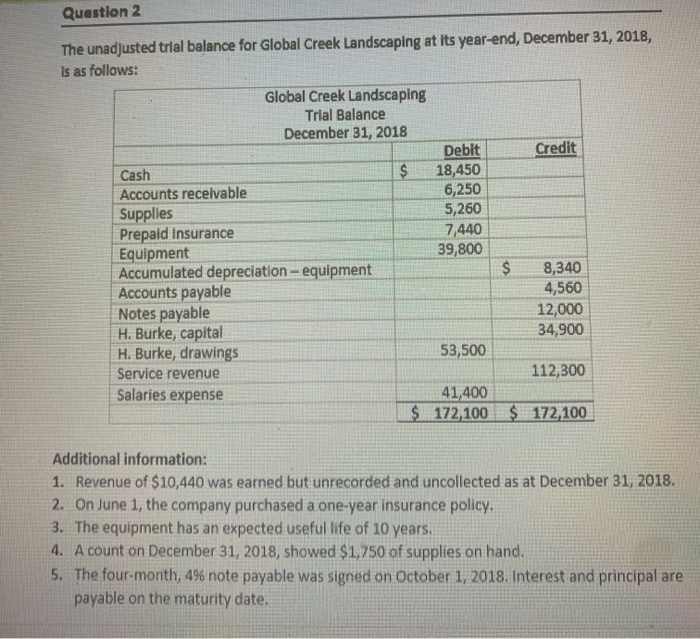

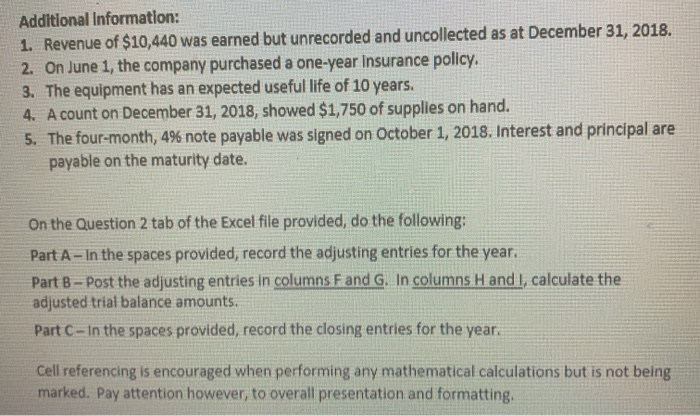

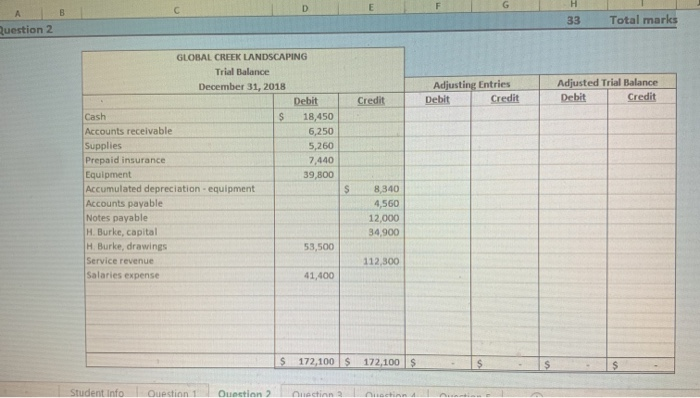

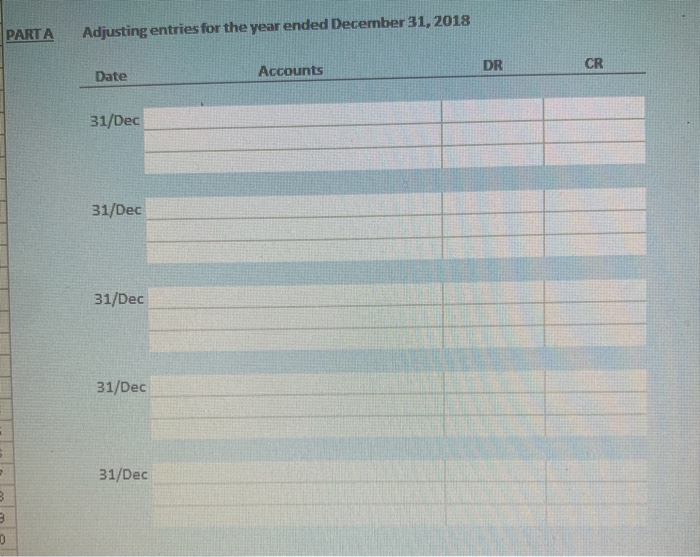

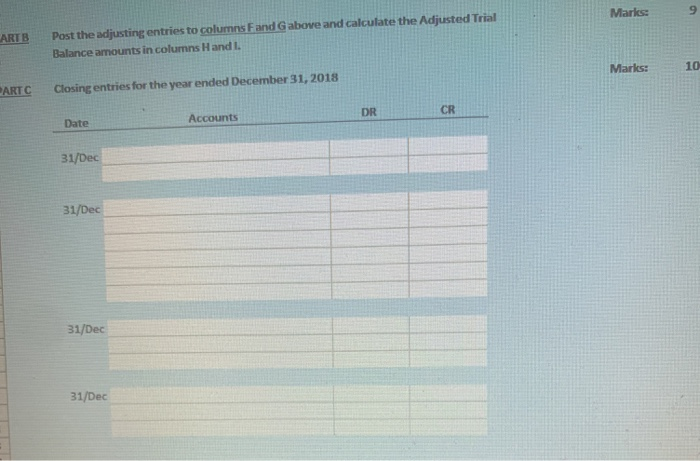

Question 2 The unadjusted trial balance for Global Creek Landscaping at its year-end, December 31, 2018, is as follows: Global Creek Landscaping Trial Balance December 31, 2018 Debit Credit Cash $ 18,450 Accounts receivable 6,250 Supplies 5,260 Prepaid Insurance 7,440 Equipment 39,800 Accumulated depreciation - equipment $ 8,340 Accounts payable 4,560 Notes payable 12,000 H. Burke, capital 34,900 H. Burke, drawings 53,500 Service revenue 112,300 Salaries expense 41,400 $ 172,100 $ 172,100 Additional information: 1. Revenue of $10,440 was earned but unrecorded and uncollected as at December 31, 2018. 2. On June 1, the company purchased a one-year insurance policy. 3. The equipment has an expected useful life of 10 years, 4. A count on December 31, 2018, showed $1,750 of supplies on hand. 5. The four-month, 4% note payable was signed on October 1, 2018. Interest and principal are payable on the maturity date. Additional Information: 1. Revenue of $10,440 was earned but unrecorded and uncollected as at December 31, 2018. 2. On June 1, the company purchased a one-year Insurance policy. 3. The equipment has an expected useful life of 10 years. 