Answered step by step

Verified Expert Solution

Question

1 Approved Answer

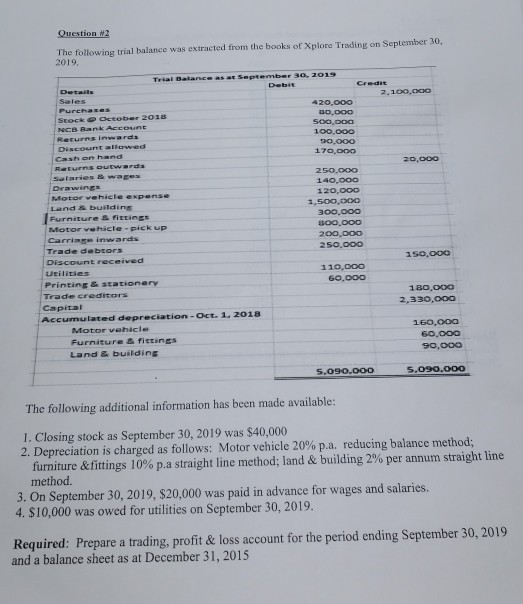

Question #2 The following trial balance was extracted from the books of Xplore Trading on September 30, 2019, Trial Balance as a September 30, 2019

Question #2 The following trial balance was extracted from the books of Xplore Trading on September 30, 2019, Trial Balance as a September 30, 2019 Debit Credi Details Sales 2.100.000 420,000 Purchases Stock October 2018 30.000 500.000 NCB Bank Account Returns inwards 100.000 Discount allowed 50,000 Cash on hand 170,000 Returns outwards 20,000 250.000 Salaries & wages Drawings 140.000 Motor vehicle expense 120.000 Land & building 1,500,000 Furniture & Fittings 300,000 Motor vehicle - pick up BOO.OOO Carriage inwards 200,000 Trade debtors 250,000 Discount received 150,000 Utilities 110,000 Printing & stationery GO,000 Trade creditors 180,000 Capital 2,330,000 Accumulated depreciation - Oct. 1. 2018 Motor vehicle 160,000 Furniture & fittings 60.000 Land & building 90,000 5.090.000 5.090.000 The following additional information has been made available: 1. Closing stock as September 30, 2019 was $40,000 2. Depreciation is charged as follows: Motor vehicle 20% p.a. reducing balance method; furniture &fittings 10% p.a straight line method; land & building 2% per annum straight line method. 3. On September 30, 2019, $20,000 was paid in advance for wages and salaries. 4. $10,000 was owed for utilities on September 30, 2019. Required: Prepare a trading, profit & loss account for the period ending September 30, 2019 and a balance sheet as at December 31, 2015

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started