Question: Stephen is a UK resident taxpayer with two different sources of income. He works part-time as an IT consultant for a small number of

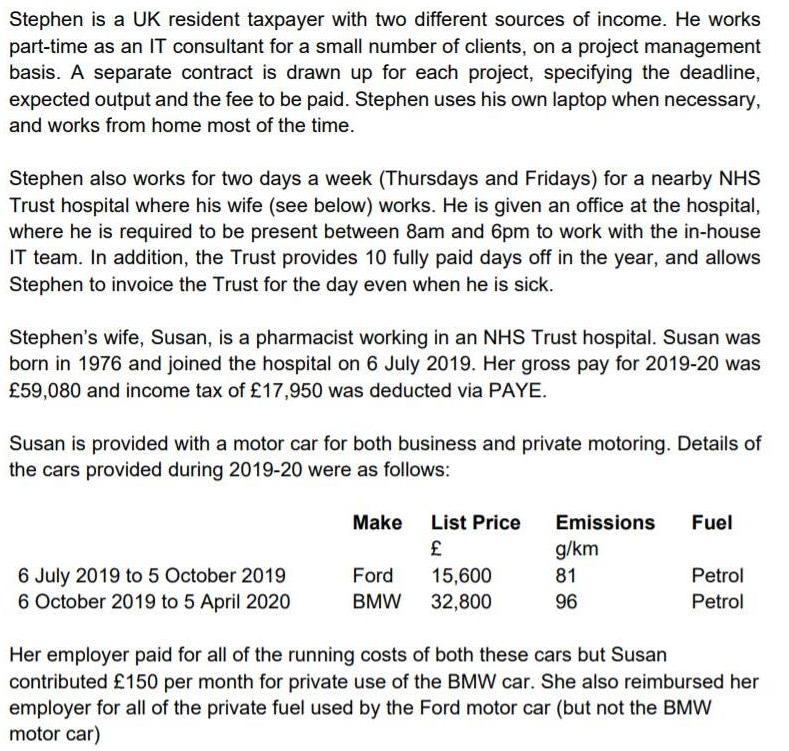

Stephen is a UK resident taxpayer with two different sources of income. He works part-time as an IT consultant for a small number of clients, on a project management basis. A separate contract is drawn up for each project, specifying the deadline, expected output and the fee to be paid. Stephen uses his own laptop when necessary, and works from home most of the time. Stephen also works for two days a week (Thursdays and Fridays) for a nearby NHS Trust hospital where his wife (see below) works. He is given an office at the hospital, where he is required to be present between 8am and 6pm to work with the in-house IT team. In addition, the Trust provides 10 fully paid days off in the year, and allows Stephen to invoice the Trust for the day even when he is sick. Stephen's wife, Susan, is a pharmacist working in an NHS Trust hospital. Susan was born in 1976 and joined the hospital on 6 July 2019. Her gross pay for 2019-20 was 59,080 and income tax of 17,950 was deducted via PAYE. Susan is provided with a motor car for both business and private motoring. Details of the cars provided during 2019-20 were as follows: 6 July 2019 to 5 October 2019 6 October 2019 to 5 April 2020 Make List Price Ford 15,600 BMW 32,800 Emissions g/km 81 96 Fuel Petrol Petrol Her employer paid for all of the running costs of both these cars but Susan contributed 150 per month for private use of the BMW car. She also reimbursed her employer for all of the private fuel used by the Ford motor car (but not the BMW motor car) On 6 August 2019, the NHS Trust lent Susan 27,000 at an interest rate of 0.5% p.a. Susan repaid 18,000 of the loan on 6 March 2020. Susan is provided with a mobile telephone and is allowed to use this telephone for both business and private calls. The NHS Trust did not have to pay for the telephone itself but paid call charges of 391 during the year (of which 128 related to private calls). Susan's other income for 2019-20 consisted of gross pay from her previous employer of 17,662 (PAYE 3,210), dividends received of 4,300 and ISA interest of 240. REQUIRED: a) Discuss and apply the criteria which may be used to determine whether Stephen should be regarded as employed of self-employed. 6 marks 8 b) Prepare an income tax computation for Susan for tax year 2019-20. If any of her income is not taxable. Explain why this is the case. 9 marks c) Calculate both Employer's and Employee's National Insurance Contributions (NICS) payable in relation to Susan for 2019-20. 5 marks

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

y fx y Emissim y f Y A fzy 12400 15400 ... View full answer

Get step-by-step solutions from verified subject matter experts