4. A count on December 31, 2018, showed $1,750 of supplies on hand. 5. The four-month, 4% note payable was signed on October 1, 2018. Interest and principal are payable on the maturity date. On the Question 2 tab of the Excel file provided, do the following: Part A - In the spaces provided, record the adjusting entries for the year. Part B -- Post the adjusting entries in columns F and G. In columns H and I, calculate the adjusted trial balance amounts. Part C - In the spaces provided, record the closing entries for the year. Cell referencing is encouraged when performing any mathematical calculations but is not being marked. Pay attention however, to overall presentation and formatting. B Question 2 33 Total marks Adjusting Entries Debit Credit Adjusted Trial Balance Debit Credit Credit GLOBAL CREEK LANDSCAPING Trial Balance December 31, 2018 Debit Cash $ 18,450 Accounts receivable 6,250 Supplies 5,260 Prepaid insurance 7,440 Equipment 39,800 Accumulated depreciation equipment Accounts payable Notes payable H. Burke, Capital H Burke, drawings 53,500 Service revenue Salaries expense 41,400 S 8,340 4,560 12,000 34,900 112,300 $ 172,100 $ 172,100 $ $ $ Student Info Question 1 Ounction 2 unctionalistinn PARTA Adjusting entries for the year ended December 31, 2018 DR CR Date Accounts 31/Dec 31/Dec 31/Dec 31/Dec 31/Dec m Marks: 9 ARTB Post the adjusting entries to columns Fand Gabove and calculate the Adjusted Trial Balance amounts in columns Hand I Marks: 10 PARTC Closing entries for the year ended December 31, 2018 DR CR Accounts Date 31/Dec 31/Dec 31/Dec 31/Dec