Answered step by step

Verified Expert Solution

Question

1 Approved Answer

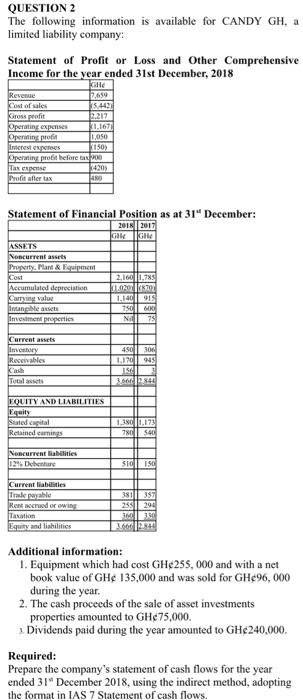

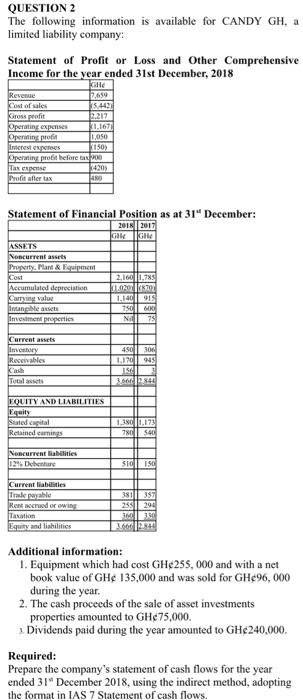

QUESTION 2 The following information is available for CANDY GH, a limited liability company: Statement of Profit or Loss and Other Comprehensive Income for the

QUESTION 2 The following information is available for CANDY GH, a limited liability company: Statement of Profit or Loss and Other Comprehensive Income for the year ended 31st December, 2018 2.659 15.4423 Revente Kost of sales Kross profit Operating expenses Operating profil Interest expenses Operating profit before Tar expense Profit after tax 1.167 1.050 1150) 14200 HARD Statement of Financial Position as at 31" December: 2018 2017 G GH ASSETS Noncurrent assets Property. Plant & Equipment Kost Accumulated depreciation Carrying value Intangible assets Investment properties 2.160 1.75 11.02 1.140915 750 60K NE 75 Current assets Inventory Recewables Cash Totalt 450 300 1,170 99 IS 1844 EQUITY AND LIABILITIES Equity Sated capital Retained caring 1.380|1.173 780|| 540 Noncurrent liabilities 12. hehe sio 150 Current liabilities Trade payable Rented or wing 381|| ST 23 | 294 03 1234 Equity and liabilities Additional information: 1. Equipment which had cost GH255,000 and with a net book value of GH 135,000 and was sold for GH96,000 during the year. 2. The cash proceeds of the sale of asset investments properties amounted to GH75,000 Dividends paid during the year amounted to GH240,000. Required: Prepare the company's statement of cash flows for the year ended 31" December 2018, using the indirect method, adopting the format in IAS 7 Statement of cash flows

QUESTION 2 The following information is available for CANDY GH, a limited liability company: Statement of Profit or Loss and Other Comprehensive Income for the year ended 31st December, 2018 2.659 15.4423 Revente Kost of sales Kross profit Operating expenses Operating profil Interest expenses Operating profit before Tar expense Profit after tax 1.167 1.050 1150) 14200 HARD Statement of Financial Position as at 31" December: 2018 2017 G GH ASSETS Noncurrent assets Property. Plant & Equipment Kost Accumulated depreciation Carrying value Intangible assets Investment properties 2.160 1.75 11.02 1.140915 750 60K NE 75 Current assets Inventory Recewables Cash Totalt 450 300 1,170 99 IS 1844 EQUITY AND LIABILITIES Equity Sated capital Retained caring 1.380|1.173 780|| 540 Noncurrent liabilities 12. hehe sio 150 Current liabilities Trade payable Rented or wing 381|| ST 23 | 294 03 1234 Equity and liabilities Additional information: 1. Equipment which had cost GH255,000 and with a net book value of GH 135,000 and was sold for GH96,000 during the year. 2. The cash proceeds of the sale of asset investments properties amounted to GH75,000 Dividends paid during the year amounted to GH240,000. Required: Prepare the company's statement of cash flows for the year ended 31" December 2018, using the indirect method, adopting the format in IAS 7 Statement of cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started