Answered step by step

Verified Expert Solution

Question

1 Approved Answer

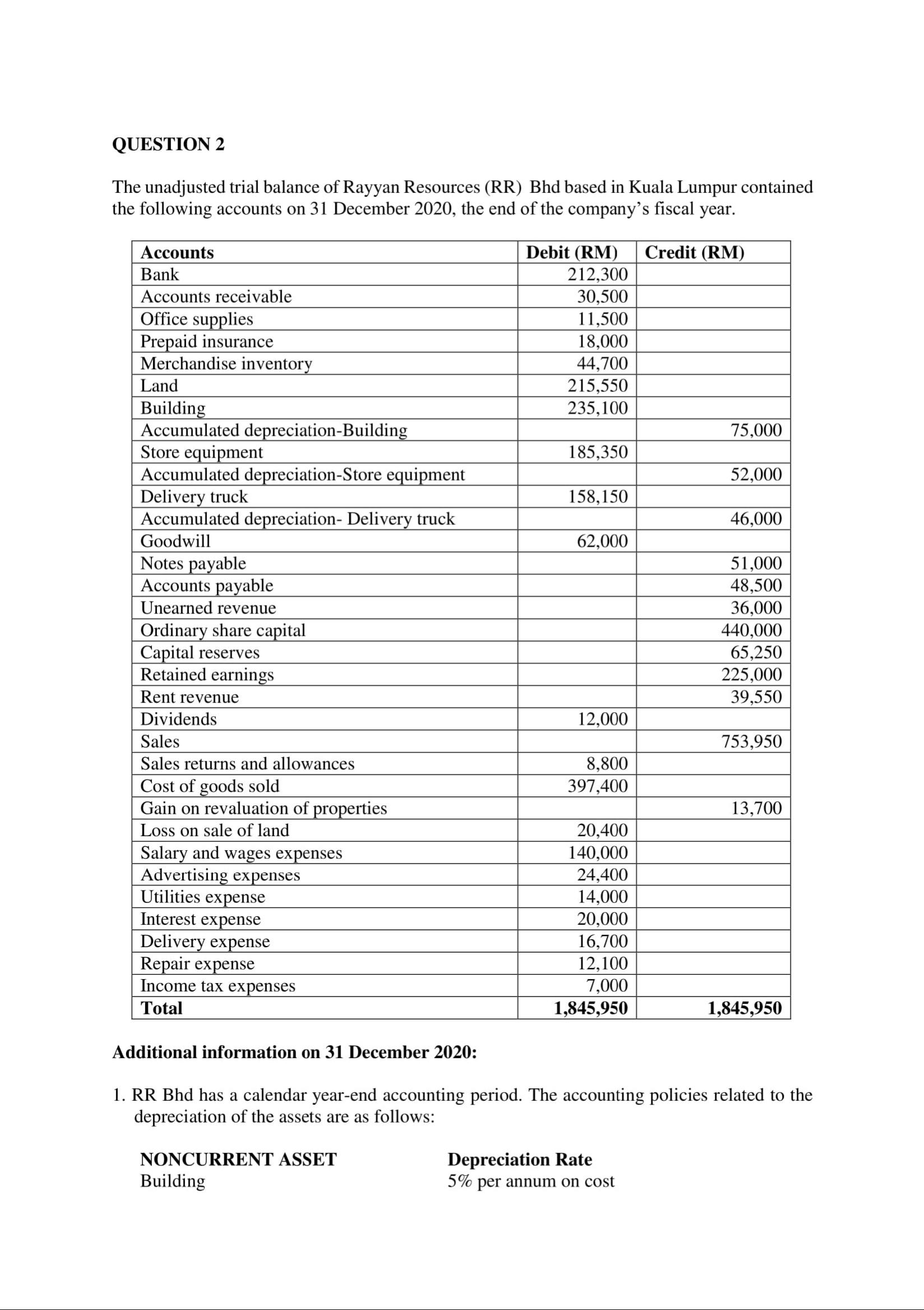

QUESTION 2 The unadjusted trial balance of Rayyan Resources (RR) Bhd based in Kuala Lumpur contained the following accounts on 31 December 2020, the

QUESTION 2 The unadjusted trial balance of Rayyan Resources (RR) Bhd based in Kuala Lumpur contained the following accounts on 31 December 2020, the end of the company's fiscal year. Debit (RM) 212,300 30,500 11,500 18,000 44,700 215,550 235,100 Accounts Credit (RM) Bank Accounts receivable Office supplies Prepaid insurance Merchandise inventory Land Building Accumulated depreciation-Building Store equipment Accumulated depreciation-Store equipment Delivery truck Accumulated depreciation- Delivery truck 75,000 185,350 52,000 158,150 46,000 Goodwill 62,000 Notes payable Accounts payable Unearned revenue 51,000 48,500 36,000 440,000 65,250 225,000 39,550 Ordinary share capital Capital reserves Retained earnings Rent revenue Dividends 12,000 Sales 753,950 Sales returns and allowances 8,800 397,400 Cost of goods sold Gain on revaluation of properties Loss on sale of land Salary and wages expenses Advertising expenses Utilities expense Interest expense Delivery expense Repair expense Income tax expenses 13,700 20,400 140,000 24,400 14,000 20,000 16,700 12,100 7,000 Total 1,845,950 1,845,950 Additional information on 31 December 2020: 1. RR Bhd has a calendar year-end accounting period. The accounting policies related to the depreciation of the assets are as follows: Depreciation Rate 5% per annum on cost NONCURRENT ASSET Building Store Equipment Delivery Truck 6% per annum on cost 4% per annum on cost 2. During the year, RM8,500 worth of additional office supplies was purchased. A physical count of office supplies on hand at the end of the year revealed that RM6,400 worth of office supplies had been used during the year. 3. RR Bhd pays its factory personnel weekly wages amounting to RM10,000 for a five-day work, on Friday. Assuming 31 December 2020, falls on Wednesday. 4. RR Bhd has rented a portion of an office building to multiple tenants. It has been determined that three tenants in the RM700 per month office and one tenant in the RM1,000 per month office had not paid their December rent as of 31 December. 5. RR Bhd borrowed RM51,000 from the bank signing a 10%, 6-month note on 1 December 2020. Principal and interest are payable to the bank on 1 June 2021. The transaction has been recorded except for accrued interest. 6. On 1 October 2020, RR Bhd purchased a general liability insurance policy for RM18,000 to provide coverage for 12 months. 7. On 1 December 2020, RR Bhd collected RM36,000 for consultancy services to be performed from 1 December 2020, through 31 May 2021. REQUIRED: (Show all your workings) (b) Prepare a Statement of Profit or Loss and Other Comprehensive Income for Rayyan Resources (RR) Bhd for the year ended 31 December 2020 according to MFRS 101 Presentation of Financial Statements. (c) Prepare a Statement of Financial Position for Rayyan Resources (RR) Bhd as at 31 December 2020 according to MFRS 101 Presentation of Financial Statements.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Presentation of Financial Statements Finan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started