Answered step by step

Verified Expert Solution

Question

1 Approved Answer

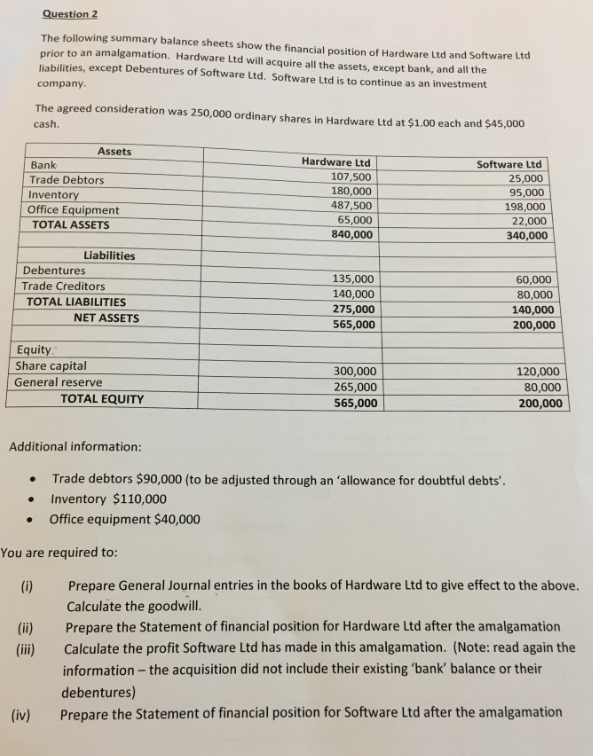

Question 2 The following summary balance sheets show the financial position of Hardware Ltd and Software Ltd prior to an amalgamation. Hardware Ltd will

Question 2 The following summary balance sheets show the financial position of Hardware Ltd and Software Ltd prior to an amalgamation. Hardware Ltd will acquire all the assets, except bank, and all the liabilities, except Debentures of Software Ltd. Software Ltd is to continue as an investment company. The agreed consideration was 250,000 ordinary shares in Hardware Ltd at $1.00 each and $45,000 cash. Bank Trade Debtors Inventory Office Equipment TOTAL ASSETS Debentures Trade Creditors TOTAL LIABILITIES Assets Equity. Share capital General reserve . Liabilities (ii) (iv) NET ASSETS TOTAL EQUITY You are required to: (i) Hardware Ltd 107,500 180,000 487,500 65,000 840,000 135,000 140,000 Additional information: Trade debtors $90,000 (to be adjusted through an 'allowance for doubtful debts'. Inventory $110,000 Office equipment $40,000 275,000 565,000 300,000 265,000 565,000 Software Ltd 25,000 95,000 198,000 22,000 340,000 60,000 80,000 140,000 200,000 120,000 80,000 200,000 Prepare General Journal entries in the books of Hardware Ltd to give effect to the above. Calculate the goodwill. Prepare the Statement of financial position for Hardware Ltd after the amalgamation Calculate the profit Software Ltd has made in this amalgamation. (Note: read again the information - the acquisition did not include their existing 'bank' balance or their debentures) Prepare the Statement of financial position for Software Ltd after the amalgamation

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Here are the solutions to the questions i Journal entries in the books of Hardware Ltd Dr Trade debt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started