Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2: Saving for Kids' College Ebony owns a small business and is saving for her daughter's college tuition. Her company just completed a

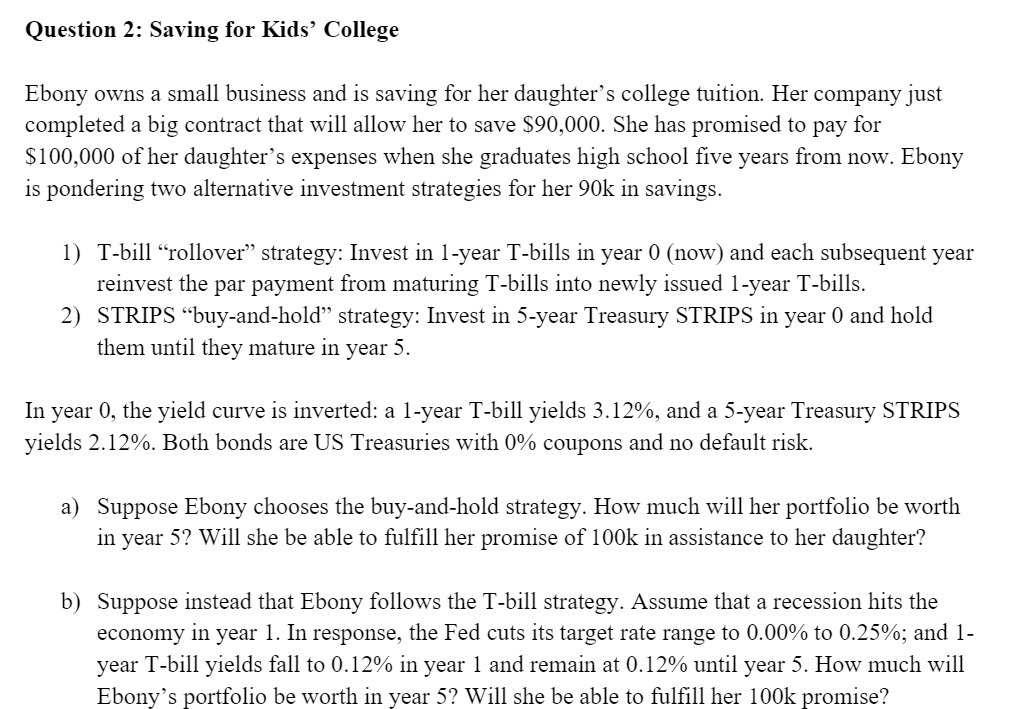

Question 2: Saving for Kids' College Ebony owns a small business and is saving for her daughter's college tuition. Her company just completed a big contract that will allow her to save $90,000. She has promised to pay for $100,000 of her daughter's expenses when she graduates high school five years from now. Ebony is pondering two alternative investment strategies for her 90k in savings. 1) T-bill "rollover" strategy: Invest in 1-year T-bills in year 0 (now) and each subsequent year reinvest the par payment from maturing T-bills into newly issued 1-year T-bills. 2) STRIPS "buy-and-hold" strategy: Invest in 5-year Treasury STRIPS in year 0 and hold them until they mature in year 5. In year 0, the yield curve is inverted: a 1-year T-bill yields 3.12%, and a 5-year Treasury STRIPS yields 2.12%. Both bonds are US Treasuries with 0% coupons and no default risk. a) Suppose Ebony chooses the buy-and-hold strategy. How much will her portfolio be worth in year 5? Will she be able to fulfill her promise of 100k in assistance to her daughter? b) Suppose instead that Ebony follows the T-bill strategy. Assume that a recession hits the economy in year 1. In response, the Fed cuts its target rate range to 0.00% to 0.25%; and 1- year T-bill yields fall to 0.12% in year 1 and remain at 0.12% until year 5. How much will Ebony's portfolio be worth in year 5? Will she be able to fulfill her 100k promise?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Solving for Ebonys Investment Strategie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started