Answered step by step

Verified Expert Solution

Question

1 Approved Answer

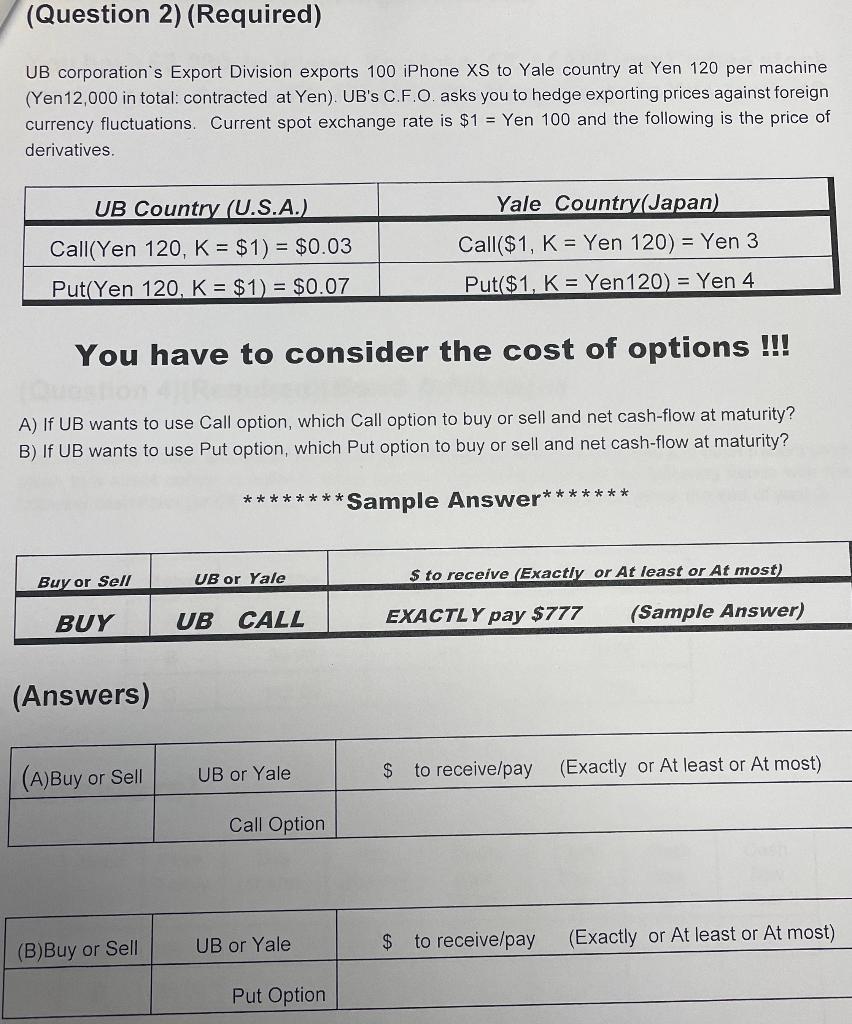

(Question 2) (Required) UB corporation's Export Division exports 100 iPhone XS to Yale country at Yen 120 per machine (Yen12,000 in total: contracted at

(Question 2) (Required) UB corporation's Export Division exports 100 iPhone XS to Yale country at Yen 120 per machine (Yen12,000 in total: contracted at Yen). UB's C.F.O. asks you to hedge exporting prices against foreign currency fluctuations. Current spot exchange rate is $1 = Yen 100 and the following is the price of derivatives. UB Country (U.S.A.) Call(Yen 120, K = $1) = $0.03 Put(Yen 120, K = $1) = $0.07 Yale Country(Japan) Call($1, K Yen 120) = Yen 3 Put($1, KYen 120) = Yen 4 You have to consider the cost of options !!! Question A) If UB wants to use Call option, which Call option to buy or sell and net cash-flow at maturity? B) If UB wants to use Put option, which Put option to buy or sell and net cash-flow at maturity? ********Sample Answer******* Buy or Sell BUY UB or Yale $ to receive (Exactly or At least or At most) UB CALL EXACTLY pay $777 (Sample Answer) (Answers) (A)Buy or Sell UB or Yale $ to receive/pay (Exactly or At least or At most) Call Option (B)Buy or Sell UB or Yale $ to receive/pay (Exactly or At least or At most) Put Option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started