Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Real Deal Ltd. has an authorized share capital of 50 000 ordinary shares of $10 per share which 30 000 have been

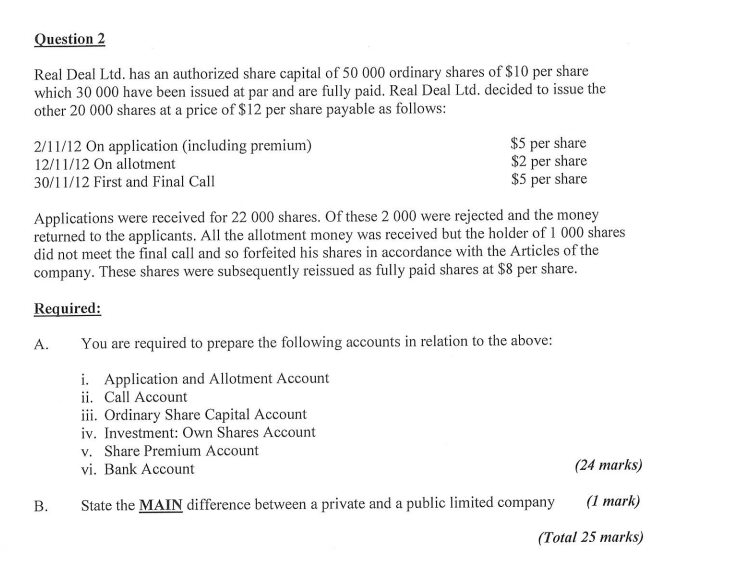

Question 2 Real Deal Ltd. has an authorized share capital of 50 000 ordinary shares of $10 per share which 30 000 have been issued at par and are fully paid. Real Deal Ltd. decided to issue the other 20 000 shares at a price of $12 per share payable as follows: 2/11/12 On application (including premium) 12/11/12 On allotment 30/11/12 First and Final Call $5 per share $2 per share $5 per share Applications were received for 22 000 shares. Of these 2 000 were rejected and the money returned to the applicants. All the allotment money was received but the holder of 1000 shares did not meet the final call and so forfeited his shares in accordance with the Articles of the company. These shares were subsequently reissued as fully paid shares at $8 per share. Required: A. You are required to prepare the following accounts in relation to the above: i. Application and Allotment Account ii. Call Account iii. Ordinary Share Capital Account iv. Investment: Own Shares Account v. Share Premium Account vi. Bank Account (24 marks) B. State the MAIN difference between a private and a public limited company (1 mark) (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started