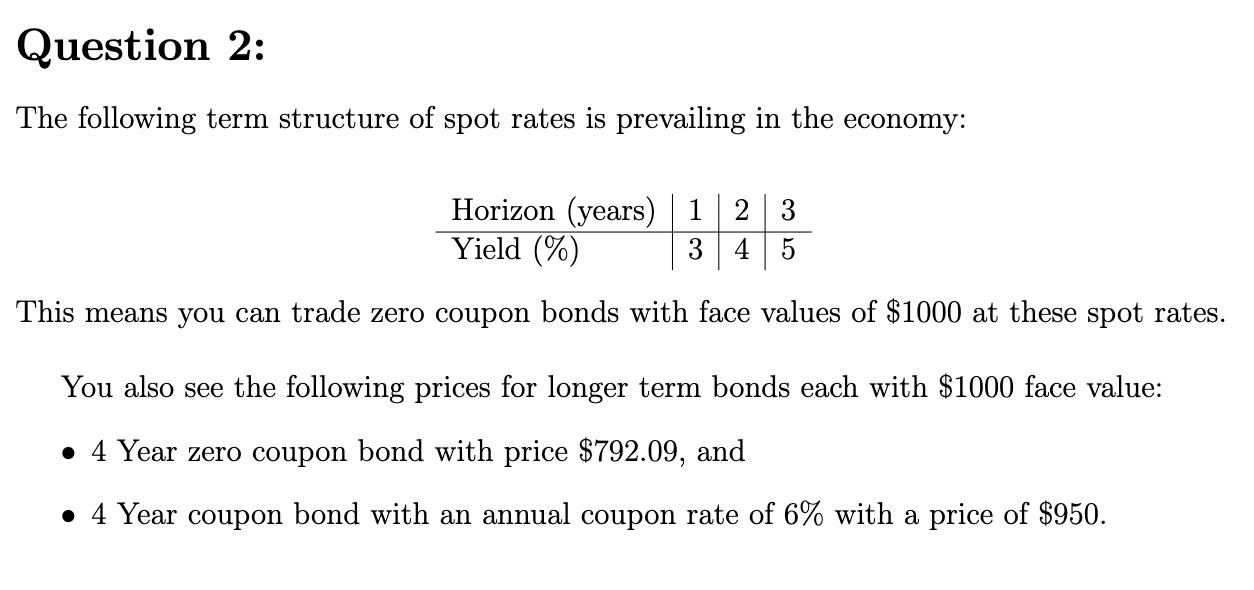

Question 2: The following term structure of spot rates is prevailing in the economy: Horizon (years) 1 2 3 Yield (%) 3 4 5

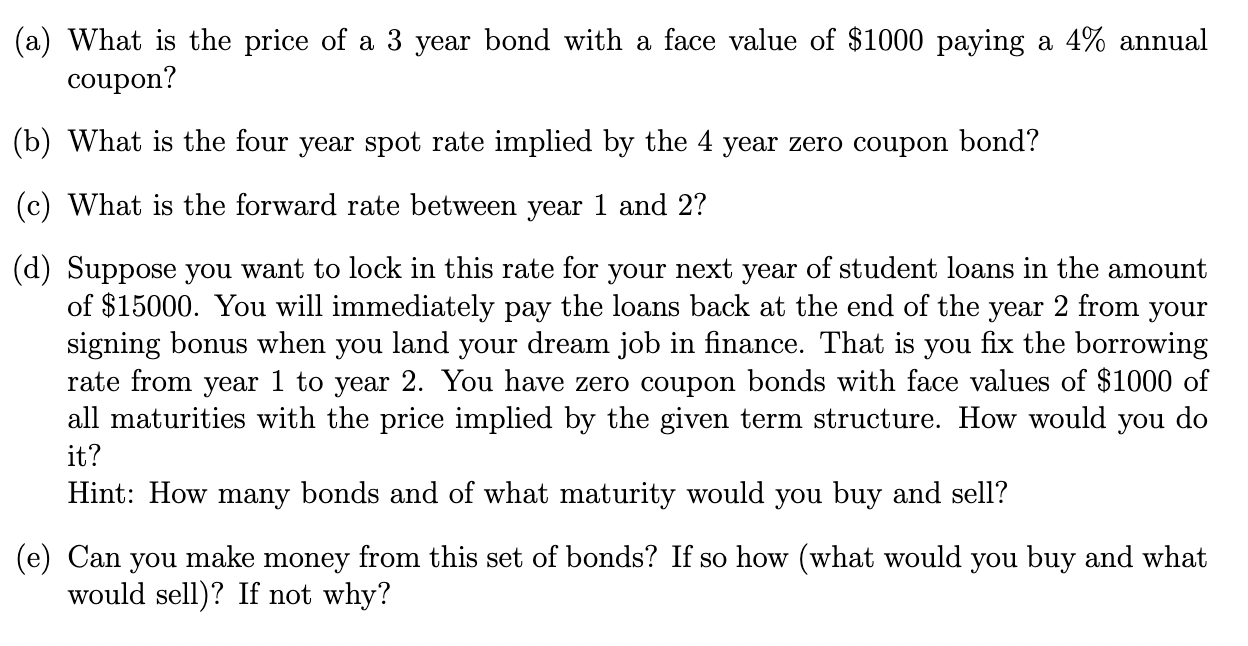

Question 2: The following term structure of spot rates is prevailing in the economy: Horizon (years) 1 2 3 Yield (%) 3 4 5 This means you can trade zero coupon bonds with face values of $1000 at these spot rates. You also see the following prices for longer term bonds each with $1000 face value: 4 Year zero coupon bond with price $792.09, and 4 Year coupon bond with an annual coupon rate of 6% with a price of $950. (a) What is the price of a 3 year bond with a face value of $1000 paying a 4% annual coupon? (b) What is the four year spot rate implied by the 4 year zero coupon bond? (c) What is the forward rate between year 1 and 2? (d) Suppose you want to lock in this rate for your next year of student loans in the amount of $15000. You will immediately pay the loans back at the end of the year 2 from your signing bonus when you land your dream job in finance. That is you fix the borrowing rate from year 1 to year 2. You have zero coupon bonds with face values of $1000 of all maturities with the price implied by the given term structure. How would you do it? Hint: How many bonds and of what maturity would you buy and sell? (e) Can you make money from this set of bonds? If so how (what would you buy and what would sell)? If not why?

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a To find the price of a 3year bond with a face value of 1000 paying a 4 annual coupon we need to ca...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started