Answered step by step

Verified Expert Solution

Question

1 Approved Answer

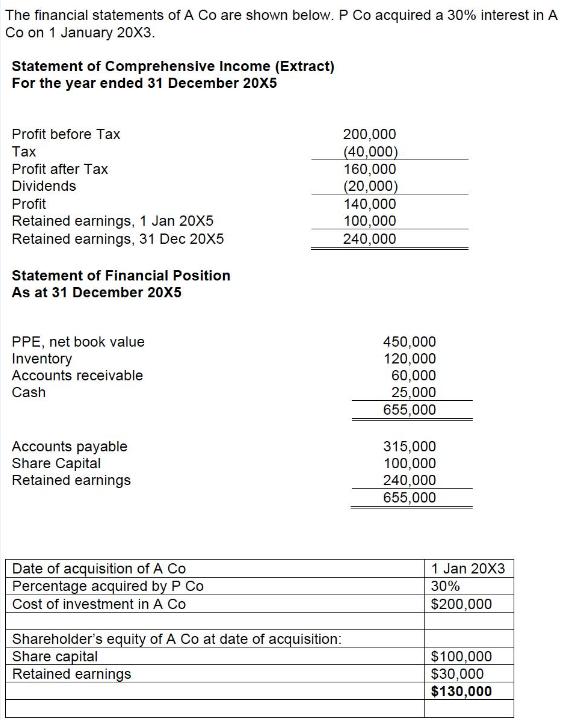

The financial statements of A Co are shown below. P Co acquired a 30% interest in A Co on 1 January 20X3. Statement of

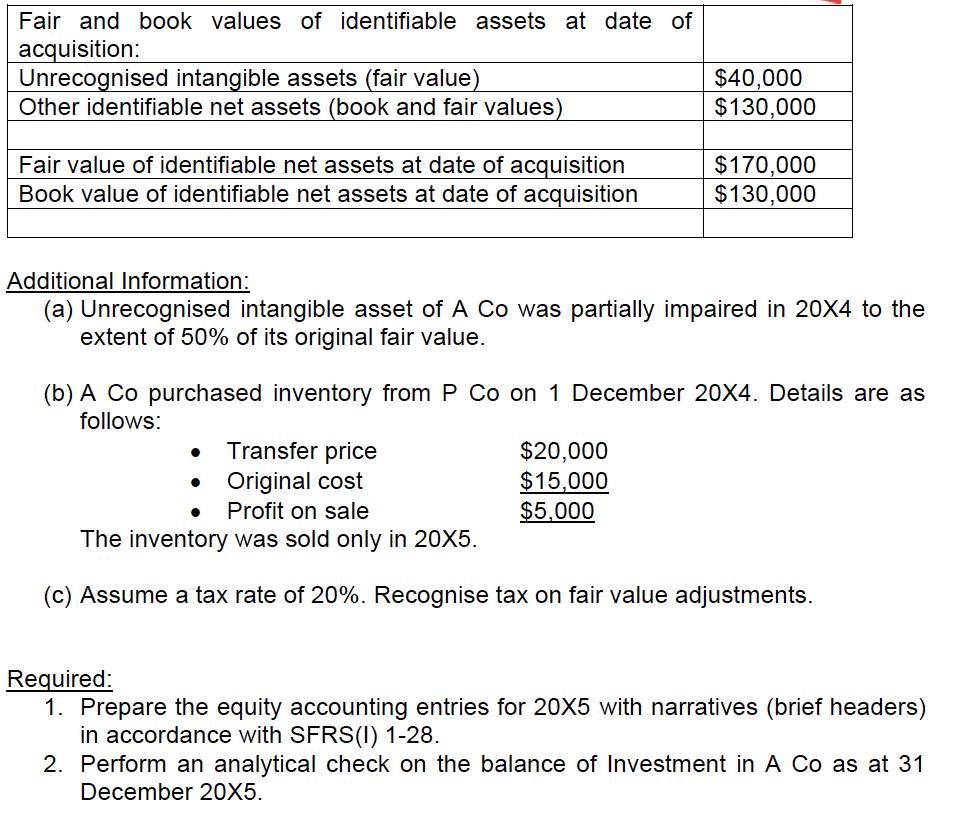

The financial statements of A Co are shown below. P Co acquired a 30% interest in A Co on 1 January 20X3. Statement of Comprehensive Income (Extract) For the year ended 31 December 20X5 200,000 (40,000) 160,000 (20,000) 140,000 100,000 240,000 Profit before Tax x Profit after Tax Dividends Profit Retained earnings, 1 Jan 20X5 Retained earnings, 31 Dec 20X5 Statement of Financial Position As at 31 December 20X5 PPE, net book value Inventory Accounts receivable 450,000 120,000 60,000 25,000 655,000 Cash Accounts payable Share Capital Retained earnings 315,000 100,000 240,000 655,000 Date of acquisition of A Co Percentage acquired by P Co Cost of investment in A Co 1 Jan 20X3 30% $200,000 Shareholder's equity of A Co at date of acquisition: Share capital Retained earnings $100,000 $30,000 $130,000 Fair and book values of identifiable assets at date of acquisition: Unrecognised intangible assets (fair value) Other identifiable net assets (book and fair values) $40,000 $130,000 Fair value of identifiable net assets at date of acquisition Book value of identifiable net assets at date of acquisition $170,000 $130,000 Additional Information: (a) Unrecognised intangible asset of A Co was partially impaired in 20X4 to the extent of 50% of its original fair value. (b) A Co purchased inventory from P Co on 1 December 20X4. Details are as follows: Transfer price Original cost $20,000 $15,000 $5,000 Profit on sale The inventory was sold only in 20X5. (c) Assume a tax rate of 20%. Recognise tax on fair value adjustments. Required: 1. Prepare the equity accounting entries for 20X5 with narratives (brief headers) in accordance with SFRS(I) 1-28. 2. Perform an analytical check on the balance of Investment in A Co as at 31 December 20X5.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started