the missing item and supply the value of the missing output (1 mark) (1) Provide, in as much detail as you consider sufficient with respect to Snapper Ltd, an explanation in words of the all of the above results (including what the formulas mean). Please note that you may find it useful to compute the values of a further relevant ratio from this data that is a summary component of ROE. (7 marks) (b) Perch Ltd has the following summary information relevant to the second decomposition 2017 2018 2019 0.1155 0.1130 0.1120 NOPAT Sales 1.2500 1.3500 1.2550 Sales Net Assets 0.0450 0.0650 0.0850 NOPAT NetInterest (1-1) Net Assets Net Debt 0.5300 0.4890 0.4670 Net Debt Equity 0.0024 -0.0715 0.0034 NUI Equity Required: () Please calculate the ROE for 2019 (1 mark) (ii) Provide, in as much detail as you consider sufficient, an explanation in words of the all of the above results for Perch Ltd (and what the formulae mean). Please note that you may find it useful to compute the values of two further ratios from this data that are summary components of ROE (second decomposition method). Please also calculate and comment on the ROE for each year. (11 marks)