Answered step by step

Verified Expert Solution

Question

1 Approved Answer

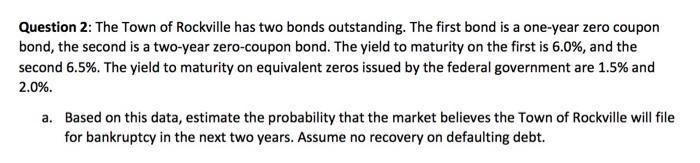

Question 2: The Town of Rockville has two bonds outstanding. The first bond is a one-year zero coupon bond, the second is a two-year

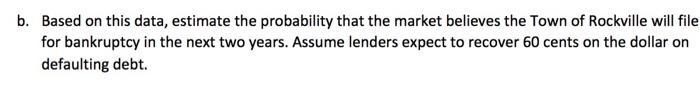

Question 2: The Town of Rockville has two bonds outstanding. The first bond is a one-year zero coupon bond, the second is a two-year zero-coupon bond. The yield to maturity on the first is 6.0%, and the second 6.5%. The yield to maturity on equivalent zeros issued by the federal government are 1.5% and 2.0%. a. Based on this data, estimate the probability that the market believes the Town of Rockville will file for bankruptcy in the next two years. Assume no recovery on defaulting debt. b. Based on this data, estimate the probability that the market believes the Town of Rockville will file for bankruptcy in the next two years. Assume lenders expect to recover 60 cents on the dollar on defaulting debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To estimate the probability that the market believes the Town of Rockville will file for bankruptcy in the next two years we can compare the yields to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started