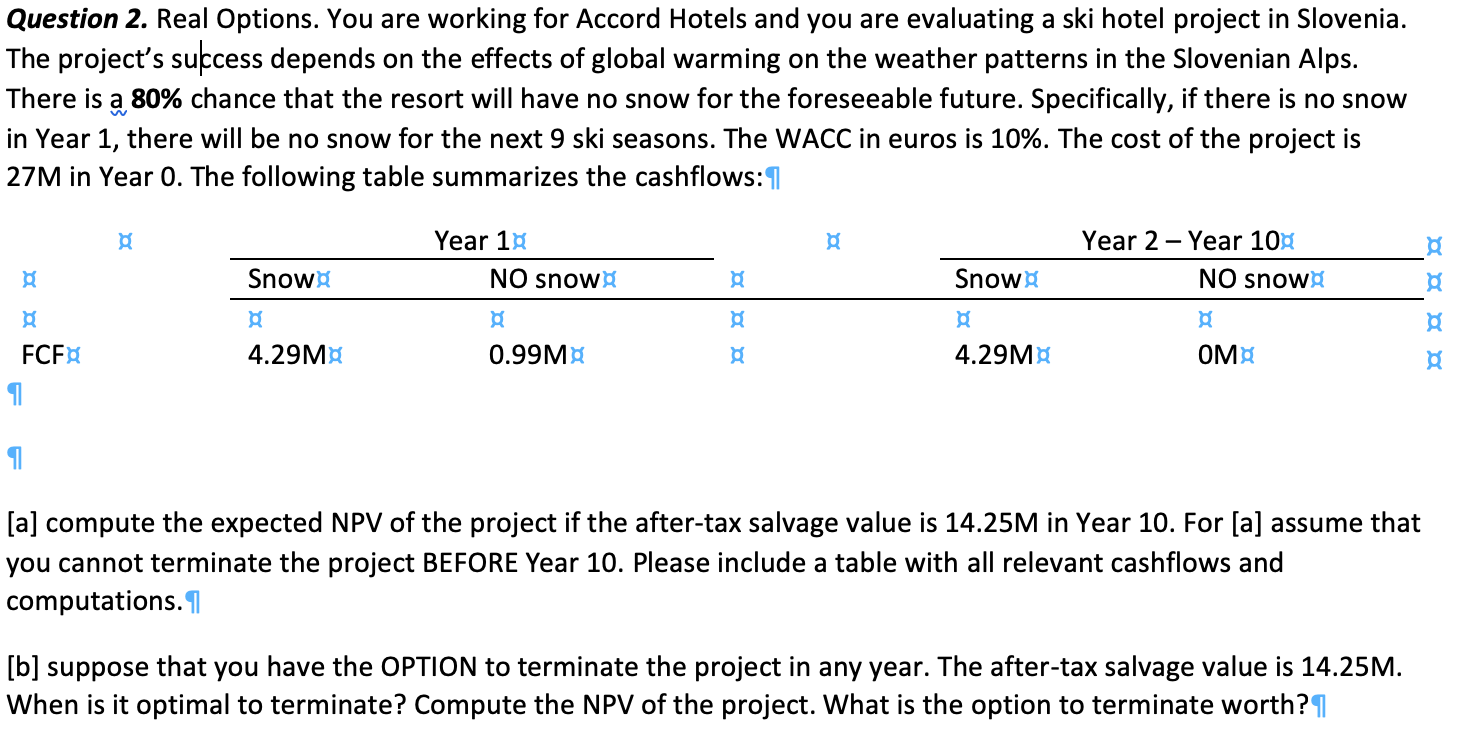

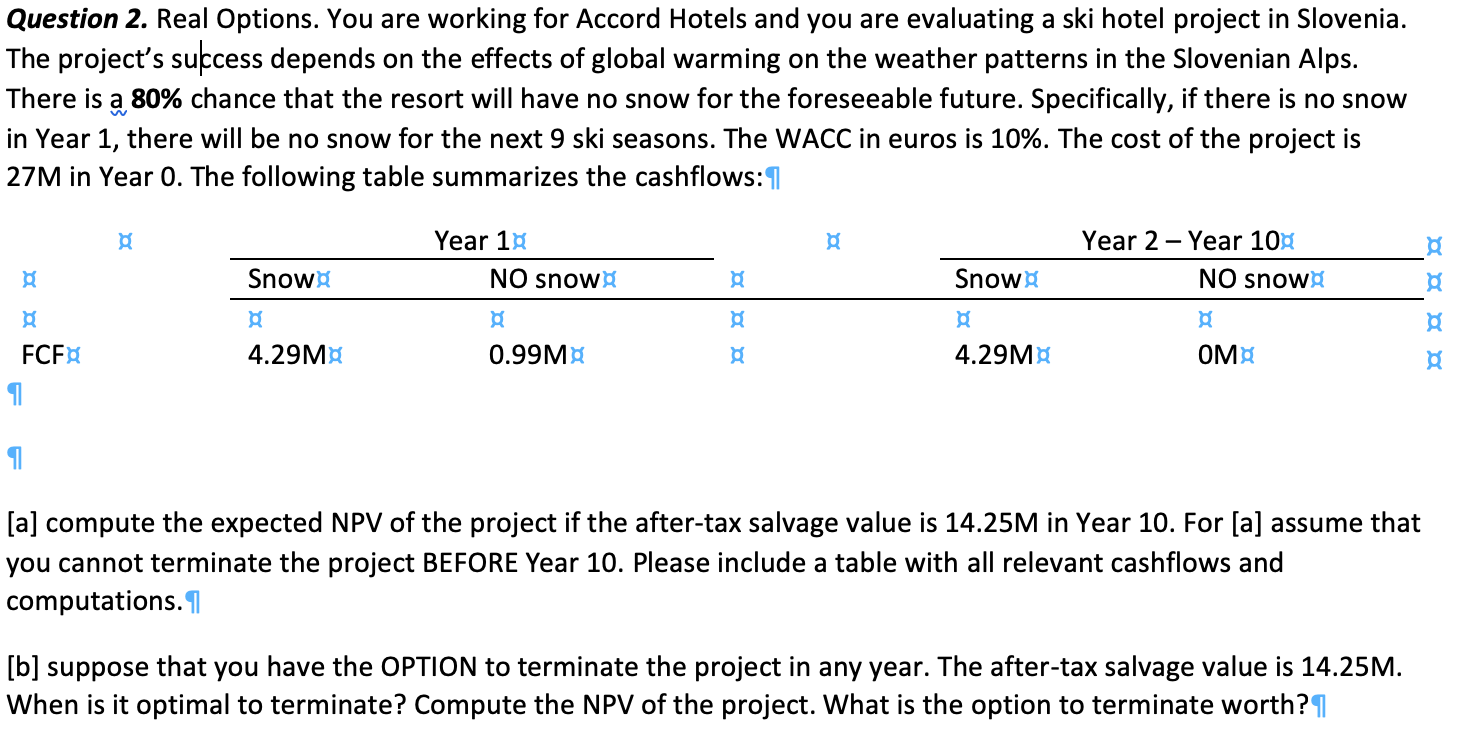

Question 2. Real Options. You are working for Accord Hotels and you are evaluating a ski hotel project in Slovenia. The project's success depends on the effects of global warming on the weather patterns in the Slovenian Alps. There is a 80% chance that the resort will have no snow for the foreseeable future. Specifically, if there is no snow in Year 1, there will be no snow for the next 9 ski seasons. The WACC in euros is 10%. The cost of the project is 27M in Year 0. The following table summarizes the cashflows: 1 Year 18 NO snowg Year 2-Year 108 NO snowg Snowg Snowg FCE8 4.29M8. 0.99M8 4.29 M8 OMS [a] compute the expected NPV of the project if the after-tax salvage value is 14.25M in Year 10. For [a] assume that you cannot terminate the project BEFORE Year 10. Please include a table with all relevant cashflows and computations. 1 [b] suppose that you have the OPTION to terminate the project in any year. The after-tax salvage value is 14.25M. When is it optimal to terminate? Compute the NPV of the project. What is the option to terminate worth? | Question 2. Real Options. You are working for Accord Hotels and you are evaluating a ski hotel project in Slovenia. The project's success depends on the effects of global warming on the weather patterns in the Slovenian Alps. There is a 80% chance that the resort will have no snow for the foreseeable future. Specifically, if there is no snow in Year 1, there will be no snow for the next 9 ski seasons. The WACC in euros is 10%. The cost of the project is 27M in Year 0. The following table summarizes the cashflows: 1 Year 18 NO snowg Year 2-Year 108 NO snowg Snowg Snowg FCE8 4.29M8. 0.99M8 4.29 M8 OMS [a] compute the expected NPV of the project if the after-tax salvage value is 14.25M in Year 10. For [a] assume that you cannot terminate the project BEFORE Year 10. Please include a table with all relevant cashflows and computations. 1 [b] suppose that you have the OPTION to terminate the project in any year. The after-tax salvage value is 14.25M. When is it optimal to terminate? Compute the NPV of the project. What is the option to terminate worth? |